Steel, Showdown, and Scrutiny: Starmer's High-Stakes PMQs Amid Trump Trade Tensions

Politics

2025-02-12 08:11:47Content

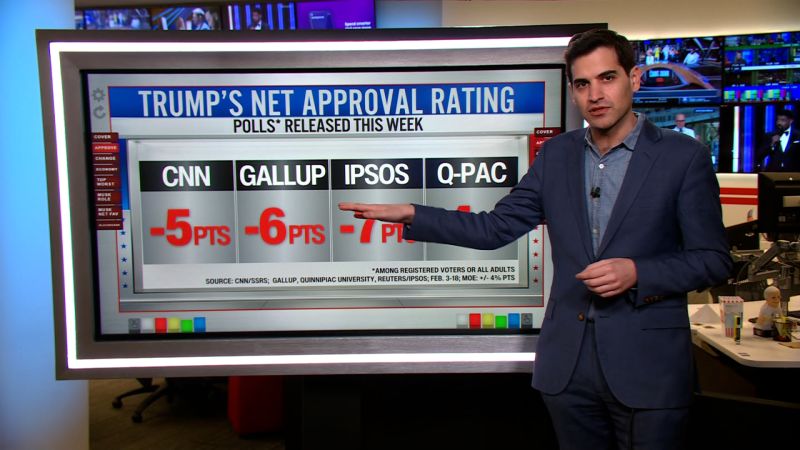

In a bold escalation of international trade tensions, the US President has signaled a potential game-changing move by threatening to impose sweeping 25 percent tariffs on all steel imports. This dramatic announcement threatens to further intensify the ongoing global trade confrontation and could send shockwaves through international markets.

The proposed tariffs represent a significant escalation in the administration's trade strategy, targeting foreign steel producers and potentially reshaping global steel trade dynamics. By proposing such a comprehensive tariff, the President aims to protect domestic steel industries and challenge what the administration views as unfair international trade practices.

Economists and trade experts are closely watching the potential implications of these proposed tariffs. The move could dramatically increase the cost of imported steel, potentially impacting manufacturing, construction, and numerous other sectors that rely on steel as a critical raw material.

International trading partners are likely to view this announcement as a provocative step that could trigger retaliatory measures, further complicating the already complex global trade landscape. The threat of these tariffs underscores the ongoing trade tensions and the administration's commitment to an aggressive economic nationalism approach.

As negotiations and diplomatic discussions continue, the global business community remains on high alert, anticipating the potential economic ripple effects of this bold trade policy maneuver.

Trade Tensions Escalate: Trump's Steel Tariff Threat Sends Shockwaves Through Global Markets

In a dramatic escalation of international economic tensions, the United States is poised to unleash a potentially devastating blow to global steel trade, signaling a renewed commitment to protectionist economic policies that could reshape international commerce and diplomatic relations.Unprecedented Economic Warfare Looms on the Horizon

The Strategic Calculus of Tariff Implementation

The proposed 25 percent tariffs represent more than just a punitive economic measure; they embody a complex geopolitical strategy designed to reassert American industrial dominance. By targeting steel imports, the administration aims to create a protective shield around domestic manufacturers, potentially triggering a seismic shift in global trade dynamics. Economists and trade experts are closely analyzing the potential ripple effects of such a sweeping tariff policy. The move could potentially destabilize established international supply chains, forcing multinational corporations to rapidly recalibrate their manufacturing and procurement strategies. Countries with significant steel export capabilities may find themselves suddenly confronted with dramatically reduced market access.Global Economic Implications and Potential Retaliatory Measures

The proposed tariffs are not merely an isolated economic decision but a calculated geopolitical maneuver with far-reaching consequences. Major steel-exporting nations are likely to view this action as a direct challenge, potentially precipitating a cascade of retaliatory trade measures that could further complicate international economic relations. Diplomatic channels are already buzzing with speculation about potential countermeasures. Some analysts predict a complex chess game of economic sanctions and strategic trade restrictions that could fundamentally alter the current global economic landscape. The potential for escalation remains high, with each participating nation carefully weighing its economic and strategic interests.Domestic Manufacturing and Industrial Policy Considerations

Behind the tariff proposal lies a nuanced industrial policy aimed at revitalizing American manufacturing. By creating artificial market advantages for domestic steel producers, the administration hopes to stimulate job creation and reinvigorate industrial sectors that have experienced significant decline over recent decades. However, economists warn that such protectionist measures often carry unintended consequences. While domestic steel manufacturers might experience short-term gains, downstream industries relying on affordable imported steel could face significant cost increases, potentially offsetting any initial economic benefits.Technological and Innovation Perspectives

The steel tariff strategy intersects intriguingly with broader technological and innovation considerations. As global manufacturing increasingly relies on advanced materials and precision engineering, the tariffs could inadvertently create incentives for accelerated technological development and alternative material research. Forward-thinking nations and corporations might view this potential trade barrier as an opportunity to invest in cutting-edge metallurgical technologies, potentially triggering a new wave of materials science innovation that transcends traditional trade restrictions.Long-Term Strategic Outlook

The proposed tariffs represent more than an isolated economic policy; they symbolize a broader geopolitical recalibration. As international trade relationships continue to evolve, such bold economic interventions signal a willingness to challenge established global economic paradigms. Stakeholders across multiple sectors—from international diplomats to corporate strategists—are closely monitoring these developments, understanding that the ramifications will extend far beyond immediate economic calculations.RELATED NEWS

Politics

Shaheen's Political Earthquake: NH's Power Landscape Shifts, 3 Burning Questions Emerge

2025-03-12 20:27:14