Tech Tremors: Meta's Latest Workforce Reduction Signals Deeper Silicon Valley Shake-Up

Companies

2025-02-28 02:25:44

In a stern message to its workforce, Meta, the tech giant led by Mark Zuckerberg, has taken decisive action against internal information leaks. The company has terminated approximately 20 employees for breaching confidential protocols, signaling a zero-tolerance approach to unauthorized information sharing. The dismissals underscore the critical importance of maintaining corporate confidentiality in an era of rapid technological innovation and intense market competition. Meta's leadership is sending a clear signal that protecting sensitive company information is not just a policy, but a fundamental expectation for all employees. These terminations come as part of Meta's ongoing efforts to safeguard its strategic plans, product developments, and internal communications. By taking swift and decisive action, Zuckerberg's team aims to create a culture of trust, discretion, and professional integrity within the organization. The move highlights the increasing challenges tech companies face in preventing information leaks in an interconnected digital workplace. For Meta, protecting its competitive edge and maintaining the trust of stakeholders remains paramount in an increasingly scrutinizing tech landscape. MORE...

Rocket Companies Unveils Q4 Financial Saga: Wall Street Braces for Surprising Earnings Revelations

Companies

2025-02-28 02:15:14

Rocket Companies Reveals Strong Financial Performance in Q4 2024

Rocket Companies (NYSE: RKT) delivered a compelling financial performance during the fourth quarter of 2024, showcasing resilience in a challenging mortgage market. The company's strategic initiatives and operational efficiency have positioned it favorably amid fluctuating economic conditions.

Key Financial Highlights

- Total revenue exceeded market expectations, demonstrating the company's robust business model

- Adjusted earnings per share showed significant improvement compared to previous quarters

- Continued focus on cost management and technological innovation

Market Strategy and Future Outlook

CEO Jay Farner emphasized the company's commitment to digital transformation and customer-centric solutions. The leadership team remains optimistic about navigating the complex mortgage landscape by leveraging advanced technology and data-driven insights.

Technological Innovation

Rocket Companies continues to invest in cutting-edge technology, streamlining the mortgage application process and enhancing customer experience. Their digital platforms have been instrumental in maintaining competitive advantage in an increasingly digital financial services market.

Investor Considerations

While market conditions remain dynamic, Rocket Companies demonstrates adaptability and strategic positioning for potential growth in the coming fiscal year. Investors are advised to monitor the company's continued technological investments and market expansion strategies.

MORE...Hollywood's New Frontier: Nevada's Bold Bid to Lure Film Giants with Tax Breakthrough

Companies

2025-02-28 01:59:35

Nevada's legislative chambers came alive on February 17th as lawmakers convened the inaugural hearing for Assembly Bill 238, a groundbreaking initiative aimed at transforming the state's entertainment and production infrastructure. Dubbed the Nevada Studio Infrastructure Jobs and Workforce Training Act, the bill promises to be a game-changer for the local entertainment and media landscape. The proposed legislation seeks to create new opportunities for Nevada's workforce by developing robust training programs and supporting the expansion of studio facilities across the state. By addressing critical gaps in job skills and infrastructure, the bill represents a strategic move to position Nevada as a competitive hub for film, television, and digital media production. Lawmakers and industry experts gathered to discuss the potential economic and workforce development impacts of the bill, signaling a commitment to innovation and growth in Nevada's entertainment sector. The hearing marks an important first step in what could be a transformative piece of legislation for the state's creative industries. MORE...

AI Showdown: Expensify's Bold Quest to Dominate FinTech's Digital Frontier

Companies

2025-02-28 00:57:55

The tech investment landscape is experiencing a dramatic shift. Where venture capitalists once heralded FinTech as the revolutionary sector poised to transform financial services, a new technological titan has emerged: artificial intelligence (AI). What was once a rising star in the investment world, FinTech, now finds itself overshadowed by the transformative potential of AI technologies. Just as FinTech disrupted traditional banking and financial systems, AI is now rapidly reshaping the entire FinTech ecosystem. Machine learning algorithms, predictive analytics, and intelligent automation are rewriting the rules of financial innovation. Investors are increasingly redirecting their capital and attention towards AI-driven solutions that promise unprecedented efficiency, personalization, and strategic insights. The momentum is clear: AI is not just eating into FinTech—it's fundamentally reimagining what's possible in financial technology. From algorithmic trading to personalized banking experiences, AI is proving to be the most exciting and potentially lucrative frontier in the tech investment landscape. MORE...

