SPACs Under Siege: How Wall Street's New Rulebook Is Reshaping Blank-Check Mergers

Companies

2025-03-31 16:37:50Content

In Brief: The SPAC Revolution - A New Pathway to Public Markets

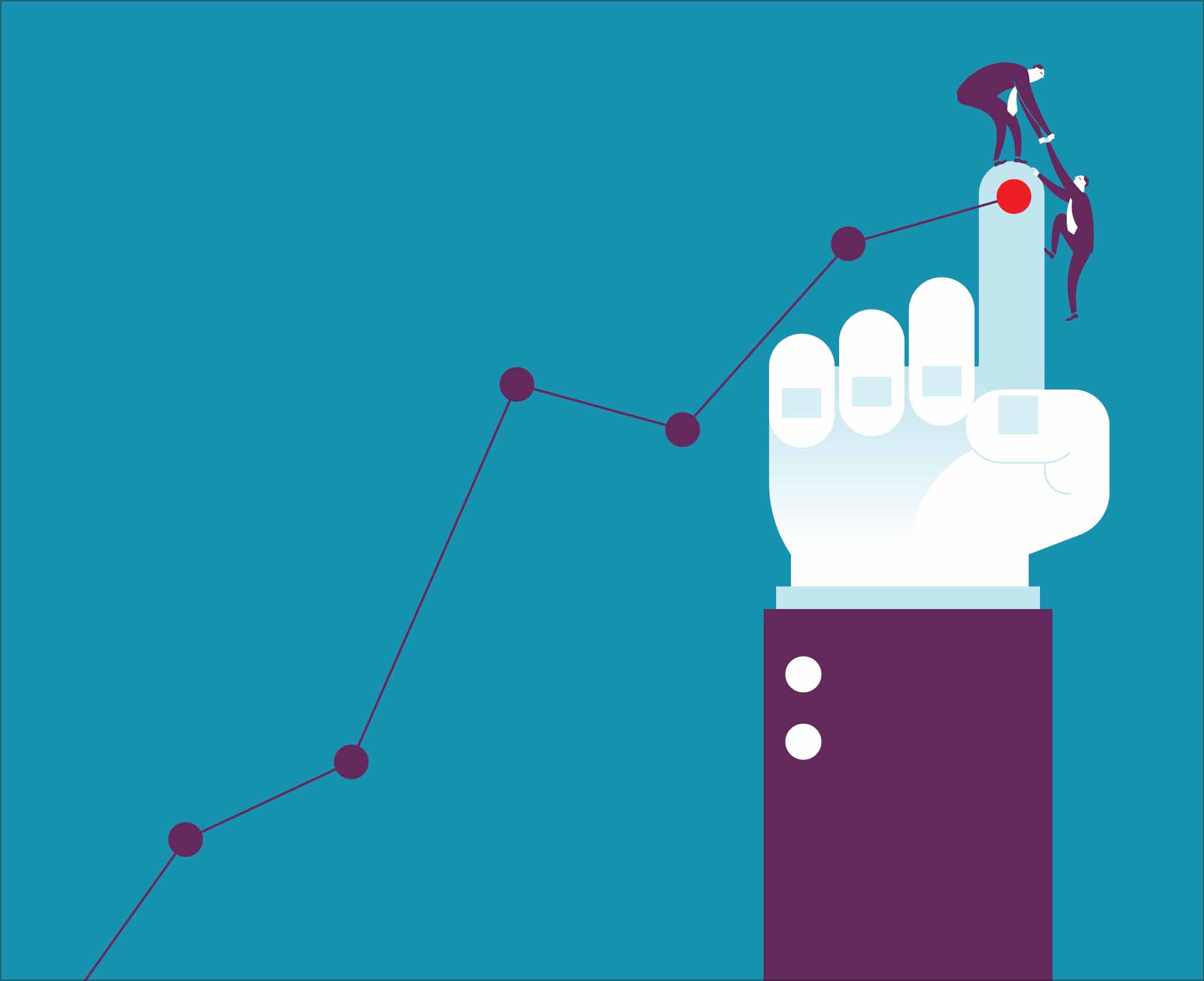

Special Purpose Acquisition Companies (SPACs) have emerged as a game-changing alternative for businesses seeking to go public, transforming the traditional initial public offering (IPO) landscape. These innovative financial vehicles, often called "blank check companies," have surged in popularity, offering entrepreneurs and investors a more flexible and streamlined route to accessing public capital markets.

