Trade Tensions Threaten Quad Cities: Manufacturing Jobs Hang in the Balance

Manufacturing

2025-03-12 23:13:26Content

A sweeping 25% tariff on aluminum imports has sent shockwaves through local business communities, triggering widespread apprehension about potential economic repercussions. Industry leaders are sounding the alarm, warning that this sudden trade policy could trigger a domino effect of challenges for manufacturers who depend heavily on imported aluminum materials.

The new tariff threatens to create a perfect storm of economic disruption, potentially forcing companies to grapple with dramatically increased production costs and reduced competitive edge. Small and medium-sized manufacturers are particularly vulnerable, as they may struggle to absorb the sudden price hikes or find alternative sourcing strategies.

Local business associations are urgently calling for a comprehensive review of the tariff, emphasizing that the immediate impact could translate into significant job losses and reduced economic productivity. The unexpected trade barrier could force some companies to reconsider their current manufacturing models and potentially relocate production to more cost-effective regions.

As businesses scramble to adapt to this new economic landscape, the long-term implications remain uncertain. Manufacturers are now faced with the critical challenge of navigating these turbulent waters while maintaining their operational efficiency and market competitiveness.

Aluminum Tariffs: A Looming Economic Storm for American Manufacturers

In the complex landscape of international trade, a new challenge emerges as the United States implements a sweeping 25% tariff on imported aluminum, sending shockwaves through the manufacturing sector and raising critical questions about economic sustainability and global competitiveness.Breaking Barriers: The Hidden Costs of Protectionist Trade Policies

The Economic Ripple Effect of Aluminum Import Restrictions

The implementation of the 25% aluminum tariff represents more than a simple trade policy adjustment. It signals a profound transformation in the manufacturing ecosystem, potentially disrupting intricate supply chains that have been carefully constructed over decades. Manufacturers across multiple industries now face unprecedented challenges as raw material costs escalate dramatically, threatening their operational margins and long-term strategic planning. Local business leaders are sounding alarm bells about the potential cascading economic consequences. The tariff doesn't merely represent an additional cost but potentially undermines the competitive positioning of American manufacturers in a global marketplace that demands agility and cost-effectiveness.Manufacturing Sector's Vulnerability to Trade Interventions

The aluminum tariff exposes the delicate balance between protectionist trade policies and industrial competitiveness. Industries ranging from automotive to aerospace rely heavily on aluminum as a critical material, and sudden price increases could trigger significant operational restructuring. Small and medium-sized manufacturers are particularly vulnerable, with limited financial buffers to absorb increased material costs. The potential for job losses looms large, as companies might be forced to reduce workforce or consider offshore manufacturing alternatives to maintain profitability.Global Trade Dynamics and Retaliatory Measures

International trade experts warn that such unilateral tariff implementations often provoke retaliatory actions from trading partners. The aluminum tariff could potentially trigger a domino effect of trade restrictions, further complicating the global economic landscape. Countries with significant aluminum production capabilities might respond with their own protective measures, creating a complex web of trade barriers that could ultimately harm global economic integration and collaborative industrial development.Technological Innovation and Material Adaptation

The tariff might inadvertently stimulate technological innovation as manufacturers seek alternative materials or more efficient production methodologies. This potential silver lining could drive research and development in lightweight, cost-effective material alternatives. Companies might accelerate investments in material science, exploring composite materials, advanced alloys, and recycling technologies that could reduce dependence on imported aluminum and create new competitive advantages.Strategic Recommendations for Manufacturers

Business leaders and policymakers must collaborate to develop nuanced strategies that mitigate the potential negative impacts of the aluminum tariff. This might involve exploring domestic production capabilities, investing in technological innovations, and creating more flexible supply chain architectures. Proactive adaptation, rather than reactive resistance, will be crucial in navigating this challenging economic terrain. Manufacturers must view this disruption as an opportunity for strategic reinvention and long-term resilience.RELATED NEWS

Manufacturing

Tech Triumph: How Trump Scored a Major Manufacturing Coup with Apple

2025-02-24 11:01:44

Manufacturing

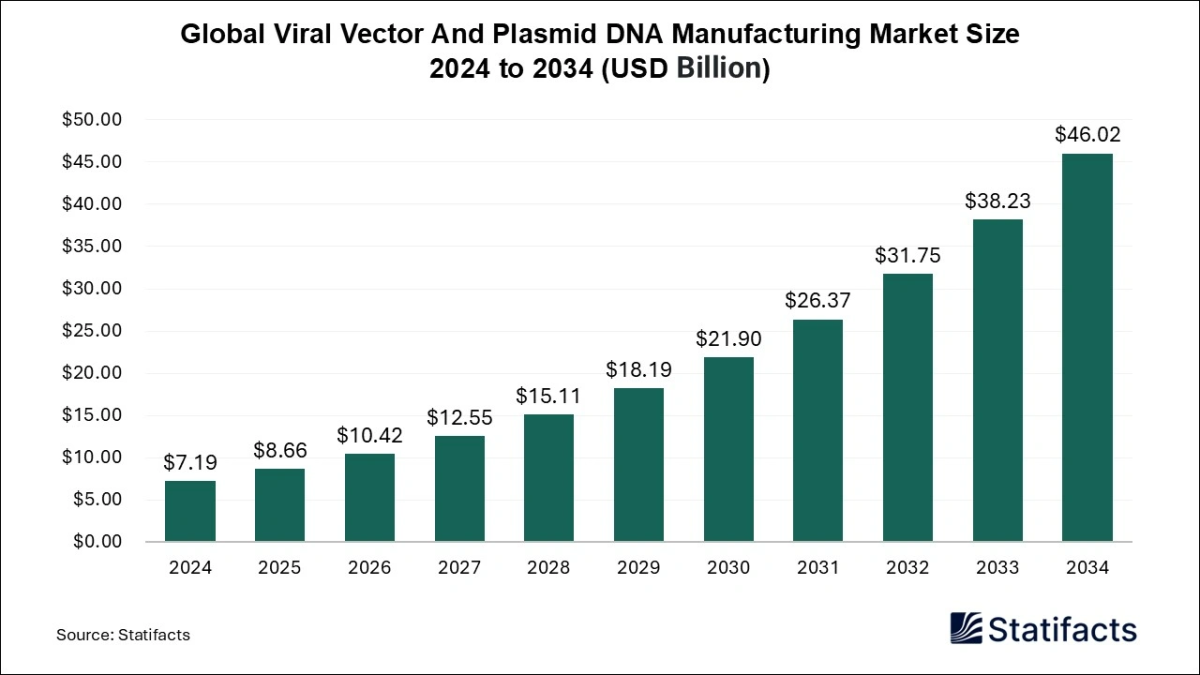

DNA Revolution: Viral Vector Manufacturing Set to Skyrocket with Stunning 20.4% Growth Trajectory

2025-02-19 18:29:00

Manufacturing

American Roads Await: ZM Trucks Breaks Ground on Inaugural U.S. Manufacturing Facility

2025-02-19 14:31:10