Commodity Compass: 5 Charts That Could Shake Global Markets This Week

Finance

2025-03-09 21:00:00Content

Energy Markets in Focus: Oil Supplies Surge and Prices Tumble at CERAWeek

The global energy landscape is set to take center stage as industry leaders converge in Houston for the prestigious CERAWeek conference. Oil markets are experiencing a significant shift, with rising supplies driving prices downward and creating a buzz of anticipation among energy experts.

Meanwhile, agricultural traders are closely watching an uncertain trade policy scenario that could impact approximately 11 million metric tons of US grain exports. The potential disruption has sparked concern and speculation about future market dynamics.

In the mining sector, gold producer earnings reports are revealing the current power players, offering insights into which companies are navigating the complex global economic environment most effectively.

As the conference unfolds, industry professionals will be dissecting these critical developments, seeking to understand the evolving trends that will shape energy, agriculture, and commodity markets in the coming months.

Energy Dynamics Shift: Unveiling the Global Market Transformation

In the ever-evolving landscape of global energy and economic markets, a complex narrative is unfolding that promises to reshape industry perspectives and challenge existing paradigms. The intricate interplay of supply chains, trade policies, and market dynamics continues to generate unprecedented opportunities and challenges for stakeholders across multiple sectors.Navigating Uncertainty: The Pulse of Global Economic Transformation

Oil Market Volatility and Supply Chain Resilience

The contemporary energy ecosystem is experiencing a profound metamorphosis, characterized by dynamic shifts in oil supply and pricing mechanisms. Emerging market trends suggest a nuanced recalibration of global petroleum infrastructure, with significant implications for international trade and geopolitical relationships. Sophisticated market analysts are closely monitoring the intricate balance between production capacities, geopolitical tensions, and technological innovations that collectively influence petroleum market trajectories. Technological advancements and strategic investments are fundamentally restructuring traditional energy paradigms. Renewable energy integration, enhanced extraction technologies, and sophisticated predictive modeling are enabling more responsive and adaptive energy ecosystems. These transformative approaches are not merely incremental improvements but represent fundamental reimagining of energy production and distribution strategies.Agricultural Trade Uncertainties and Global Economic Implications

The precarious state of international grain trade underscores the complex interdependencies within global agricultural markets. Approximately 11 million metric tons of United States agricultural products are currently suspended in a state of uncertainty, reflecting broader geopolitical and economic challenges. These trade disruptions extend beyond mere economic transactions, representing intricate negotiations that impact food security, international relations, and economic stability. Complex regulatory environments and evolving trade policies are creating unprecedented challenges for agricultural exporters. Stakeholders must navigate increasingly sophisticated diplomatic and economic landscapes, requiring adaptive strategies and robust risk management frameworks. The interconnected nature of global markets means that seemingly localized trade disruptions can generate cascading economic consequences.Mining Sector Dynamics and Economic Performance

