Survive and Thrive: Smart Money Moves to Outsmart the Economic Downturn

Finance

2025-03-11 16:09:24Content

Navigating Economic Uncertainty: Smart Financial Strategies for Challenging Times

The specter of a recession can send shivers down anyone's spine, particularly for those already struggling to make ends meet. But fear not – with the right approach, you can transform financial uncertainty into an opportunity for resilience and growth.

Economic downturns don't have to be a financial death sentence. By adopting proactive strategies, you can shield yourself from potential economic turbulence and even position yourself to emerge stronger. The key is preparation, adaptability, and a strategic mindset.

Start by building a robust emergency fund that can cushion unexpected financial shocks. Diversify your income streams, explore side hustles, and look for ways to enhance your marketable skills. Cut unnecessary expenses, prioritize debt reduction, and be strategic about your investments.

Remember, recessions aren't just about survival – they're also about finding hidden opportunities. Some of the most successful businesses and personal financial turnarounds have been born during economic challenges. Stay informed, remain flexible, and view this period as a chance to reassess and reinvent your financial approach.

With careful planning and a positive outlook, you can not only weather economic uncertainty but potentially thrive in the face of it.

Navigating Financial Turbulence: Mastering Economic Resilience in Uncertain Times

In an era of unprecedented economic volatility, individuals find themselves standing at a critical crossroads where financial preparedness can mean the difference between survival and struggle. The global economic landscape has become increasingly unpredictable, challenging even the most financially savvy individuals to rethink their approach to personal economic management.Unlock Your Financial Potential: Strategies for Weathering Economic Storms

Understanding Economic Vulnerability

The contemporary economic environment presents a complex maze of challenges that disproportionately impact individuals with limited financial resources. Economic downturns are not merely statistical abstractions but lived experiences that can dramatically alter personal financial trajectories. Lower-income populations often find themselves most susceptible to systemic economic fluctuations, experiencing heightened job insecurity, reduced earning potential, and limited financial buffers. Comprehensive risk assessment becomes paramount in these circumstances. Individuals must develop a nuanced understanding of their personal economic ecosystem, identifying potential vulnerabilities and creating strategic contingency plans. This involves meticulously analyzing income streams, existing debt structures, and potential alternative revenue sources that can provide financial resilience during turbulent periods.Strategic Financial Adaptation Mechanisms

Proactive financial management transcends traditional savings approaches. Modern economic survival requires a multifaceted strategy that combines defensive and opportunistic elements. Diversification emerges as a critical principle, extending beyond traditional investment portfolios to encompass skill development, multiple income streams, and adaptive career strategies. Technological platforms and digital ecosystems offer unprecedented opportunities for economic empowerment. Emerging gig economy platforms, freelance marketplaces, and remote work opportunities provide flexible income alternatives that can supplement traditional employment. Individuals who cultivate digital skills and maintain technological adaptability position themselves more favorably in an increasingly dynamic economic landscape.Psychological Resilience and Financial Decision-Making

Economic challenges are not merely external phenomena but deeply psychological experiences that require emotional intelligence and strategic thinking. Developing psychological resilience becomes as crucial as financial planning. This involves cultivating a growth mindset, maintaining emotional equilibrium during financial stress, and developing cognitive flexibility that allows for rapid adaptation. Emotional intelligence plays a pivotal role in financial decision-making. Individuals who can maintain rational perspectives during economic uncertainty are more likely to make sound financial choices. This requires developing self-awareness, managing emotional responses to financial stress, and maintaining a long-term perspective that transcends immediate economic challenges.Innovative Risk Mitigation Strategies

Contemporary financial resilience demands innovative approaches to risk management. Traditional insurance models are evolving, with emerging micro-insurance and community-based financial protection mechanisms offering more flexible and accessible options. Collaborative economic models, such as peer-to-peer lending and community investment platforms, provide alternative financial support structures. Technology-driven financial tools increasingly democratize access to sophisticated financial management resources. Artificial intelligence-powered budgeting applications, predictive financial analytics, and personalized economic forecasting tools empower individuals to make more informed financial decisions with greater precision and confidence.Building Sustainable Economic Ecosystems

Long-term economic resilience extends beyond individual strategies to encompass broader systemic transformations. Community-based economic initiatives, collaborative consumption models, and localized economic networks emerge as powerful mechanisms for collective financial stability. Individuals who invest in building robust social and professional networks create additional layers of economic protection. These networks provide informational resources, potential economic opportunities, and collective support mechanisms that can be crucial during challenging economic periods.RELATED NEWS

Finance

Naturenergie Holding's Financial Forecast Stumbles: Annual Earnings Fall Short of Wall Street Predictions

2025-03-02 06:37:25

Finance

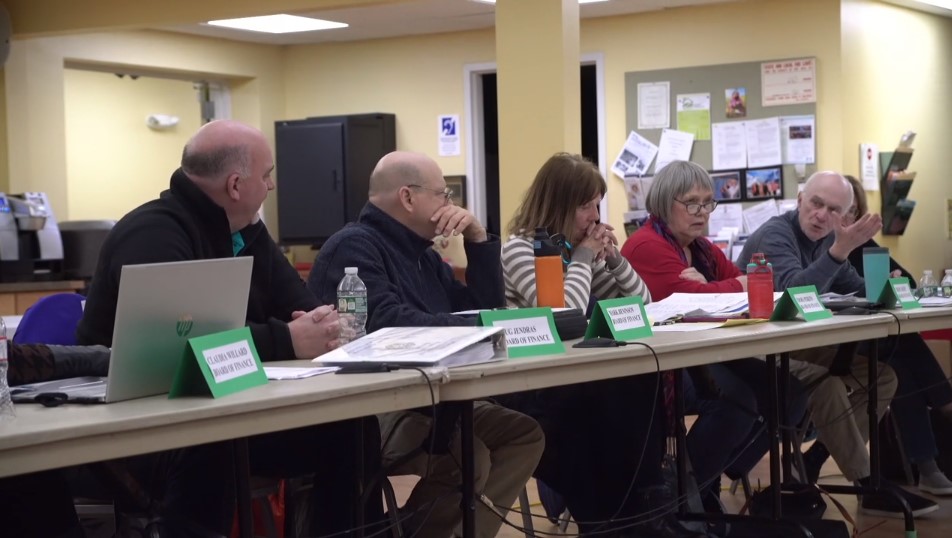

Tensions Boil Over: Finance Board Member Quits, Demands Immediate Departmental Overhaul

2025-03-09 09:00:00