Insider Stakes: Top ASX Growth Stocks Where Executives Are All In

Companies

2025-02-12 04:02:30Content

The Australian stock market is showing resilience today, with the ASX200 climbing a modest 0.25% to reach 8,505 points, propelled by strong performance in the Industrials sector. This subtle yet promising movement has investors scanning the horizon for potential growth opportunities.

In the current market landscape, companies with significant insider ownership are emerging as particularly compelling investment prospects. These firms offer a unique value proposition, where management's financial interests are closely aligned with those of shareholders, potentially signaling confidence and commitment to long-term value creation.

As the Australian market continues to evolve, savvy investors are looking beyond surface-level metrics, seeking out companies where leadership has a meaningful financial stake. This approach can provide an additional layer of reassurance, suggesting that management is not just managing, but genuinely invested in the company's success.

The current market conditions present an intriguing environment for investors willing to dig deeper and identify opportunities where corporate leadership and shareholder interests converge.

Insider Ownership: The Hidden Catalyst in Australian Market Dynamics

In the ever-evolving landscape of financial markets, savvy investors are constantly seeking strategic insights that can unlock potential growth opportunities. The Australian Securities Exchange (ASX) presents a fascinating ecosystem where company performance, sector trends, and insider dynamics intersect to create a complex investment environment.Decoding Market Potential: Where Insider Commitment Meets Shareholder Value

The Pulse of Australian Market Performance

The Australian financial landscape is experiencing a nuanced transformation, with the ASX200 index demonstrating subtle yet significant movements. Recent market indicators suggest a delicate balance between sector performance and investor sentiment. Industrial sectors are emerging as key drivers of market momentum, signaling a potential shift in investment strategies. Sophisticated investors recognize that market indices are more than mere numerical representations. They are complex ecosystems reflecting broader economic narratives, corporate strategies, and investor confidence. The current 0.25% rise in the ASX200 might appear modest, but it conceals intricate underlying dynamics that astute market participants are keen to decode.Insider Ownership: A Strategic Investment Lens

Insider ownership represents a critical yet often overlooked dimension of corporate governance and investment potential. When company executives and board members maintain substantial equity stakes, it signals a profound alignment of management interests with shareholder expectations. This alignment creates a unique value proposition. Executives with significant personal investments in their companies are inherently motivated to drive strategic decisions that enhance long-term organizational performance. Their financial commitment transcends traditional management approaches, embedding a deeper sense of accountability and strategic vision.Navigating Sector Dynamics and Growth Opportunities

The industrial sector's current leadership in market performance offers a compelling narrative for investors. These sectors are not merely economic indicators but represent complex networks of innovation, operational efficiency, and strategic adaptation. Companies demonstrating robust insider ownership within industrial domains present particularly intriguing investment prospects. Their leadership's financial stake creates a natural incentive for sustainable growth, operational excellence, and shareholder value creation.Strategic Implications for Investor Decision-Making

Understanding insider ownership requires a multifaceted approach. Investors must look beyond surface-level financial metrics and delve into the qualitative aspects of corporate governance, leadership commitment, and strategic vision. Quantitative analysis combined with qualitative insights provides a more comprehensive investment framework. Tracking insider trading patterns, understanding management's long-term strategic vision, and evaluating their personal financial commitment can offer nuanced perspectives that traditional financial analysis might overlook.Emerging Trends and Future Outlook

The Australian market continues to evolve, presenting dynamic opportunities for discerning investors. Technological disruption, global economic shifts, and changing regulatory landscapes are reshaping investment strategies. Insider ownership emerges as a critical lens through which investors can assess potential growth trajectories. Companies where leadership demonstrates substantial financial commitment are more likely to navigate complex market challenges with resilience and strategic agility.RELATED NEWS

Companies

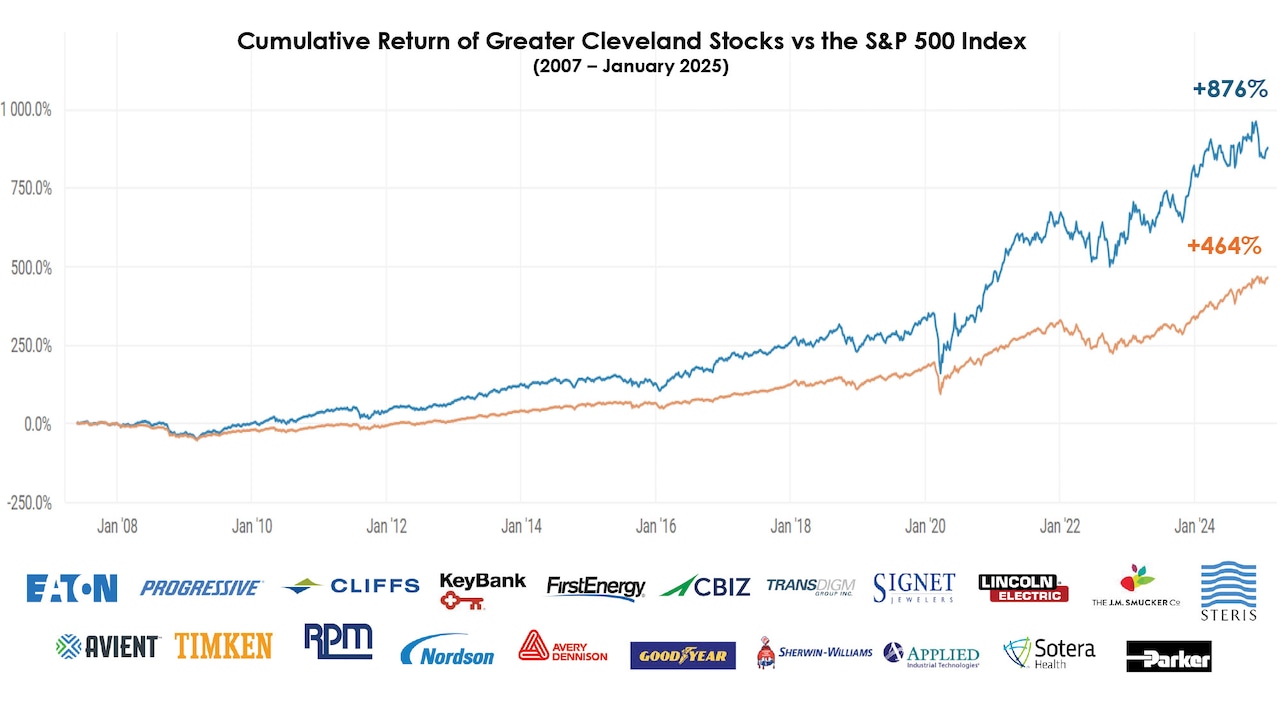

Local Powerhouse: Northeast Ohio Firms Outperform Wall Street's Gold Standard

2025-03-07 21:24:44

Companies

Pesticide Industry's Legal Shield: Iowa Senate Paves Way for Corporate Protection

2025-02-20 00:51:29