Wall Street's Next Big Bet: Can Walmart Transform Investor Fortunes?

Finance

2025-03-08 21:15:00Content

Walmart's Stock: A Wealth-Creating Powerhouse

Since its debut on the stock market in 1970, Walmart (NYSE: WMT) has been a remarkable wealth generator for investors. The retail giant's impressive performance proves that you don't need to be an early investor to benefit from its extraordinary growth.

In a testament to the company's financial strength, Walmart's stock has delivered exceptional returns, surging over 150% in just five years leading up to early March 2025. This remarkable performance significantly outpaced the S&P 500, which gained 94% during the same period.

Investors who strategically positioned themselves in Walmart shares have been rewarded with substantial returns, demonstrating the company's resilience and consistent market performance. The stock's ability to consistently outperform broader market indices highlights Walmart's strategic management and dominant position in the retail landscape.

Whether you're a long-term investor or someone exploring potential market opportunities, Walmart's track record offers an compelling narrative of sustained financial success and investor value.

Walmart's Phenomenal Stock Performance: A Wealth Creation Powerhouse Unveiled

In the dynamic world of stock market investments, few companies have demonstrated the remarkable wealth-generating potential quite like Walmart. This retail giant has not just survived but thrived, transforming countless investors' financial landscapes through its extraordinary market performance and strategic growth trajectory.Unlock the Secrets of Generational Wealth Creation

The Evolution of Walmart's Market Dominance

Walmart's journey from a modest retail operation to a global economic powerhouse represents a masterclass in strategic business expansion. Founded by Sam Walton in 1962, the company revolutionized retail by prioritizing low-cost operations and customer-centric strategies. Unlike many competitors who struggled to adapt, Walmart consistently innovated, leveraging technology, supply chain optimization, and strategic market positioning to maintain its competitive edge. The company's stock market performance tells a compelling narrative of sustained growth and investor confidence. From its initial public offering in 1970, Walmart has consistently outperformed market expectations, delivering extraordinary returns that have transformed modest investments into substantial wealth portfolios.Analyzing Walmart's Unprecedented Stock Performance

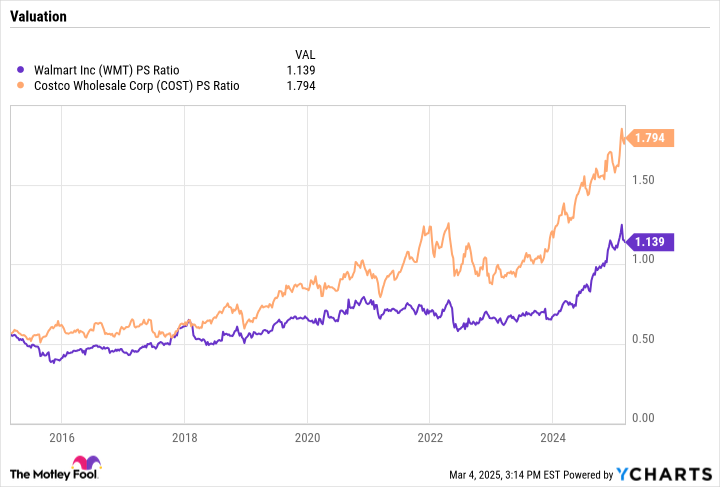

Investors who recognized Walmart's potential early have reaped extraordinary benefits. Between 2020 and 2025, the company's stock demonstrated remarkable resilience, significantly outpacing broader market indices. While the S&P 500 experienced a respectable 94% gain during this period, Walmart's shares surged an impressive 150%, showcasing the company's robust financial strategy and market adaptability. This exceptional performance isn't merely a result of luck but stems from strategic decisions, including aggressive e-commerce expansion, technological integration, and a forward-thinking approach to retail challenges. Walmart's ability to navigate complex market dynamics, from pandemic-induced disruptions to changing consumer behaviors, has been nothing short of remarkable.The Strategic Pillars Behind Walmart's Investment Success