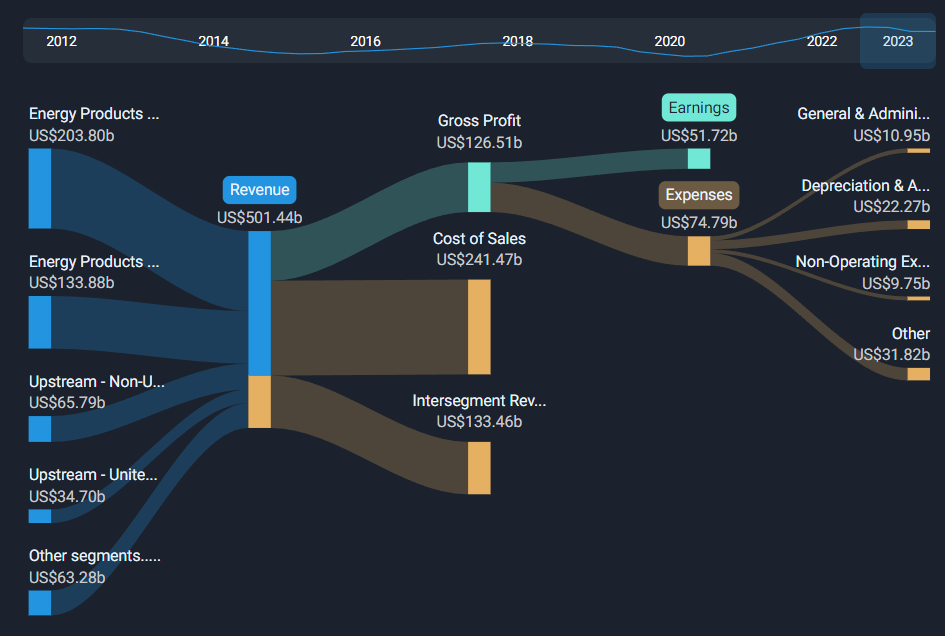

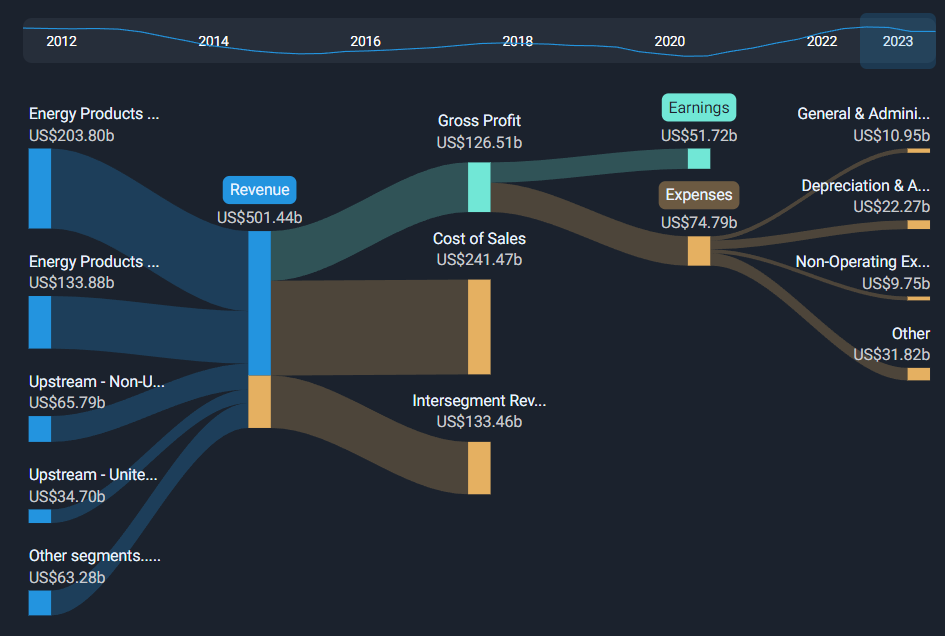

The gold mining industry presents a fascinating microcosm of broader economic trends, with recent earnings reports revealing significant variations in corporate performance. These financial indicators provide critical insights into global economic health, investment strategies, and resource extraction dynamics. Sophisticated investors and market analysts are meticulously examining these reports to understand underlying economic trends and potential investment opportunities. Technological innovations, environmental considerations, and geopolitical factors are increasingly influencing mining sector strategies. Companies demonstrating adaptability, technological prowess, and sustainable practices are emerging as industry leaders, challenging traditional operational paradigms and setting new benchmarks for corporate performance.Institutional Transformations and Strategic Realignments

Emerging trends in institutional restructuring, such as collegiate mergers and strategic consolidations, reflect broader economic adaptation mechanisms. These developments signal a profound recalibration of organizational strategies in response to complex economic pressures. Educational institutions, much like corporate entities, are increasingly required to demonstrate financial resilience and strategic agility. The convergence of technological disruption, economic uncertainty, and evolving regulatory landscapes is generating unprecedented challenges and opportunities. Successful navigation of these complex environments requires sophisticated strategic thinking, adaptable frameworks, and a nuanced understanding of interconnected global systems.RELATED NEWS

Breaking: International Personal Finance Defies Odds with Surprise Earnings Triumph

Nuclear Energy Innovator NANO Taps Seasoned Finance Veteran Darlene DeRemer as Corporate Finance Chief