Vision Fund Woes: SoftBank Bleeds $2.4B in Quarterly Shock

Companies

2025-02-12 06:55:36

In a unexpected turn of events, SoftBank Group stunned investors by reporting a significant quarterly loss on Wednesday, falling short of market expectations. The Japanese tech conglomerate not only missed analysts' revenue projections but also revealed financial challenges that caught the market off guard. The company's financial performance underscores the volatile nature of the tech investment landscape, highlighting the ongoing challenges faced by major technology investment firms in today's rapidly changing global market. SoftBank's unexpected results are likely to spark intense discussion among investors and market analysts about the company's strategic investments and future outlook. While specific details of the loss were not immediately disclosed, the announcement serves as a reminder of the complex and unpredictable world of technology investments that SoftBank has become known for in recent years. MORE...

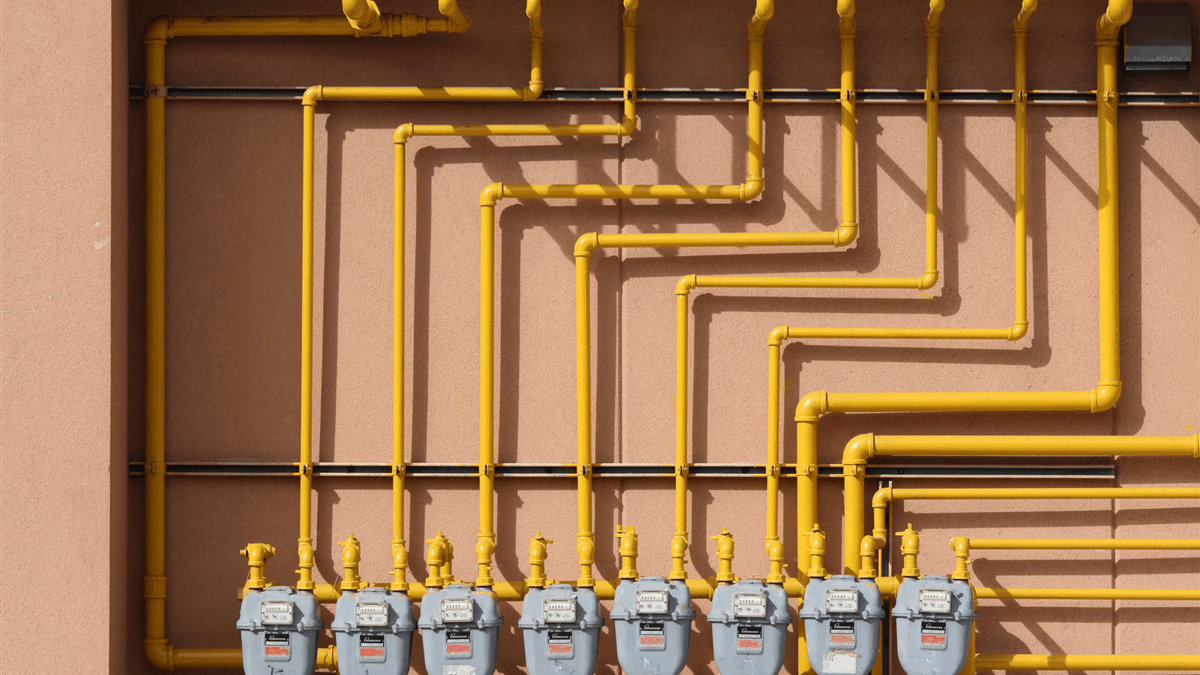

Energy Titans Sound Alarm: EU's Gas Price Cap Could Spark Market Chaos

Companies

2025-02-12 06:25:08

The proposed price cap on energy is proving to be a complex and potentially counterproductive strategy for addressing global energy challenges. While intended to provide relief, this approach may actually generate unintended consequences that could destabilize European energy markets. Rather than effectively reducing global energy prices, the price cap mechanism is more likely to create additional market distortions. Specifically, it could trigger increased price volatility and potentially drive energy prices higher across European markets. Energy suppliers and traders may respond to such artificial constraints by adjusting their supply chains, trading strategies, and pricing models. The fundamental economic principle at play suggests that artificially constraining market prices does not eliminate underlying supply and demand dynamics. Instead, it can lead to market inefficiencies, potentially causing energy suppliers to reduce investments, limit supply, or seek alternative markets with more favorable trading conditions. European policymakers must carefully consider these potential ripple effects. A nuanced approach that balances market stability, consumer protection, and long-term energy infrastructure investment will be crucial in navigating the complex global energy landscape. MORE...

Insider Stakes Soar: 3 High-Potential Companies Where Executives Are All In

Companies

2025-02-12 05:02:38

In a week of economic turbulence and shifting market dynamics, global financial landscapes have demonstrated remarkable resilience. Despite looming tariff uncertainties and complex economic signals, U.S. stock markets experienced modest pullbacks while European indices defied trade-related apprehensions, ultimately registering noteworthy gains. Savvy investors are increasingly focusing their attention on companies characterized by robust growth potential and substantial insider ownership—key indicators that signal underlying confidence in an organization's strategic direction and future prospects. These nuanced metrics provide valuable insights beyond traditional market performance indicators, offering a more comprehensive view of potential investment opportunities. The current market environment underscores the importance of strategic analysis and adaptability. As international trade tensions continue to evolve, investors and market participants remain vigilant, carefully navigating the intricate web of global economic interactions and seeking opportunities amidst uncertainty. With economic indicators presenting a mixed narrative, the ability to interpret subtle market signals becomes paramount for those looking to make informed investment decisions in an increasingly complex global financial ecosystem. MORE...

