Betting Billions: Why Arizona's Sports Gambling Gold Rush Might Be Slipping Away

Sports

2025-03-18 01:27:09Content

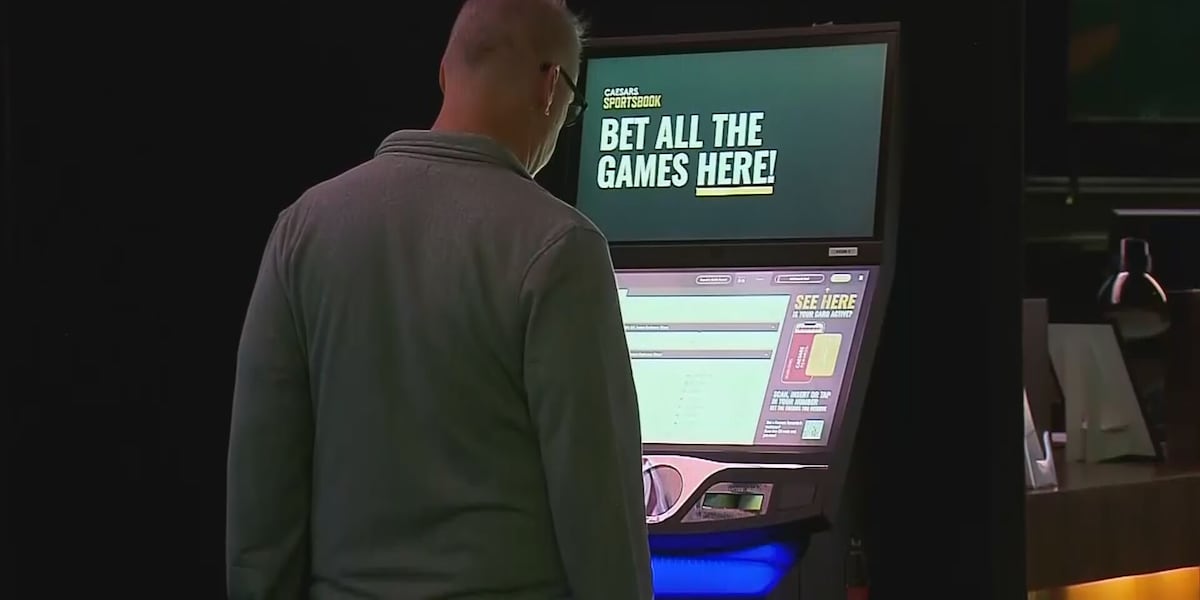

Arizona's sports betting tax rate has sparked debate among industry experts, with critics arguing that the state's modest 8% to 10% levy on gambling profits falls short compared to tax rates in other jurisdictions. While the current tax structure may attract sports betting operators, it raises questions about whether the state is maximizing potential revenue from this rapidly growing industry.

Compared to neighboring states and other regions with established sports betting markets, Arizona's tax rate appears notably conservative. This approach could potentially draw more gambling businesses to the state, but it also means potentially lower tax revenues for state programs and infrastructure.

Stakeholders continue to scrutinize the current tax framework, suggesting that a more competitive rate might better balance attracting operators and generating substantial public funding. As the sports betting landscape evolves, Arizona's tax policy remains a topic of ongoing discussion and potential future adjustment.

Arizona's Sports Betting Tax Landscape: A Critical Examination of Competitive Challenges

The rapidly evolving sports betting market in Arizona has sparked intense debate among industry experts, policymakers, and economic analysts regarding the state's taxation strategy. As the gambling landscape continues to transform, stakeholders are closely scrutinizing the financial implications of current tax structures and their potential long-term impact on the state's economic competitiveness.Unveiling the Hidden Challenges in Sports Betting Taxation

The Taxation Dilemma: Balancing Revenue and Market Attractiveness

Arizona's current approach to sports betting taxation presents a complex economic puzzle that demands careful analysis. The state's 8% to 10% tax rate on sports betting profits has emerged as a focal point of heated discussions among industry professionals. While this rate might appear competitive on the surface, it reveals significant underlying challenges that could potentially hinder the state's economic potential. Comparative analysis with other states demonstrates a stark contrast in taxation strategies. Many competing jurisdictions have implemented more nuanced tax frameworks that provide greater incentives for sports betting operators. This discrepancy raises critical questions about Arizona's ability to attract and retain major gambling enterprises in an increasingly competitive market.Economic Implications and Market Dynamics

The relatively low tax rate represents a double-edged sword for Arizona's economic ecosystem. On one hand, it might appear attractive to potential operators seeking to establish a foothold in the market. Conversely, the rate may not generate sufficient revenue to support critical state infrastructure and regulatory mechanisms. Experts argue that the current taxation model fails to capture the full economic potential of sports betting. The delicate balance between attracting operators and generating meaningful state revenue requires a more sophisticated approach that considers multiple economic variables.Regulatory Challenges and Future Perspectives

The sports betting landscape continues to evolve at an unprecedented pace, demanding adaptive and forward-thinking taxation strategies. Arizona finds itself at a critical juncture, where policy decisions will significantly impact its long-term economic competitiveness. Policymakers must carefully evaluate the broader implications of the current tax structure. This involves conducting comprehensive economic impact assessments, engaging with industry stakeholders, and developing more dynamic taxation models that can respond to market fluctuations.Comparative Market Analysis

A deeper examination of neighboring states reveals stark differences in sports betting taxation approaches. Some jurisdictions have implemented more aggressive tax strategies that generate substantially higher revenue streams. This comparative analysis underscores the urgent need for Arizona to reassess its current taxation framework. The potential economic consequences extend beyond immediate revenue considerations. A suboptimal tax structure could potentially discourage investment, limit market expansion, and create long-term competitive disadvantages for the state's gambling ecosystem.Technological and Regulatory Innovation

The future of sports betting taxation lies in embracing technological innovations and developing more sophisticated regulatory frameworks. Arizona stands at a critical juncture where strategic policy decisions can either propel the state to the forefront of the sports betting market or relegate it to a secondary position. Emerging technologies, including advanced data analytics and blockchain-based verification systems, offer unprecedented opportunities for creating more transparent and efficient taxation models. These innovations could potentially revolutionize how states approach sports betting regulation and revenue generation.RELATED NEWS

Sports

Cord-Cutters' Home Run: Your Ultimate Guide to Streaming MLB 2025 Without Breaking the Bank

2025-03-12 00:37:31

Sports

Quarterback Swap Shocker: Browns Secure Kenny Pickett in Blockbuster Trade

2025-03-10 21:41:41