Social Security Cracks Down: New Rule Demands In-Person Verification, Leaving Claimants No Choice

Politics

2025-03-18 23:56:11Content

In a bold move to combat identity fraud, the Social Security Administration (SSA) has unveiled a new policy requiring applicants who cannot verify their identities online to complete their benefit claims in person at local field offices. The announcement, made on Tuesday, signals a significant shift in the agency's approach to protecting sensitive personal information and preventing fraudulent claims.

As digital identity verification becomes increasingly sophisticated, the SSA is taking proactive steps to ensure that only legitimate applicants receive benefits. Those unable to prove their identity through online channels will now need to make a personal appearance, adding an extra layer of security to the application process.

This new requirement aims to safeguard the integrity of the Social Security system and protect both applicants and taxpayers from potential identity theft and fraudulent activities. By mandating in-person verification for certain applicants, the agency hopes to significantly reduce the risk of unauthorized benefit claims.

Identity Verification Revolution: Social Security's Bold Move to Fortify Benefit Claims

In an era of escalating digital fraud and identity theft, the Social Security Administration has unveiled a groundbreaking strategy to protect vulnerable citizens and safeguard the integrity of critical government benefits. This transformative approach represents a significant leap forward in combating systemic vulnerabilities within the nation's social support infrastructure.Protecting America's Most Vulnerable: A Comprehensive Identity Verification Overhaul

The Digital Identity Verification Landscape

The contemporary digital ecosystem presents unprecedented challenges for government agencies tasked with protecting citizen benefits. Cybercriminals have become increasingly sophisticated, exploiting technological vulnerabilities with alarming precision. The Social Security Administration's recent announcement signals a proactive and comprehensive approach to mitigating these complex risks. Traditional online verification methods have proven inadequate in preventing fraudulent claims. By mandating in-person verification for applicants unable to authenticate their identities through digital channels, the agency is implementing a multi-layered security protocol that significantly reduces the potential for unauthorized benefit access.Technological Challenges in Identity Authentication

Modern identity verification requires a nuanced understanding of technological limitations and human behavioral patterns. The Social Security Administration's new policy acknowledges that digital authentication alone cannot guarantee complete security. By requiring physical presence at field offices, the agency introduces a critical human element that automated systems cannot replicate. Biometric verification, document cross-referencing, and direct personal interaction provide multiple layers of security that digital platforms often lack. This approach not only prevents fraudulent claims but also ensures that legitimate beneficiaries receive the support they desperately need.Implications for Benefit Applicants

The new verification protocol will undoubtedly create additional administrative challenges for benefit applicants. Individuals who cannot complete online identity verification will need to allocate time and resources to visit local Social Security field offices. While potentially inconvenient, this process represents a necessary evolution in protecting individual and collective financial interests. Applicants should prepare comprehensive documentation, including government-issued identification, supporting legal documents, and proof of residency. The in-person verification process will likely involve detailed interviews and thorough document examination, ensuring the highest standards of authenticity.Broader Societal Impact

This policy transformation extends beyond mere administrative procedure. It represents a significant statement about governmental commitment to protecting social support systems from exploitation. By implementing rigorous verification protocols, the Social Security Administration demonstrates its dedication to maintaining the financial integrity of critical social safety nets. The approach also serves as a deterrent to potential fraudsters, signaling that unauthorized benefit claims will face increasingly sophisticated detection mechanisms. This proactive stance potentially saves taxpayers millions of dollars annually by preventing systemic fraud.Technological and Human Synergy

The new verification strategy brilliantly balances technological innovation with human expertise. While digital platforms offer efficiency, human interaction provides nuanced understanding and contextual verification that algorithms cannot replicate. Field office personnel become crucial gatekeepers, combining technological tools with professional judgment. This hybrid approach represents a sophisticated model of identity verification that could potentially serve as a blueprint for other government agencies and private sector organizations facing similar authentication challenges.Future Outlook and Potential Developments

As technological landscapes continue evolving, identity verification methods must correspondingly adapt. The Social Security Administration's current policy likely represents an initial phase of a more comprehensive digital transformation strategy. Future iterations might incorporate advanced biometric technologies, artificial intelligence-driven verification protocols, and increasingly sophisticated fraud detection mechanisms. Continuous refinement of these systems will be crucial in maintaining a delicate balance between accessibility, security, and user experience for benefit applicants nationwide.RELATED NEWS

