Energy Titans Sound Alarm: EU's Gas Price Cap Could Spark Market Chaos

Companies

2025-02-12 06:25:08Content

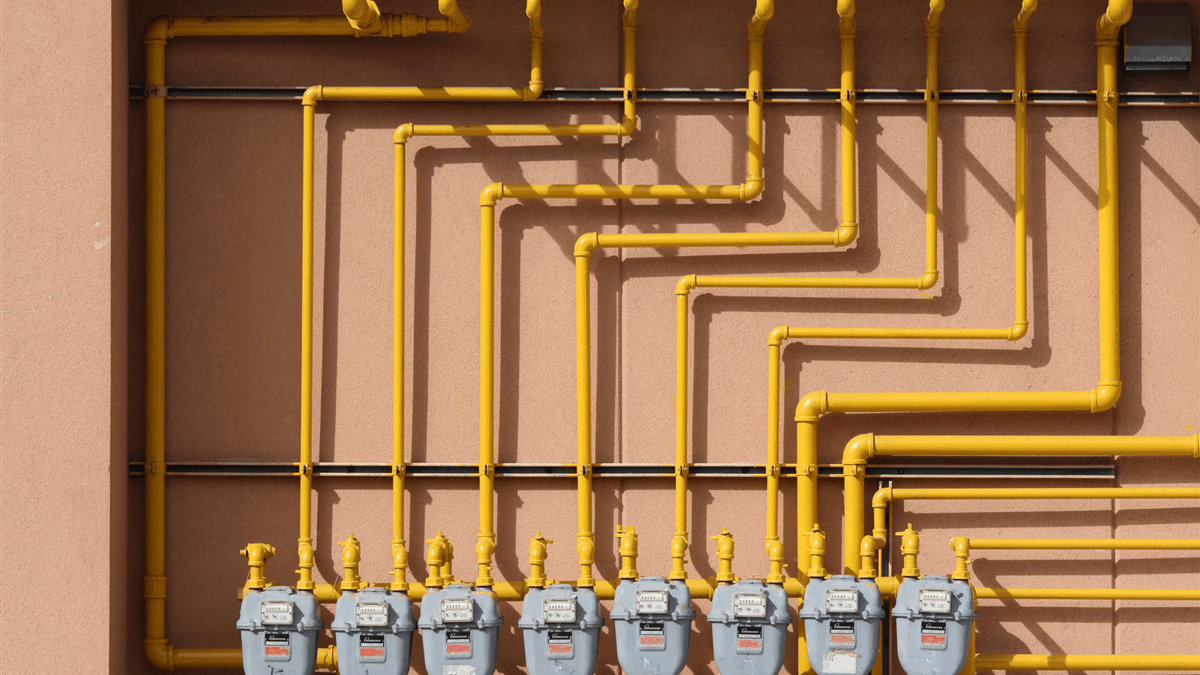

The proposed price cap on energy is proving to be a complex and potentially counterproductive strategy for addressing global energy challenges. While intended to provide relief, this approach may actually generate unintended consequences that could destabilize European energy markets.

Rather than effectively reducing global energy prices, the price cap mechanism is more likely to create additional market distortions. Specifically, it could trigger increased price volatility and potentially drive energy prices higher across European markets. Energy suppliers and traders may respond to such artificial constraints by adjusting their supply chains, trading strategies, and pricing models.

The fundamental economic principle at play suggests that artificially constraining market prices does not eliminate underlying supply and demand dynamics. Instead, it can lead to market inefficiencies, potentially causing energy suppliers to reduce investments, limit supply, or seek alternative markets with more favorable trading conditions.

European policymakers must carefully consider these potential ripple effects. A nuanced approach that balances market stability, consumer protection, and long-term energy infrastructure investment will be crucial in navigating the complex global energy landscape.

Energy Market Tremors: The High-Stakes Debate Over European Gas Price Regulation

In the complex landscape of global energy economics, a critical battle is unfolding between European policymakers and energy industry stakeholders, where proposed price cap mechanisms are threatening to reshape the delicate balance of energy market dynamics.Navigating Turbulent Energy Markets: A Critical Policy Challenge

The Intricate Mechanics of Energy Price Intervention

The proposed European gas price cap represents a sophisticated yet potentially disruptive regulatory intervention that could fundamentally alter energy market equilibrium. Energy economists and industry experts are deeply concerned about the potential unintended consequences of such a mechanism. The proposed regulation aims to mitigate extreme price volatility, but paradoxically might introduce even greater market instability. Sophisticated market analysis suggests that artificial price constraints could create significant distortions in supply chains, potentially undermining the natural market mechanisms that traditionally regulate energy pricing. By imposing external limitations, policymakers risk disrupting the intricate global energy trading ecosystem that has evolved over decades of complex international interactions.Economic Ripple Effects and Market Psychology

The psychological impact of price interventions cannot be understated. When governments attempt to artificially constrain market prices, traders and energy suppliers often respond with strategic adaptations that can amplify market volatility. These responses might include reduced investment in infrastructure, decreased supply commitments, or more complex financial hedging strategies. Energy market participants are particularly sensitive to regulatory signals. A price cap could send unintended messages about market predictability, potentially triggering speculative behaviors that counteract the original policy objectives. The delicate balance between regulatory intent and market reaction requires nuanced understanding and precise implementation.Global Energy Dynamics and Geopolitical Considerations

Beyond immediate economic implications, the proposed price cap intersects with broader geopolitical energy strategies. Major energy-producing nations might perceive such interventions as direct challenges to their economic sovereignty, potentially leading to retaliatory measures or strategic realignments in global energy trade. The interconnected nature of modern energy markets means that European policy decisions reverberate far beyond continental boundaries. Energy suppliers could strategically redirect resources, adjust long-term contracts, or explore alternative market opportunities in response to perceived regulatory risks.Technological and Infrastructure Implications

Regulatory interventions like price caps can significantly impact long-term energy infrastructure investments. Energy companies might become more hesitant to commit capital to complex infrastructure projects if they perceive increased regulatory uncertainty. This potential chilling effect could have profound implications for future energy transition strategies. Technological innovation in energy systems requires stable, predictable investment environments. Excessive regulatory interference could potentially slow down critical developments in renewable energy, energy storage, and grid modernization efforts.Risk Management and Strategic Adaptation

Energy market participants must develop sophisticated risk management strategies in response to potential regulatory changes. This involves creating flexible operational models, diversifying supply chains, and maintaining robust financial buffers to navigate potential market disruptions. The most successful organizations will be those capable of rapidly adapting to changing regulatory landscapes while maintaining strategic long-term perspectives. Agility, comprehensive market intelligence, and proactive scenario planning become crucial competitive advantages in this complex environment.RELATED NEWS

Companies

Ethical Excellence: Republic Services Clinches Prestigious Global Recognition for 7th Consecutive Year

2025-03-11 13:04:00

Companies

Ethics Champions: Leidos Clinches Eighth Straight Year on Global Integrity Honors List

2025-03-11 12:00:00