Unlike conventional IPOs, SPACs provide a unique mechanism where a publicly traded shell company raises capital through an initial public offering, with the primary goal of acquiring or merging with an existing private company. This approach allows promising businesses to bypass the complex and time-consuming traditional IPO process, offering a faster and potentially more cost-effective path to becoming a publicly traded entity.

The dramatic rise of SPACs represents a significant shift in how companies approach public market entry, providing an attractive alternative that has captured the attention of both emerging businesses and seasoned investors alike.

The Rise and Fall of SPACs: A Financial Revolution Unraveled

In the dynamic landscape of modern finance, few investment vehicles have captured the imagination and sparked as much debate as Special Purpose Acquisition Companies (SPACs). These enigmatic financial instruments emerged as a revolutionary alternative to traditional initial public offerings, promising entrepreneurs and investors a streamlined path to public markets that challenged conventional wisdom and reshaped investment strategies.Unlocking the Future of Public Market Investments: A Game-Changing Financial Strategy

The SPAC Phenomenon: Understanding the Mechanism of Alternative Public Offerings

The emergence of Special Purpose Acquisition Companies represents a profound transformation in how companies approach public market entry. Unlike traditional initial public offerings, SPACs provide a unique mechanism for private enterprises to transition into publicly traded entities. These shell companies, often referred to as "blank check" corporations, are designed with a singular purpose: to identify and merge with promising private businesses, effectively circumventing the complex and time-consuming traditional IPO process. Investors in SPACs essentially place their capital into a speculative vehicle with no predetermined operational history, betting on the expertise and strategic vision of experienced management teams. This approach introduces a fascinating dynamic where investment becomes less about current performance and more about potential future growth and strategic alignment.The Economic Landscape: Driving Forces Behind SPAC Popularity

The exponential growth of SPACs can be attributed to a confluence of economic factors and market dynamics. Venture capitalists, private equity firms, and entrepreneurial leaders recognized the inherent limitations of traditional fundraising mechanisms. The SPAC model offered unprecedented flexibility, allowing companies to negotiate valuation terms more directly and access public markets with greater speed and efficiency. Technological disruption and the emergence of innovative sectors like electric vehicles, space technology, and advanced digital platforms created a fertile ground for SPAC-driven investments. Entrepreneurs in cutting-edge industries found SPACs particularly attractive, as they provided a rapid mechanism to secure substantial capital while maintaining significant strategic control.Regulatory Landscape and Investor Considerations

The regulatory environment surrounding SPACs has evolved dramatically, reflecting both the innovation and potential risks associated with these financial instruments. Securities regulators have implemented increasingly stringent disclosure requirements and enhanced due diligence protocols to protect investor interests. Sophisticated investors must navigate a complex ecosystem of risk assessment, understanding that while SPACs offer exciting opportunities, they also present unique challenges. The lack of historical financial performance and the speculative nature of these investments demand a nuanced approach to portfolio management and risk mitigation.Global Impact and Future Trajectory

The global financial ecosystem has been profoundly influenced by the SPAC phenomenon. International markets have observed and adapted to this innovative approach, with jurisdictions worldwide developing regulatory frameworks to accommodate these novel investment vehicles. While the initial euphoria surrounding SPACs has somewhat tempered, the underlying innovation continues to reshape investment strategies. The market has matured, with investors becoming more discerning and management teams developing more sophisticated approaches to identifying and integrating potential merger targets.Technological Integration and Strategic Transformation

The intersection of technological innovation and financial engineering has been a defining characteristic of the SPAC revolution. Advanced data analytics, artificial intelligence, and sophisticated valuation models have enhanced the ability of SPAC managers to identify and evaluate potential merger opportunities. Emerging technologies have not only facilitated the SPAC process but have also become primary targets for these investment vehicles. Sectors like quantum computing, renewable energy, and advanced biotechnology have particularly benefited from the flexible capital acquisition model that SPACs represent.RELATED NEWS

Companies

Winter's Grip: Tow Truck Operators in Hampton Roads Gear Up for Snowy Challenges

2025-02-19 03:34:29