Wall Street Wisdom: Why Political Noise Shouldn't Derail Your Investment Strategy

Politics

2025-03-17 15:57:08Content

In a candid discussion on 'Varney & Co.', UBS managing director and senior portfolio manager Jason Katz delivered a powerful message to investors: keep your emotions in check when it comes to political landscapes. Katz warns that allowing political sentiments to drive investment decisions can potentially derail your financial strategy and compromise portfolio performance.

Drawing from his extensive experience in financial markets, Katz emphasized the critical importance of maintaining an objective, data-driven approach to investing. Political turbulence and heated debates can often cloud judgment, leading investors to make impulsive decisions that may not align with their long-term financial goals.

By advocating for a rational and disciplined investment mindset, Katz reminds investors that successful portfolios are built on sound financial principles, comprehensive research, and strategic planning—not on emotional reactions to political events or rhetoric.

Navigating Financial Turbulence: The Emotional Pitfalls of Political Investing

In the complex world of financial management, investors face a constant challenge of separating emotional impulses from rational decision-making. The intersection of personal political beliefs and investment strategies can create a treacherous landscape that threatens to undermine long-term financial success. Understanding how emotional reactions to political events can derail investment portfolios is crucial for maintaining financial stability and achieving strategic wealth management goals.Mastering Your Money: Why Emotional Investing Destroys Wealth

The Psychological Trap of Political Bias

Financial experts have long recognized the dangerous tendency of investors to allow political emotions to cloud their judgment. When personal political convictions infiltrate investment decisions, rational analysis takes a backseat to emotional reactivity. Investors become susceptible to making impulsive choices that can significantly erode portfolio performance. The human brain is wired to seek confirmation of existing beliefs, creating a cognitive bias that can lead to catastrophic financial mistakes. Psychological research demonstrates that emotional investing often results in substantial financial losses. Investors who allow political sentiments to drive their investment strategies typically experience lower returns compared to those who maintain a disciplined, objective approach. The emotional rollercoaster of political events can trigger knee-jerk reactions, causing investors to buy or sell assets based on short-term political narratives rather than fundamental economic principles.Strategic Detachment: A Professional Investor's Approach

Successful portfolio management requires a clinical, dispassionate perspective that transcends political narratives. Professional investors like Jason Katz emphasize the critical importance of maintaining emotional distance from political fluctuations. This approach involves developing a robust investment strategy grounded in comprehensive market analysis, long-term economic trends, and diversification principles. The most sophisticated investors cultivate a mindset of strategic detachment. They recognize that political landscapes are inherently volatile and that emotional reactions can lead to catastrophic investment decisions. By implementing disciplined investment frameworks, these professionals can navigate complex market environments while minimizing the impact of political noise on their portfolio performance.Risk Mitigation in a Politically Charged Environment

Developing resilience against political emotional triggers requires a multifaceted approach. Investors must cultivate self-awareness, recognize their emotional patterns, and implement systematic safeguards against impulsive decision-making. This involves creating predefined investment strategies, establishing clear risk management protocols, and maintaining a long-term perspective that transcends short-term political fluctuations. Risk mitigation becomes paramount in politically turbulent times. Successful investors develop sophisticated hedging strategies that protect their portfolios from potential political disruptions. This might involve diversifying across multiple sectors, geographical regions, and asset classes to minimize exposure to politically induced market volatility.The Neuroscience of Financial Decision-Making

Cutting-edge neuroscience research provides profound insights into how emotional responses impact financial decision-making. The human brain's limbic system, responsible for emotional processing, can override rational thinking during moments of political excitement or anxiety. Understanding these neurological mechanisms allows investors to develop more sophisticated self-regulation techniques. Neuroplasticity research suggests that investors can train their brains to respond more objectively to political and financial stimuli. By practicing mindfulness, developing emotional intelligence, and creating structured decision-making frameworks, individuals can gradually rewire their cognitive responses to minimize emotional interference in investment strategies.Technology and Emotional Intelligence in Investing

Emerging technological tools are revolutionizing how investors manage emotional responses. Advanced algorithmic trading platforms, artificial intelligence-driven analysis, and sophisticated risk management software provide objective counterpoints to emotional decision-making. These technologies offer data-driven insights that can help investors maintain perspective during politically charged market environments. The integration of emotional intelligence technologies with traditional financial analysis represents a significant advancement in investment strategy. By leveraging machine learning and predictive analytics, investors can develop more nuanced approaches that balance human intuition with objective, data-driven decision-making processes.RELATED NEWS

Politics

Rising Democratic Star Slotkin Chosen to Deliver Powerful Rebuttal to Trump's Congressional Address

2025-02-27 20:37:13

Politics

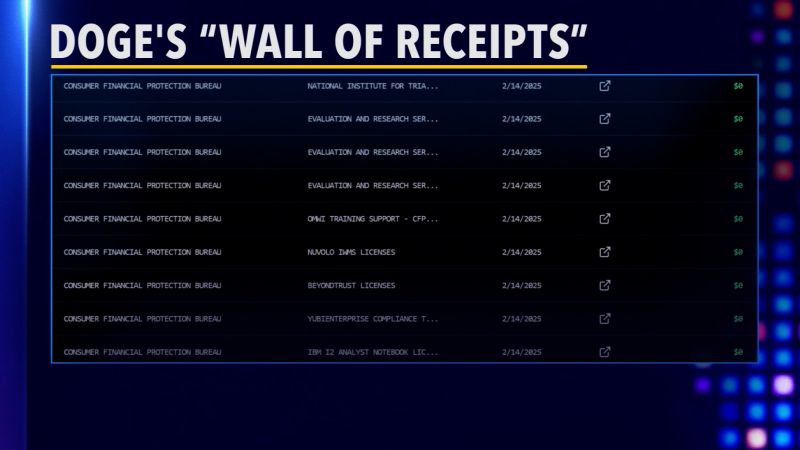

Dogecoin's Daring Dive: Laura Coates Unveils the Real Impact of Crypto Cost-Cutting

2025-02-26 05:38:50