Wall Street's Old Guard Embraces Crypto: Stablecoin Legislation Sparks Financial Revolution

Finance

2025-03-11 17:05:15Content

Wall Street's heavyweight players are making a bold statement about cryptocurrency's mainstream future. During a recent U.S. congressional hearing on the proposed House stablecoin legislation, prominent financial institutions and legal experts signaled a significant shift towards traditional finance's embrace of digital assets.

Notably, BNY Mellon—one of America's oldest and most respected banks—joined forces with top-tier legal professionals to demonstrate growing institutional interest in cryptocurrency regulation. The hearing highlighted a pivotal moment where traditional financial powerhouses are no longer viewing digital currencies as a fringe technology, but as a legitimate financial instrument requiring structured oversight.

The testimony from these witnesses underscores a transformative trend: Wall Street is not just observing the crypto landscape, but actively seeking to integrate and legitimize digital assets within the existing financial ecosystem. This congressional hearing represents more than just a discussion—it's a clear indication that cryptocurrency is transitioning from an experimental technology to a serious financial asset class.

As regulatory frameworks take shape, the involvement of established financial institutions suggests a new era of credibility and potential mainstream adoption for stablecoins and other digital currencies.

Wall Street's Digital Currency Revolution: Stablecoin Legislation Signals Massive Financial Transformation

The financial landscape is undergoing a seismic shift as traditional financial institutions increasingly embrace cryptocurrency technologies, with congressional hearings revealing a groundbreaking moment in digital asset regulation and institutional adoption.Bridging Traditional Finance and Cryptocurrency Innovation

The Congressional Hearing: A Watershed Moment

The recent U.S. congressional hearing on stablecoin legislation represents far more than a routine legislative discussion. It symbolizes a critical intersection where Wall Street's established financial powerhouses are actively engaging with emerging digital currency frameworks. Prominent financial institutions, including banking giants and elite legal experts, are signaling a profound transformation in how traditional financial systems perceive and integrate cryptocurrency technologies. Witnesses from prestigious organizations like BNY Mellon demonstrated unprecedented openness to blockchain-based financial instruments. Their participation suggests a strategic recognition that digital currencies are no longer peripheral technologies but fundamental components of future financial ecosystems. The hearing illuminated a nuanced understanding that stablecoins represent more than speculative assets—they are potential bridges connecting conventional banking infrastructure with decentralized financial networks.Institutional Perspectives on Stablecoin Regulation

The congressional dialogue revealed complex considerations surrounding stablecoin implementation. Legal and financial experts presented multifaceted arguments exploring regulatory frameworks, risk management strategies, and potential economic implications. Their testimonies highlighted the delicate balance between fostering innovation and maintaining robust consumer protections. Wall Street's engagement signals a remarkable paradigm shift. Where cryptocurrency was once viewed with skepticism, it is now being seriously evaluated as a legitimate financial technology. The presence of established financial institutions in these discussions underscores a growing recognition of digital assets' transformative potential.Technological and Economic Implications

Stablecoins represent a sophisticated financial innovation that addresses cryptocurrency volatility concerns. By maintaining price stability through various backing mechanisms, these digital assets offer unprecedented opportunities for seamless cross-border transactions, reduced transaction costs, and enhanced financial accessibility. The congressional hearing demonstrated that regulatory bodies are developing nuanced approaches to integrate these technologies responsibly. Witnesses emphasized the importance of creating flexible yet comprehensive guidelines that can accommodate rapid technological evolution while protecting investor interests.Future of Financial Infrastructure

The convergence of traditional financial institutions and cryptocurrency technologies suggests an imminent restructuring of global financial systems. Stablecoins could potentially revolutionize international payments, remittance services, and financial inclusion for underserved populations. Financial experts anticipate that comprehensive legislation will accelerate institutional adoption, providing clear regulatory pathways for banks and investment firms to explore digital asset integrations. This legislative momentum represents a critical step toward mainstream cryptocurrency acceptance.Strategic Implications for Global Finance

As major financial institutions like BNY Mellon demonstrate increasing interest in stablecoin technologies, global financial dynamics are poised for unprecedented transformation. The congressional hearing serves as a pivotal moment, signaling that digital currencies are transitioning from speculative assets to legitimate financial instruments with substantial institutional backing. The emerging regulatory landscape promises to create more transparent, efficient, and accessible financial ecosystems, bridging traditional banking practices with cutting-edge technological innovations.RELATED NEWS