Utah's Home-Buying Crackdown Crumbles: Legislator Pulls Plug on Corporate Real Estate Restrictions

Companies

2025-02-28 00:53:11

In a surprising turn of events, a Utah state legislator has decided to withdraw a proposed bill that aimed to block corporate purchases of single-family homes. The proposed legislation, which sparked heated debate about housing affordability and market dynamics, will no longer move forward after careful reconsideration. The bill, which sought to prevent companies from buying residential properties, has been shelved amid growing discussions about its potential impact on the state's real estate market. While the original intent was to protect individual homebuyers from corporate competition, the lawmaker ultimately chose to step back from the proposed restriction. This development highlights the complex challenges facing Utah's housing landscape, where concerns about corporate investment and housing accessibility continue to generate significant public interest. The decision reflects the nuanced approach needed when addressing sensitive economic and property rights issues. As the housing market continues to evolve, stakeholders will be watching closely to see what alternative approaches might emerge to address concerns about home ownership and market competition. MORE...

Downtown St. Louis Poised for Dramatic Makeover: Iconic Arch Park Foundation Unveils Bold Transformation Plan

Companies

2025-02-28 00:24:52

A Transformative Urban Renewal: Millennium Hotel's Exciting Riverside Transformation Nestled in the heart of downtown St. Louis, the Millennium Hotel is poised to undergo a remarkable redevelopment that promises to breathe new life into the iconic location adjacent to the historic Gateway Arch. This ambitious project aims to create a vibrant destination that will not only attract visitors but also become a cherished gathering space for local residents. Strategically positioned at 200 S. 4th Street, the hotel's prime location offers an unparalleled opportunity to reimagine urban space. With stunning views of the Mississippi River and proximity to one of America's most recognizable landmarks, the redevelopment project is set to become a cornerstone of St. Louis's urban renaissance. The planned transformation seeks to blend modern design with the city's rich architectural heritage, creating a dynamic environment that celebrates St. Louis's unique character while offering contemporary amenities and experiences. Local community members and urban planners are eagerly anticipating how this project will enhance the downtown landscape and create new opportunities for engagement and economic growth. MORE...

Consumer Watchdog in Retreat: Trump's CFPB Abandons Fraud Investigations

Companies

2025-02-28 00:21:28

A scathing critique has emerged, warning that the current climate sends a troubling signal to corporate leaders that financial misconduct can be pursued without meaningful consequences. Critics argue that the lack of robust accountability could potentially embolden unethical business practices across corporate America. "This sends a dangerous message to corporate America that financial fraud and abuse will go unchecked," a prominent industry watchdog warned. The statement underscores growing concerns about the potential normalization of corporate malfeasance and the urgent need for stronger regulatory oversight. The criticism highlights the critical importance of maintaining strict ethical standards and implementing rigorous mechanisms to deter and punish financial wrongdoing. Without meaningful consequences, experts fear that corporate entities might feel increasingly emboldened to exploit systemic vulnerabilities for their own financial gain. MORE...