Digital Lifeline: How Consumer Brands Can Bounce Back from Shareholder Panic

Companies

2025-02-12 05:01:00

Consumer Product Sales Slow Down in 2024 as Market Dynamics Shift

The global consumer products market experienced a notable deceleration in 2024, marking a significant turning point for retailers and manufacturers worldwide. After years of aggressive price increases, the market has reached a critical inflection point where price-driven growth is losing momentum.

Sales growth has moderated to approximately 7.5%, reflecting a complex landscape where companies are now challenged to drive expansion through innovative strategies rather than simple price adjustments. Volume growth remains tepid, indicating that consumers are becoming increasingly selective and price-sensitive.

This slowdown suggests a potential market reset, with businesses needing to focus on value creation, product innovation, and more nuanced marketing approaches to stimulate consumer demand. The era of easy price-based revenue growth appears to be waning, compelling companies to rethink their competitive strategies.

Industry analysts predict that successful brands will need to prioritize consumer experience, product quality, and targeted marketing to navigate the evolving economic environment effectively.

MORE...Audit Firms Demand Financial Freedom: Breaking the ESG Fee Barrier

Companies

2025-02-12 05:00:25

Industry experts are raising concerns about new regulatory measures that are effectively blocking businesses from accessing the potentially profitable quality assurance market. The stringent regulations have created significant barriers to entry, preventing many companies from participating in this lucrative sector. Regulatory constraints are proving to be a major challenge for businesses seeking to establish themselves in quality assurance services. These complex requirements are not only limiting competition but also restricting opportunities for smaller and emerging enterprises to gain a foothold in the industry. The current regulatory landscape appears to favor established players, making it increasingly difficult for new entrants to break into the market. Companies are finding themselves caught in a complex web of compliance requirements that demand substantial resources and expertise. Stakeholders argue that these regulations, while potentially well-intentioned, are ultimately counterproductive. They suggest that the overly restrictive approach could stifle innovation and reduce the overall dynamism of the quality assurance sector. As businesses continue to grapple with these challenges, there is growing calls for a more balanced regulatory approach that can protect industry standards while still allowing for healthy competition and market growth. MORE...

Turbine Troubles: Iowa's Wind Industry Hangs in Limbo After Trump's Unexpected Moratorium

Companies

2025-02-12 04:12:00

Iowa is leading the charge in renewable energy, with wind power emerging as a powerhouse in the state's electricity generation. According to the Iowa Environmental Council, wind turbines now produce an impressive 65% of the state's total electricity, marking a significant milestone in clean energy production. This remarkable achievement highlights Iowa's commitment to sustainable energy and positions the state as a national leader in wind power adoption. The substantial percentage of wind-generated electricity not only reduces carbon emissions but also demonstrates the state's innovative approach to meeting its energy needs through renewable resources. As wind technology continues to advance and become more efficient, Iowa stands as a shining example of how states can successfully integrate renewable energy into their power infrastructure, paving the way for a greener and more sustainable future. MORE...

Insider Stakes: Top ASX Growth Stocks Where Executives Are All In

Companies

2025-02-12 04:02:30

The Australian stock market is showing resilience today, with the ASX200 climbing a modest 0.25% to reach 8,505 points, propelled by strong performance in the Industrials sector. This subtle yet promising movement has investors scanning the horizon for potential growth opportunities. In the current market landscape, companies with significant insider ownership are emerging as particularly compelling investment prospects. These firms offer a unique value proposition, where management's financial interests are closely aligned with those of shareholders, potentially signaling confidence and commitment to long-term value creation. As the Australian market continues to evolve, savvy investors are looking beyond surface-level metrics, seeking out companies where leadership has a meaningful financial stake. This approach can provide an additional layer of reassurance, suggesting that management is not just managing, but genuinely invested in the company's success. The current market conditions present an intriguing environment for investors willing to dig deeper and identify opportunities where corporate leadership and shareholder interests converge. MORE...

Inside the Shadows: How Ad-Tech Firms Are Tracking America's Military

Companies

2025-02-12 04:00:00

In a startling revelation that exposes the far-reaching implications of digital surveillance, a Florida data brokerage firm has disclosed its acquisition of highly sensitive information about U.S. military personnel stationed in Germany. The disclosure, made through a letter to a U.S. senator, highlights the alarming ease with which personal data can be harvested and traded across international borders. The data was reportedly obtained from a Lithuanian company, underscoring the global and interconnected nature of online advertising tracking. This incident serves as a stark reminder of the potential vulnerabilities faced by military personnel and the sophisticated methods employed by data brokers in collecting and monetizing personal information. The letter not only reveals the technical capabilities of these data firms but also raises critical questions about privacy, national security, and the largely unregulated digital marketplace where personal data is bought and sold like a commodity. As military personnel and government officials grapple with these emerging threats, the incident calls for increased scrutiny and robust protective measures in the digital landscape. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129