Chip Kings: Why Hedge Fund Titans Are Betting Big on Taiwan Semiconductor

Manufacturing

2025-02-21 19:58:27Content

In our recent exploration of top global investment opportunities, we delved into the 12 Best Global Stocks recommended by leading hedge funds. Today, we turn our spotlight on Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), a powerhouse in the semiconductor industry that has captured the attention of savvy investors worldwide.

As the United States continues to be a beacon for global investment, Taiwan Semiconductor (TSM) stands out as a compelling player in the technology sector. This semiconductor giant has consistently demonstrated remarkable performance, making it a standout choice among hedge fund managers and individual investors alike.

Our in-depth analysis reveals why TSM is not just another stock, but a strategic investment that offers unique value in the ever-evolving global market. From its cutting-edge technological innovations to its robust financial performance, Taiwan Semiconductor represents the kind of forward-thinking company that smart investors are eager to add to their portfolios.

Stay tuned as we break down the key factors that make TSM a potential game-changer in the world of global stock investments.

Global Investment Insights: Navigating the Semiconductor Landscape with Taiwan Semiconductor Manufacturing

In the dynamic world of global investments, few sectors capture the imagination of financial strategists quite like the semiconductor industry. As technology continues to reshape our global economic landscape, investors are increasingly turning their attention to key players that drive technological innovation and economic growth.Unlock the Potential of Cutting-Edge Technology Investments

The Semiconductor Revolution: A Global Economic Powerhouse

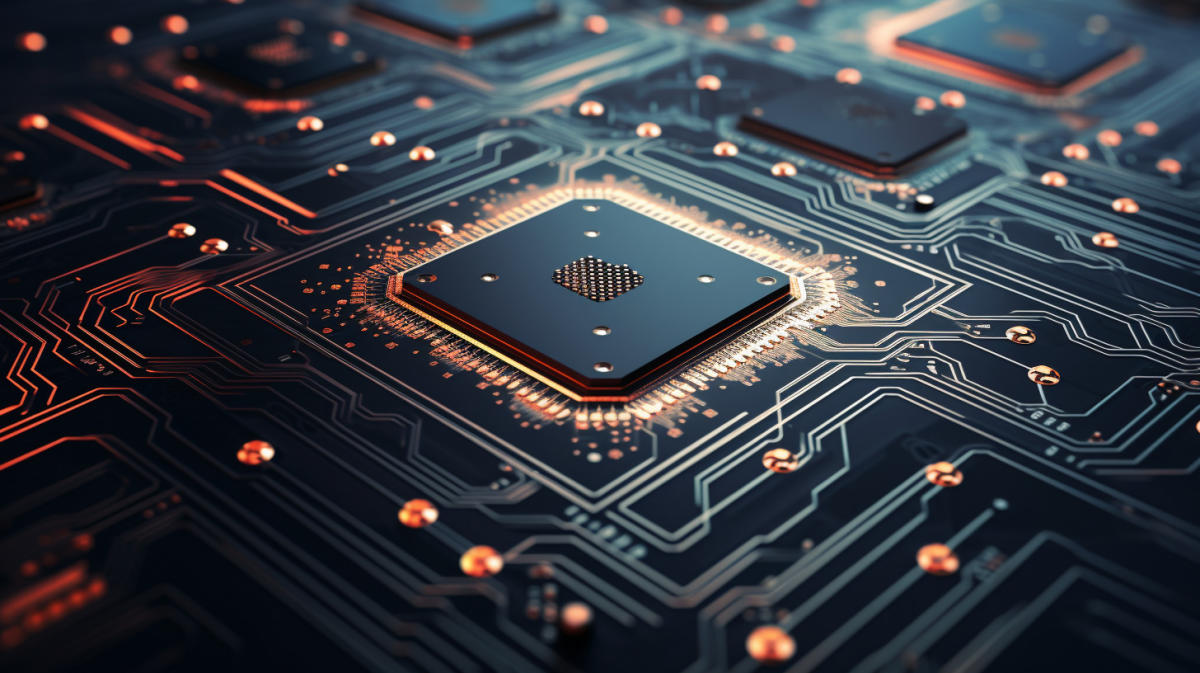

The semiconductor industry stands at the forefront of technological transformation, representing a critical nexus of innovation, economic potential, and global strategic importance. Taiwan Semiconductor Manufacturing Company (TSM) emerges as a pivotal player in this complex ecosystem, commanding significant attention from sophisticated investors and hedge fund managers worldwide. The company's strategic positioning goes far beyond simple manufacturing. TSM has established itself as a technological leader, pioneering advanced manufacturing processes that push the boundaries of semiconductor design and production. Its ability to consistently deliver high-performance chips that power everything from smartphones to advanced computing systems has made it a cornerstone of global technological infrastructure.Hedge Fund Perspectives: Analyzing Strategic Investment Opportunities

Sophisticated investors have long recognized the intrinsic value of strategic semiconductor investments. The complex landscape of global technology markets requires nuanced understanding and deep analytical insight. Hedge funds approach TSM with a multifaceted perspective, examining not just current performance but potential future trajectories. The company's robust research and development capabilities provide a significant competitive advantage. By consistently investing in cutting-edge manufacturing technologies, TSM maintains its position at the forefront of semiconductor innovation. This commitment to technological advancement creates a compelling narrative for long-term investors seeking exposure to high-growth technological sectors.Global Market Dynamics and Technological Leadership

Understanding TSM's market position requires a comprehensive examination of global technological trends. The semiconductor industry represents a critical infrastructure for modern technological ecosystems, powering everything from artificial intelligence to advanced telecommunications networks. Geopolitical considerations play a significant role in the semiconductor landscape. With increasing tensions between global technological powers, TSM's strategic location in Taiwan and its advanced manufacturing capabilities make it a critical player in global technology supply chains. Investors must carefully consider these complex geopolitical dynamics when evaluating potential investments.Financial Performance and Investment Strategies

Financial analysts closely track TSM's performance, recognizing the company's ability to generate consistent value for shareholders. The company's robust financial metrics, including strong revenue growth and strategic market positioning, make it an attractive option for sophisticated investors. The semiconductor industry's cyclical nature requires investors to develop nuanced investment strategies. TSM's diversified product portfolio and technological leadership provide a measure of stability in an otherwise volatile market. Hedge funds often view the company as a strategic long-term investment opportunity, balancing potential risks with significant growth potential.Technological Innovation and Future Prospects

The future of semiconductor technology lies in continuous innovation and adaptation. TSM has consistently demonstrated its ability to lead technological transformations, investing heavily in research and development to maintain its competitive edge. Emerging technologies such as artificial intelligence, 5G networks, and advanced computing systems create unprecedented demand for sophisticated semiconductor solutions. TSM's strategic positioning allows it to capitalize on these emerging technological trends, offering investors exposure to cutting-edge technological developments.RELATED NEWS

Manufacturing

3D Printing Revolution: Global Market Set to Explode by 2025, Experts Predict

2025-02-17 13:37:48

Manufacturing

Investors' Golden Run: Hammond Manufacturing's Stunning 42% Annual Returns Revealed

2025-02-22 13:17:36