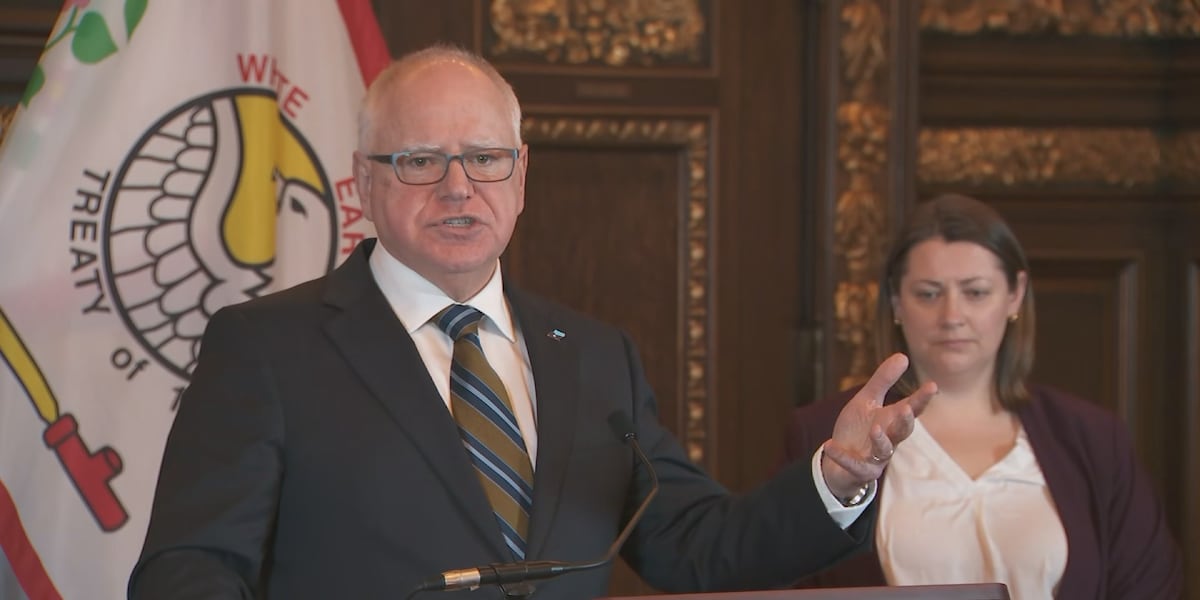

Healthcare Cost Crackdown: Walz Challenges Insurers to Step Up

Companies

2025-02-27 23:48:14

In a bold move to reshape Minnesota's healthcare landscape, Governor Tim Walz is proposing a significant policy shift for the state's reinsurance program. The governor is challenging insurance companies to contribute what he describes as their fair share, aiming to create a more balanced and equitable healthcare funding model. Walz's proposal seeks to restructure the current reinsurance system by asking insurance providers to step up their financial contributions. By doing so, he hopes to stabilize insurance costs and improve healthcare accessibility for Minnesota residents. The initiative reflects a commitment to addressing rising healthcare expenses and ensuring that the financial burden is more evenly distributed across the industry. The governor's push for a more equitable approach signals a potential transformation in how reinsurance programs are funded and managed in the state. Insurance companies will likely face increased scrutiny and pressure to align with the administration's vision of a more transparent and fair healthcare funding mechanism. MORE...

Rocket Companies Soars: Earnings Report Shatters Revenue Records

Companies

2025-02-27 22:41:19

Rocket Companies Soars with Impressive Financial Performance in 2024 Rocket Companies has made a remarkable breakthrough, delivering exceptional financial results that significantly outperform its 2023 performance. The company's robust fourth-quarter and full-year earnings have not only exceeded expectations but also sparked investor enthusiasm, with shares surging approximately 7% in after-hours trading following the release of its comprehensive financial report. The impressive financial milestone underscores Rocket Companies' strategic growth and resilience in a competitive market, signaling strong momentum and potential for continued success in the coming year. Investors and market analysts are taking note of the company's ability to generate substantial value and maintain a trajectory of financial excellence. This stellar performance highlights Rocket Companies' commitment to innovation, operational efficiency, and strategic positioning in the financial services landscape. The significant stock price jump reflects market confidence in the company's leadership and future prospects. MORE...

Green Energy Breakthrough: Bloom Energy Soars After Stellar Q4 Performance

Companies

2025-02-27 22:38:59

Bloom Energy Soars: Quarterly Results Exceed Market Expectations Bloom Energy (NYSE:BE), a pioneering electricity generation and hydrogen production company, has delivered an impressive financial performance that has caught the market's attention. The company reported robust fourth-quarter results for 2024, showcasing remarkable growth and surpassing analyst predictions. In a standout performance, Bloom Energy's revenues surged by an impressive 60.4% year-over-year, reaching $572.4 million. This substantial increase demonstrates the company's strong market position and growing demand for its innovative energy solutions. The company's financial outlook remains equally promising. Bloom Energy's full-year revenue guidance of $1.75 billion not only meets but exceeds analysts' expectations by 3.6%, signaling continued momentum and strategic growth. Perhaps most notably, the company's non-GAAP earnings per share of $0.43 significantly outpaced consensus estimates by 39.9%. This remarkable achievement underscores Bloom Energy's operational efficiency and potential for sustained profitability in the competitive clean energy landscape. Investors and industry observers are taking note of Bloom Energy's consistent performance and forward-looking strategy in the rapidly evolving renewable energy sector. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129