Financial Titans Scramble: Europe's Defense Transformation Sparks Banking Revolution

Finance

2025-03-09 09:00:00Content

European Defense Priorities Clash with Banking Interests

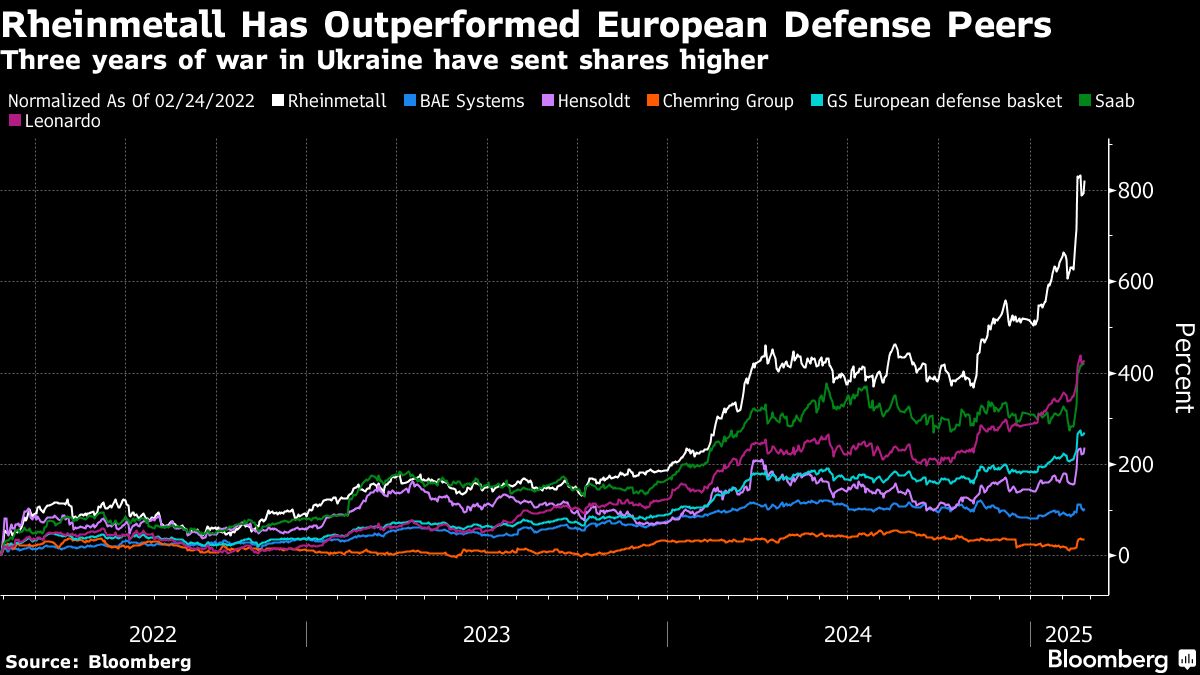

As Europe pivots towards bolstering its defense capabilities, a complex tension is emerging between military strategists and financial institutions. The continent's renewed focus on military preparedness is creating unprecedented challenges for traditional banking approaches.

Key stakeholders across defense industries, political circles, and financial sectors are now engaged in a critical dialogue about how to restructure economic priorities. The push for increased military spending is forcing banks to reconsider their investment strategies and risk assessments.

Senior executives from defense companies are advocating for more flexible financial mechanisms to support rapid military modernization. Meanwhile, bankers are cautiously evaluating the long-term economic implications of this strategic shift.

The emerging landscape suggests a fundamental realignment of European economic and security priorities, with defense emerging as a top national and regional concern. This transformation represents a significant departure from previous economic models that prioritized commercial and trade interests.

As geopolitical tensions continue to evolve, Europe's ability to balance military readiness with economic stability will be crucial in maintaining its strategic autonomy and global competitiveness.

Europe's Defense Dilemma: Banking on Security in a Shifting Geopolitical Landscape

In the complex world of international relations, Europe finds itself at a critical crossroads, where financial institutions and defense strategies are colliding in an unprecedented manner. The continent's longstanding approach to security and economic policy is undergoing a dramatic transformation, driven by geopolitical tensions, emerging threats, and the urgent need for strategic resilience.Navigating the Turbulent Waters of European Defense Transformation

The Financial Sector's Strategic Realignment

European financial institutions are experiencing a profound paradigm shift as defense becomes a paramount priority. Traditional banking models are being challenged by the urgent need for strategic investment in national and collective security infrastructure. The banking sector is no longer viewing defense as a peripheral concern but as a central strategic imperative that demands innovative financial approaches. The complexity of this transformation extends beyond mere monetary considerations. Banks are now required to develop sophisticated risk assessment models that incorporate geopolitical dynamics, technological advancements, and national security imperatives. This represents a fundamental reimagining of financial strategy, where economic calculations are increasingly intertwined with defense and security considerations.Technological Innovation and Defense Investment

The convergence of financial expertise and defense requirements is driving unprecedented technological innovation. European banks are now actively exploring investment strategies that support cutting-edge defense technologies, including artificial intelligence, cybersecurity infrastructure, and advanced military research and development. This technological frontier presents both challenges and opportunities. Financial institutions must balance traditional risk management principles with the need for rapid, flexible investment in emerging defense capabilities. The result is a dynamic ecosystem where technological innovation, financial strategy, and national security are becoming increasingly interconnected.Geopolitical Pressures and Strategic Recalibration

External geopolitical pressures are accelerating Europe's defense transformation. The traditional post-Cold War approach of minimal military investment is being rapidly dismantled in favor of a more proactive and comprehensive security strategy. Banks are playing a crucial role in this transition, providing the financial architecture necessary to support rapid defense modernization. The strategic recalibration involves more than just increased military spending. It encompasses a holistic approach to national and collective security that integrates economic resilience, technological capabilities, and diplomatic strategies. Financial institutions are becoming key architects of this complex transformation, developing nuanced investment models that support long-term strategic objectives.Challenges of Institutional Adaptation

The integration of defense priorities into financial strategies is not without significant challenges. European banks must navigate complex regulatory environments, manage potential conflicts between economic interests and security imperatives, and develop new expertise in defense-related financial modeling. Moreover, this transformation requires a cultural shift within financial institutions. Traditional risk assessment frameworks must be reimagined to incorporate geopolitical dynamics, technological potential, and national security considerations. This represents a profound evolution in institutional thinking and strategic planning.Future Outlook and Strategic Implications

As Europe continues to reshape its defense and financial landscapes, the relationship between banking and security will become increasingly symbiotic. Financial institutions are no longer passive observers but active participants in national and continental security strategies. The ongoing transformation suggests a future where economic and defense capabilities are deeply interconnected, requiring unprecedented levels of strategic coordination, technological innovation, and adaptive thinking. European banks are emerging as critical enablers of this complex and dynamic strategic environment.RELATED NEWS

CFPB Under Siege: Trump Team's Radical Plan to Gut Consumer Protection Agency

Wall Street Surges: Tech Stocks Propel Markets as Trump's Trade Tactics Unfold