Finance

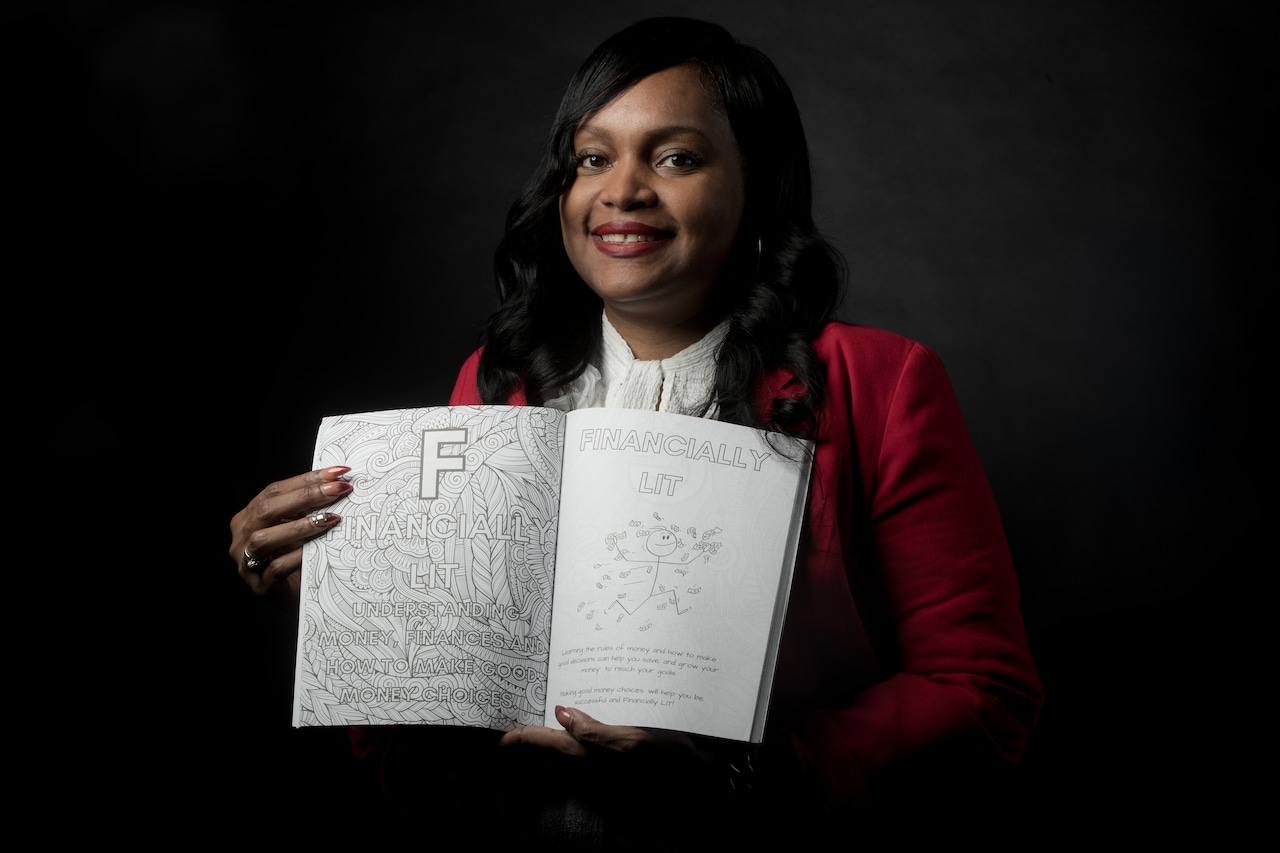

From Broke to Brilliant: How One Financial Guru is Rewriting the Rules of Money Management

2025-02-18 10:05:00

Finance

Financial Shake-up: Abrdn Lures Top Banking Talent from Coutts to Lead Finance Strategy

2025-02-28 07:31:56

Finance

Financial Leadership Shake-Up: Pinnacle Tech Taps Joe Elebash as New CFO

2025-02-17 14:45:00