Capital One Braces for Turbulence in Trump's Shifting Political Landscape

Finance

2025-03-10 08:00:11Content

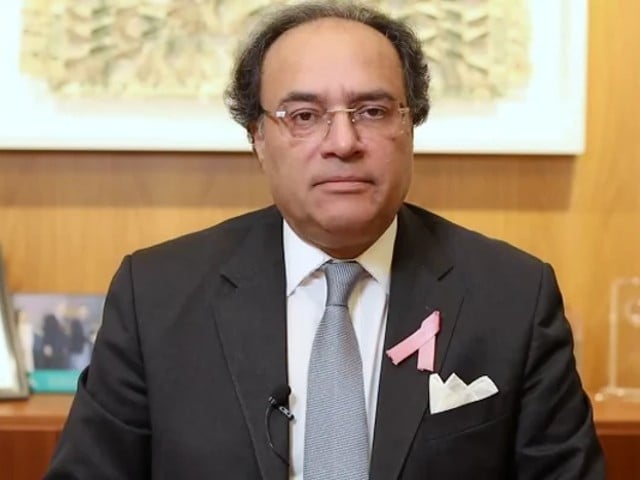

Capital One finds itself navigating a complex legal and business landscape, simultaneously battling a fresh lawsuit from a Trump-affiliated company while seeking crucial merger approval from the former president's antitrust regulators. The banking giant is walking a delicate tightrope, balancing legal challenges and corporate ambitions in a high-stakes corporate drama.

The lawsuit and merger approval process highlight the intricate interconnections between corporate strategy and political relationships, putting Capital One in a particularly sensitive position. With legal pressures mounting and regulatory scrutiny intensifying, the company must carefully manage its approach to both the pending litigation and its strategic expansion plans.

This multifaceted challenge underscores the complex environment in which major financial institutions must operate, where legal disputes and regulatory approvals can dramatically impact corporate trajectories. Capital One's current situation serves as a compelling case study of the intricate dance between corporate interests, legal challenges, and political dynamics.

Capital One's Legal Tightrope: Navigating Trump's Business Empire and Antitrust Challenges

In the complex world of corporate legal battles and strategic mergers, Capital One finds itself at a critical intersection of business, politics, and legal scrutiny. The financial giant is simultaneously confronting a new lawsuit from a Trump-owned enterprise while seeking crucial merger approval from regulatory authorities previously led by the former president's administration.Unraveling the High-Stakes Corporate Chess Match

The Legal Landscape of Corporate Confrontation

Capital One's current predicament represents a multifaceted challenge that extends far beyond typical corporate litigation. The lawsuit, originating from a business entity connected to former President Donald Trump, introduces a layer of complexity that transcends standard legal proceedings. This legal action emerges at a particularly sensitive moment for the financial institution, which is simultaneously pursuing a significant merger that requires careful navigation through antitrust regulatory frameworks. The strategic implications of this dual challenge are profound. Capital One must simultaneously defend its legal interests while maintaining a delicate balance in its merger negotiations. The involvement of Trump-affiliated business interests adds an unprecedented dimension to the corporate strategy, requiring nuanced legal and public relations approaches.Merger Dynamics and Regulatory Scrutiny

The merger approval process represents a critical juncture for Capital One's strategic expansion. Antitrust regulators, who previously operated under the Trump administration's framework, now present a complex evaluation environment. The financial institution must demonstrate not only the economic merit of its proposed merger but also its ability to navigate potentially politically charged regulatory assessments. Regulatory experts suggest that the timing and nature of this lawsuit could potentially influence the merger approval process. The interconnected nature of legal challenges and corporate expansion strategies creates a high-stakes environment where every legal maneuver could have significant consequences for Capital One's future trajectory.Strategic Implications and Corporate Resilience

Capital One's response to these concurrent challenges will likely become a case study in corporate resilience and strategic legal navigation. The financial institution must simultaneously protect its legal interests, maintain investor confidence, and continue its strategic growth objectives. The lawsuit from a Trump-owned entity introduces additional complexity, potentially transforming a standard legal dispute into a broader narrative about corporate power, political connections, and regulatory dynamics. Capital One's legal team must craft a response that is both legally robust and strategically sophisticated, addressing the immediate legal challenge while preserving the company's long-term strategic vision.Financial and Reputational Risk Management

Beyond the immediate legal and merger considerations, Capital One faces significant reputational risks. The intersection of corporate litigation and political connections demands a carefully calibrated communication strategy. Investors, stakeholders, and the broader financial community will be closely monitoring the company's ability to manage these multifaceted challenges. The financial implications extend beyond immediate legal costs. Market perception, investor confidence, and potential regulatory responses could significantly impact Capital One's strategic positioning. The company's leadership must demonstrate exceptional strategic agility and legal acumen to successfully navigate this complex landscape.Future Outlook and Strategic Adaptation

As Capital One confronts these intricate challenges, the financial industry will be watching closely. The outcome of this legal dispute and merger process could establish important precedents for corporate strategy, regulatory engagement, and the complex relationship between business entities and political landscapes. The company's ability to maintain strategic focus while addressing these concurrent challenges will be a testament to its corporate resilience and strategic sophistication. Capital One stands at a critical juncture, where legal strategy, corporate expansion, and political dynamics converge in a high-stakes corporate narrative.RELATED NEWS

Finance

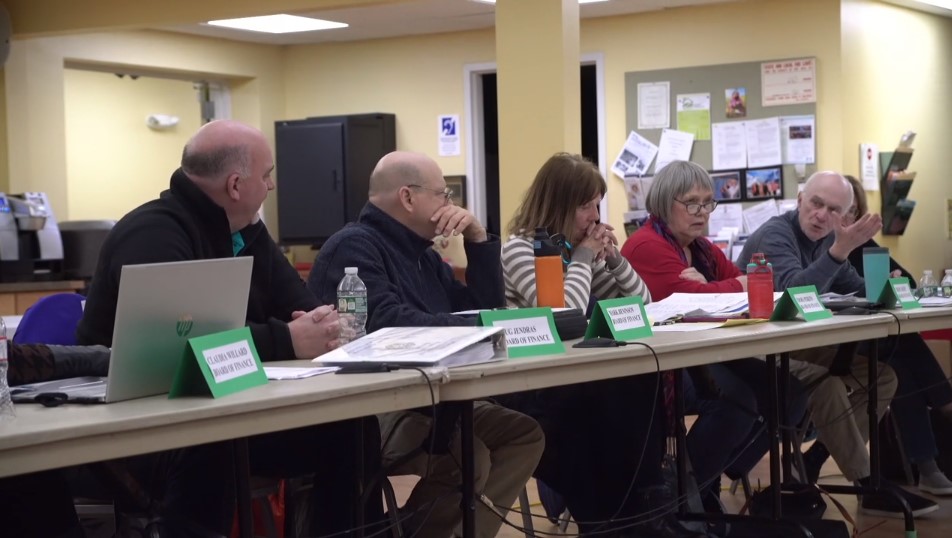

Tensions Boil Over: Finance Board Member Quits, Demands Immediate Departmental Overhaul

2025-03-09 09:00:00

Finance

Money, Myths, and Momentum: How Women Are Shattering the Financial Glass Ceiling

2025-03-09 10:00:45

Finance

Digital Trade Finance Revolution: Bank of Ireland Partners with Surecomp to Transform Banking Services

2025-03-11 12:44:07