When Mental Health Investments Go Wrong: A Survival Guide for Savvy Investors

Health

2025-03-18 14:34:00Content

Navigating the High-Stakes World of Behavioral Health Investments: When Risk Meets Reward

In the dynamic landscape of venture capital, investors who dare to back innovative behavioral health startups understand that risk is an inherent part of their investment strategy. Yet, for those with a keen eye and strategic insight, these calculated risks can transform into remarkable success stories.

The behavioral health sector presents a unique investment frontier—fraught with challenges but brimming with potential. Savvy venture capitalists recognize that behind every seemingly risky investment lies the possibility of groundbreaking solutions that could revolutionize mental health care and treatment approaches.

While not every investment will yield extraordinary returns, those who carefully assess emerging companies, understand market trends, and identify truly transformative technologies can find themselves at the forefront of a healthcare revolution. The most successful investors in this space are those who combine bold vision with meticulous due diligence.

Navigating the High-Stakes World of Behavioral Health Venture Capital: Risks, Rewards, and Revolutionary Insights

In the dynamic landscape of healthcare innovation, venture capital represents a critical lifeline for transformative behavioral health startups. These financial pioneers navigate a complex terrain of potential breakthroughs and substantial risks, where strategic investments can unlock groundbreaking solutions to mental health challenges that have long remained unaddressed.Pioneering Change: Where Investment Meets Breakthrough Mental Health Solutions

The Evolving Ecosystem of Behavioral Health Investments

The behavioral health investment landscape has undergone remarkable metamorphosis in recent years. Venture capitalists are no longer merely financial backers but strategic partners driving systemic transformation. Traditional investment models have given way to more nuanced approaches that prioritize holistic impact over immediate financial returns. Sophisticated investors recognize that mental health innovations require patient capital and deep understanding of complex psychological ecosystems. They're not just funding companies; they're catalyzing fundamental shifts in how society perceives, treats, and supports mental wellness.Risk Assessment in Behavioral Health Venture Capital

Calculating investment risks in behavioral health demands extraordinary analytical sophistication. Unlike traditional technology or pharmaceutical sectors, mental health startups present uniquely multifaceted challenges that require comprehensive evaluation frameworks. Successful venture capitalists develop intricate risk assessment models that transcend traditional financial metrics. They examine founder expertise, technological innovation potential, scalability of mental health solutions, regulatory compliance, and potential societal impact. Each investment represents a delicate balance between financial prudence and transformative potential.Technological Innovations Driving Mental Health Investments

Cutting-edge technologies are revolutionizing behavioral health investment strategies. Artificial intelligence, machine learning, teletherapy platforms, and personalized mental health tracking systems represent frontier technologies attracting significant venture capital attention. These technological breakthroughs promise unprecedented insights into mental health diagnosis, treatment, and prevention. Investors are particularly excited about solutions that can democratize mental health access, reduce treatment costs, and provide personalized, data-driven interventions.Emerging Investment Trends and Market Dynamics

The behavioral health venture capital market is experiencing unprecedented growth and diversification. Investors are increasingly drawn to startups addressing critical gaps in mental health care, such as digital therapeutics, workplace mental wellness programs, and specialized treatment platforms for underserved populations. Venture capital firms are developing specialized funds dedicated exclusively to behavioral health innovations, signaling a profound recognition of the sector's immense potential. These targeted investments aim to accelerate solutions that can meaningfully improve global mental health outcomes.Ethical Considerations and Social Impact

Modern behavioral health venture capitalists are deeply committed to ethical investment principles. They prioritize startups demonstrating genuine commitment to patient privacy, evidence-based interventions, and meaningful social impact. This approach represents a significant departure from traditional investment models, where financial returns were the sole consideration. Today's investors seek ventures that can simultaneously generate financial returns and contribute to broader societal mental health improvements.Future Outlook: Transforming Behavioral Health Investments

The future of behavioral health venture capital looks incredibly promising. As technological capabilities expand and societal understanding of mental health deepens, investment opportunities will continue to evolve. Venture capitalists who can successfully navigate this complex landscape will play a pivotal role in driving mental health innovation. Their investments have the potential to unlock transformative solutions that could fundamentally reshape how we understand, treat, and support mental wellness globally.RELATED NEWS

Health

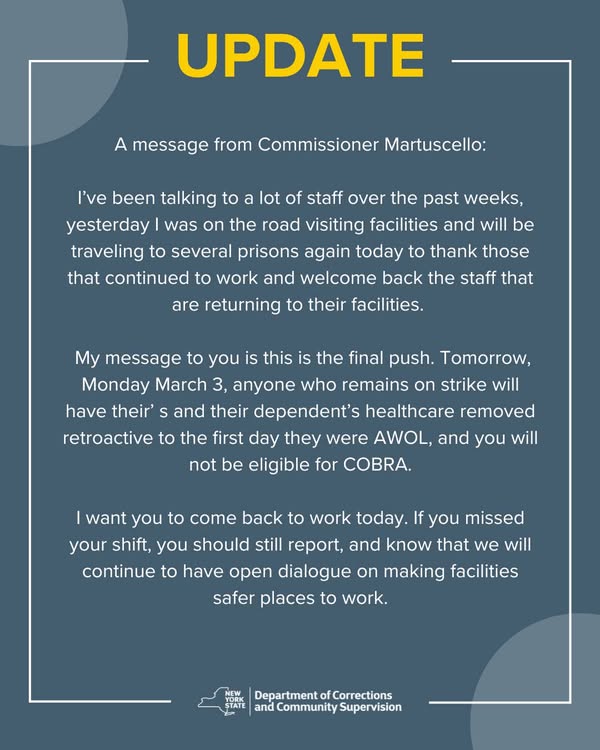

Healthcare Cut: NY Prison Officials Crack Down on Striking Corrections Officers

2025-03-02 20:49:00

Health

Vatican Watch: Pope Shows Resilience in Pneumonia Battle, Signs of Strength Emerge

2025-03-03 11:21:25

Health

Springing Forward: The Hidden Health Risks Lurking Behind Daylight Saving Time

2025-03-08 14:02:27