Politics

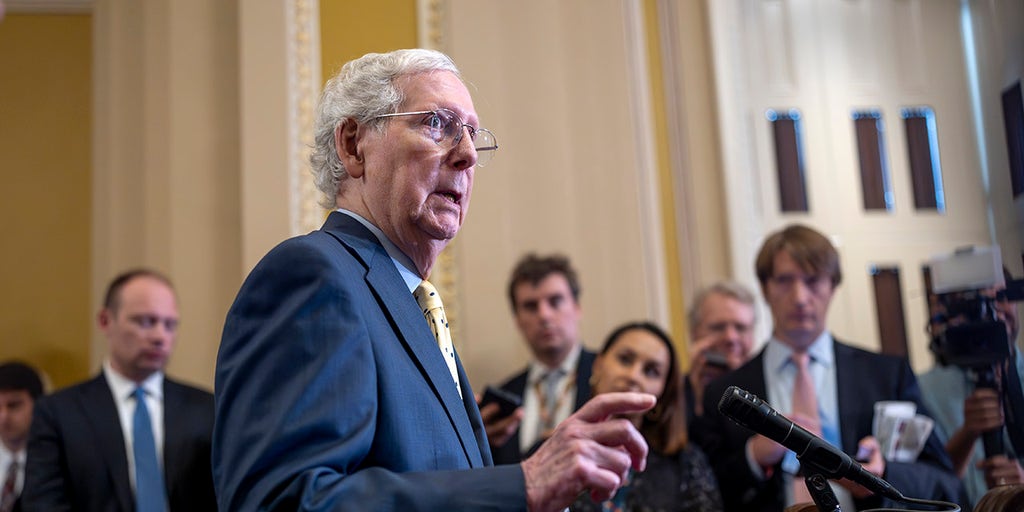

Political Showdown: Democrats Escalate Pressure on DOJ Official in Adams Probe

2025-03-04 19:30:21

Politics

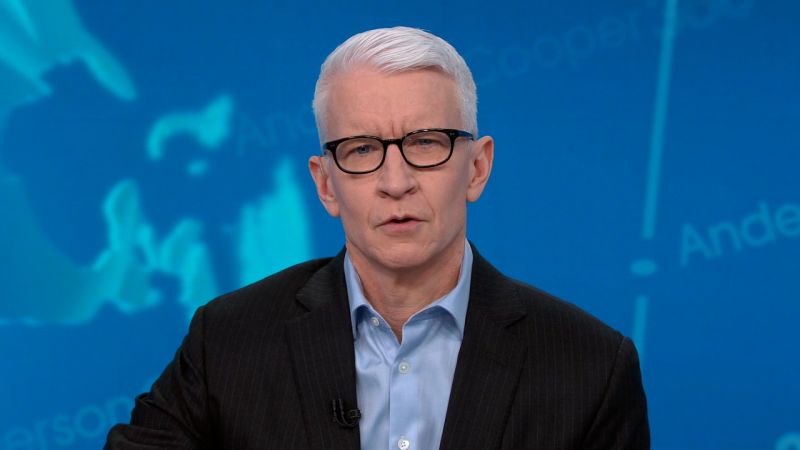

Insider Speaks Out: Federal Employee Challenges Trump's Narrative on Musk's Controversial Email Leak

2025-02-25 07:34:17

Politics

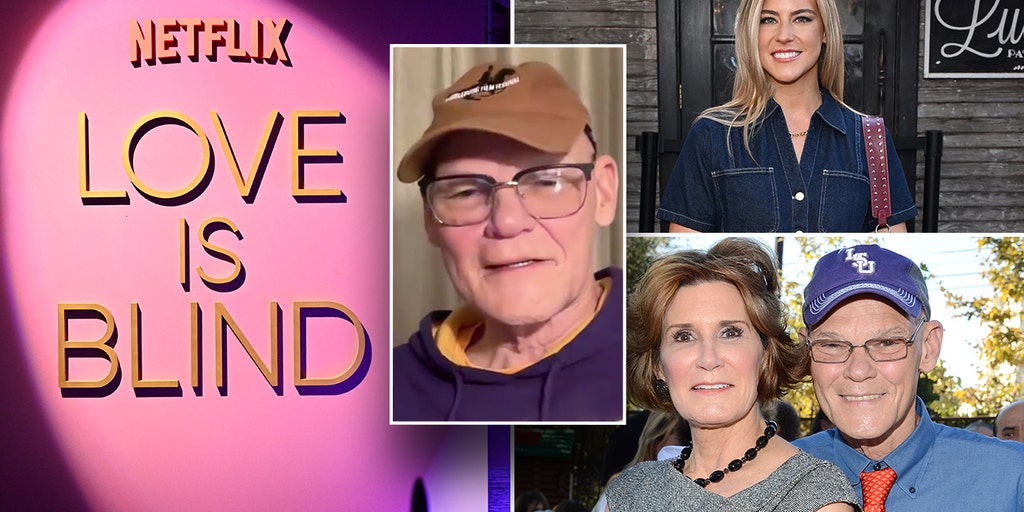

Love, Politics, and Reality TV: Carville's Unexpected Wisdom for Young Progressives

2025-03-15 14:00:22