Chemical Sourcing Startup Scimplify Bags $40M to Revolutionize Manufacturing Supply Chains

Manufacturing

2025-03-12 11:00:34Content

Scimplify, a rising tech innovator, has secured a substantial $40 million in equity funding, with prominent venture capital firm Accel leading the investment round. This significant financial boost is set to fuel the company's ambitious expansion strategy, targeting a broader presence in the United States market and exploring exciting new business opportunities.

The fresh capital injection will enable Scimplify to accelerate its growth, strengthen its market position, and potentially develop innovative solutions that can disrupt existing industry landscapes. By partnering with Accel, a renowned investor with a track record of supporting transformative technology companies, Scimplify signals its commitment to scaling operations and driving technological advancement.

This strategic funding round represents a pivotal moment for Scimplify, positioning the company for rapid growth and increased market penetration in the competitive tech ecosystem. The investment not only provides financial resources but also brings Accel's extensive network and strategic expertise to support the company's future development.

Scimplify's Groundbreaking $40 Million Funding: Revolutionizing Tech Expansion Strategies

In the rapidly evolving landscape of technological innovation, startup funding continues to reshape the boundaries of entrepreneurial potential. The recent financial milestone achieved by Scimplify represents more than just a monetary injection—it signals a transformative moment for emerging technology companies seeking strategic global expansion.Powering the Next Wave of Technological Disruption

Strategic Investment Landscape

Accel's substantial investment of $40 million into Scimplify unveils a compelling narrative of technological potential and strategic market positioning. This significant funding round transcends traditional financial support, representing a profound vote of confidence in the company's innovative approach and future trajectory. The investment demonstrates Accel's keen understanding of emerging technological ecosystems and their potential to redefine industry paradigms. The strategic implications of this funding extend far beyond immediate capital infusion. By targeting U.S. market expansion and exploring new market territories, Scimplify is positioning itself as a dynamic, forward-thinking organization capable of navigating complex global technological landscapes. This approach reflects a sophisticated understanding of market dynamics and the critical importance of geographical diversification in contemporary tech environments.Market Expansion Dynamics

Scimplify's ambitious expansion strategy represents a nuanced approach to technological growth. The company's focus on penetrating the U.S. market signals a calculated move to leverage one of the world's most competitive and innovative technological ecosystems. By strategically allocating resources and establishing a robust presence in this market, Scimplify is poised to access unprecedented opportunities for technological development and strategic partnerships. The investment from Accel provides more than financial resources—it offers a network of expertise, strategic guidance, and potential collaborative opportunities. Such comprehensive support is crucial for startups seeking to navigate complex technological and market challenges. The funding enables Scimplify to invest in critical areas such as research and development, talent acquisition, and infrastructure enhancement.Technological Innovation and Future Potential

Beyond immediate market expansion, this funding round represents a testament to Scimplify's technological capabilities and potential for future innovation. The substantial investment suggests that the company has developed proprietary technologies or approaches that distinguish it from competitors. Such differentiation is critical in increasingly saturated technological markets. The ability to attract significant venture capital reflects not just current performance but potential for future growth. Investors like Accel are known for their rigorous evaluation processes, meaning that Scimplify has demonstrated exceptional promise in its technological offerings and strategic vision. This validation from a prominent venture capital firm can attract additional talent, partnerships, and future investment opportunities.Global Technology Ecosystem Implications

Scimplify's funding and expansion strategy offer broader insights into the global technology ecosystem. The investment highlights the continued robustness of venture capital markets, even amid economic uncertainties. It underscores the ongoing appetite for innovative technological solutions that can address complex challenges across various industries. The company's approach exemplifies a new generation of technology firms—agile, globally oriented, and capable of rapid adaptation. By securing significant funding and targeting strategic market expansion, Scimplify is not just growing its own capabilities but contributing to the broader narrative of technological innovation and global interconnectedness.RELATED NEWS

Manufacturing

Behind Apple's Massive $500B Bet: Reshaping American Manufacturing

2025-02-25 00:08:05

Manufacturing

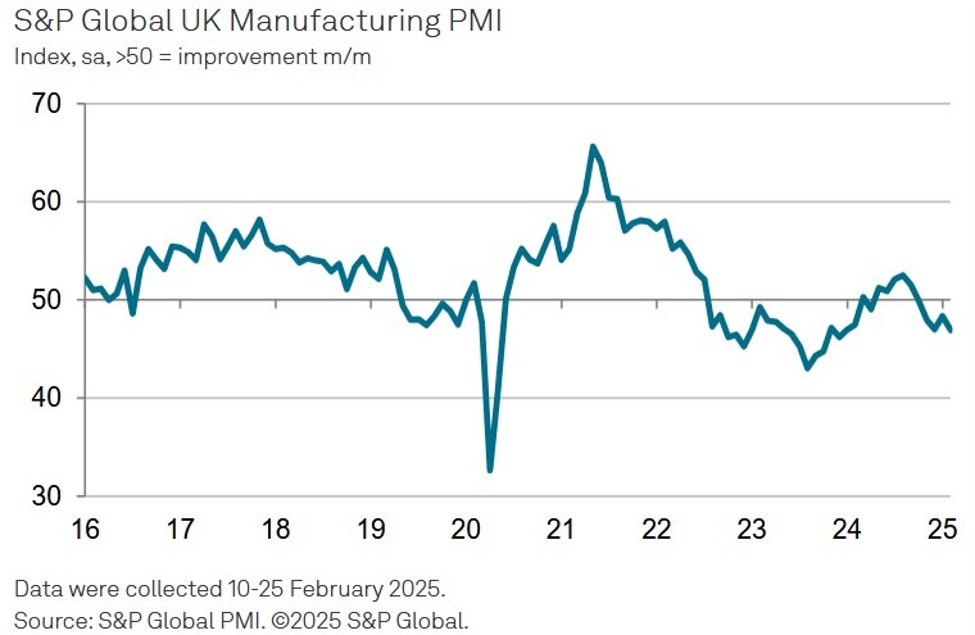

Manufacturing Sector Resilience: UK's February PMI Beats Preliminary Estimates

2025-03-03 09:30:04

Manufacturing

Tech Titan's Mega-Investment: How Apple Is Supercharging American Innovation

2025-02-25 14:18:02