Medical Miracle: Local Mom's $126K Debt Vanishes Thanks to 5 On Your Side Intervention

Health

2025-03-10 21:41:56Content

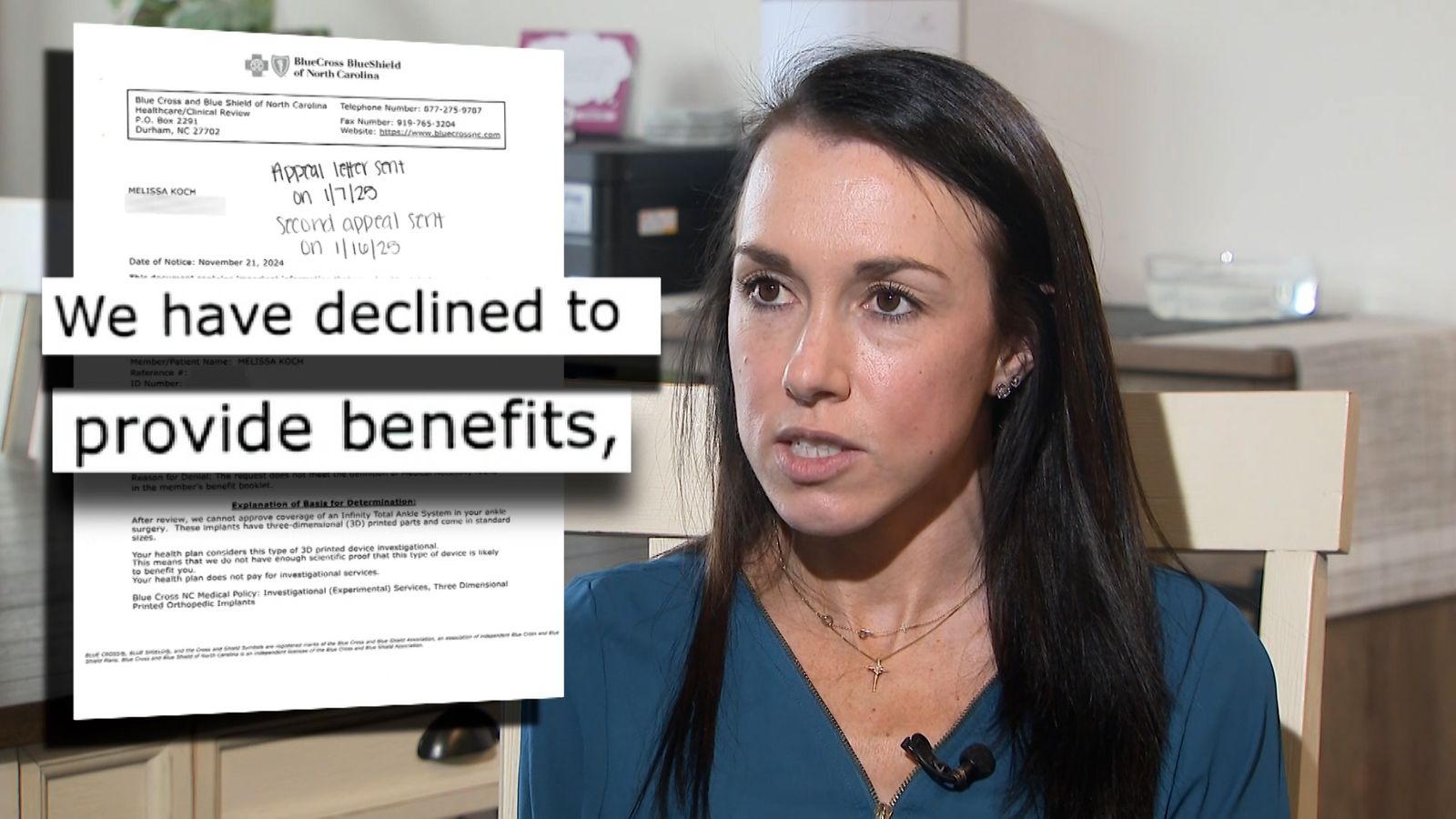

When Melissa Koch decided to undergo ankle replacement surgery, she believed she had done everything right. As a Wake County mother battling a chronic joint disorder, she meticulously obtained pre-authorization from her insurance company, confident that her medical procedure was fully approved.