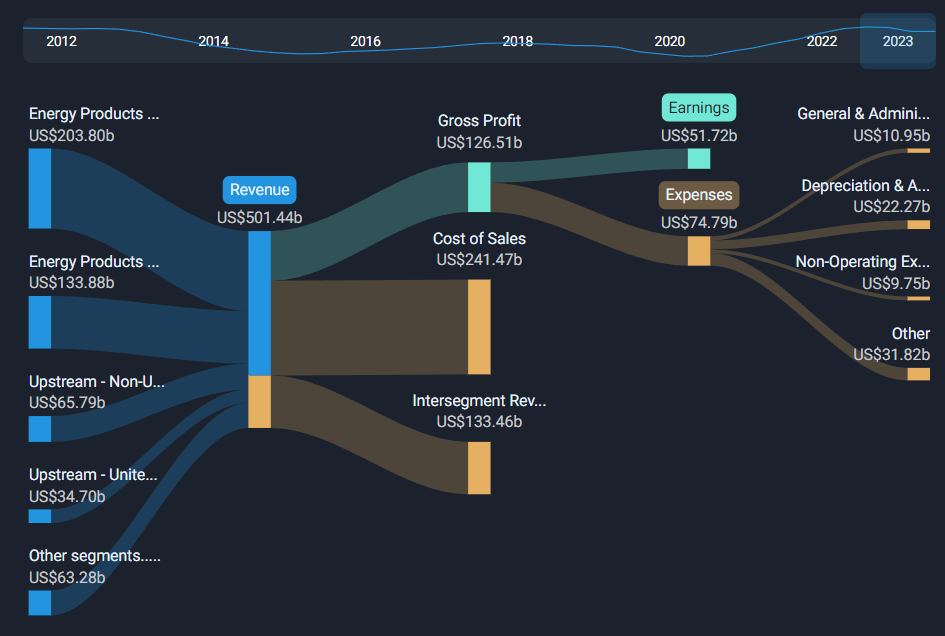

Walmart's investment appeal extends beyond raw numbers. The company has systematically diversified its revenue streams, investing heavily in digital infrastructure, developing robust online platforms, and creating innovative omnichannel shopping experiences. By anticipating and responding to emerging market trends, Walmart has positioned itself as a forward-looking enterprise capable of sustained growth. The retail giant's global footprint provides additional investment attractiveness. With operations spanning multiple countries and continuous expansion into emerging markets, Walmart offers investors a geographically diversified investment opportunity. This strategic approach mitigates risks associated with regional economic fluctuations and provides multiple growth avenues.Understanding the Investment Potential of Retail Giants

Walmart's success story offers profound insights into long-term investment strategies. The company demonstrates that sustainable growth isn't about short-term gains but consistent value creation. By maintaining a laser focus on operational efficiency, customer satisfaction, and technological adaptation, Walmart has created a blueprint for successful corporate evolution. Investors seeking stable, growth-oriented investments can draw significant lessons from Walmart's trajectory. The company's ability to transform challenges into opportunities, continuously reinvent its business model, and maintain financial discipline makes it a compelling case study in strategic corporate development.Future Outlook and Investment Considerations

Looking forward, Walmart's investment potential remains promising. The company's continued investment in artificial intelligence, data analytics, and sustainable practices positions it favorably in an increasingly complex global marketplace. Emerging technologies like autonomous delivery, advanced inventory management systems, and personalized shopping experiences are likely to drive future growth. Potential investors should recognize that Walmart represents more than a traditional retail stock. It embodies a dynamic, adaptive enterprise capable of navigating complex economic landscapes while consistently delivering shareholder value.RELATED NEWS

Finance

Gold Rush 2.0: Australia Floods US Markets with Unprecedented Precious Metal Shipment

2025-03-07 06:53:58

Finance

Money Moves: Breaking the Cycle of Financial Struggle for Gen Z and Millennials

2025-02-20 14:10:00