However, her relief was short-lived. After successfully completing the surgery, Koch received a shocking letter from her insurance provider denying coverage—a devastating turn of events that left her frustrated and financially vulnerable. Determined to seek justice and understand the sudden reversal, she turned to 5 On Your Side for help.

Koch's experience highlights the complex and often unpredictable world of medical insurance, where patients can find themselves caught in bureaucratic limbo even after taking proactive steps to ensure their treatment is covered. Her story serves as a powerful reminder of the challenges many patients face when navigating healthcare systems and insurance protocols.

Insurance Nightmare: When Medical Authorization Turns into Denial Shock

In the complex world of healthcare insurance, patients often find themselves navigating a labyrinth of bureaucratic challenges that can transform a seemingly straightforward medical procedure into an emotional and financial rollercoaster. The story of Melissa Koch, a Wake County resident battling a chronic joint disorder, epitomizes the frustrating reality many Americans face when dealing with health insurance coverage.Unraveling the Healthcare Coverage Conundrum: A Patient's Desperate Battle

The Initial Authorization: A False Sense of Security

Medical procedures are typically preceded by a meticulous process of insurance verification, designed to provide patients with peace of mind before undergoing potentially life-changing treatments. For Melissa Koch, the journey began with what appeared to be a standard pre-authorization for her ankle replacement surgery. Insurance companies typically conduct comprehensive reviews, assessing medical necessity, potential risks, and treatment protocols before granting approval. The pre-authorization process is meant to be a protective mechanism, ensuring that patients understand their coverage and potential financial responsibilities. In Koch's case, the initial authorization seemed to be a green light, suggesting that her chronic joint disorder warranted the surgical intervention and that her insurance would support her medical needs.The Unexpected Denial: Navigating Medical Insurance Complexities

Despite receiving prior authorization, Koch was confronted with an unexpected and devastating letter following her ankle replacement surgery. The insurance company's abrupt denial of coverage transformed what should have been a moment of medical relief into a potential financial catastrophe. This scenario is not uncommon in the intricate landscape of healthcare insurance. Patients frequently encounter situations where initial approvals are rescinded, leaving them vulnerable to substantial medical expenses. The denial mechanism often involves complex medical coding, retrospective reviews, and intricate policy interpretations that can be challenging for patients to comprehend or challenge.Patient Advocacy: Breaking Through Insurance Barriers

Koch's response to the denial demonstrates the critical importance of patient advocacy and proactive communication. By reaching out to local media through the 5 On Your Side platform, she highlighted a systemic issue that affects countless individuals navigating the healthcare system. Patient advocacy involves understanding one's rights, maintaining meticulous documentation, and being prepared to challenge decisions that seem unjust or inconsistent. In Koch's case, the media involvement potentially created additional pressure on the insurance company to review and potentially reconsider their denial.The Broader Healthcare Coverage Landscape

The incident underscores broader challenges within the healthcare insurance ecosystem. Patients with chronic conditions often face additional scrutiny, with insurance companies carefully evaluating the medical necessity and cost-effectiveness of treatments. Medical professionals, patient advocacy groups, and healthcare policy experts continue to push for greater transparency and fairness in insurance coverage determinations. The goal is to create a system that prioritizes patient care and medical necessity over bureaucratic complications.Legal and Ethical Considerations in Medical Insurance

Koch's experience raises significant legal and ethical questions about the insurance authorization process. When an insurance company provides initial approval and subsequently denies coverage, it creates a complex legal landscape that may require professional intervention. Consumer protection laws and healthcare regulations provide potential avenues for patients to challenge seemingly arbitrary coverage decisions. Legal experts specializing in medical insurance disputes can offer guidance and representation for individuals facing similar challenges.Strategies for Patients Facing Insurance Coverage Challenges

Patients confronted with unexpected insurance denials can employ several strategic approaches. These include maintaining comprehensive medical documentation, seeking detailed explanations for denials, consulting with healthcare providers, and potentially engaging legal or media support to challenge unfair decisions. Understanding insurance policies, maintaining open communication with healthcare providers, and being prepared to advocate for oneself are crucial skills in navigating the complex healthcare insurance landscape.RELATED NEWS

Health

Pumping Iron at 60+: How Strength Training Could Be the Secret to Aging Gracefully

2025-02-17 19:28:28

Health

Breaking: Roanoke County Schools Employees Lose On-Site Health Clinic Access

2025-02-28 21:22:31

Health

Breaking: Pope Francis Rests Comfortably, Vatican Signals Calm After Health Scare

2025-03-09 09:59:26