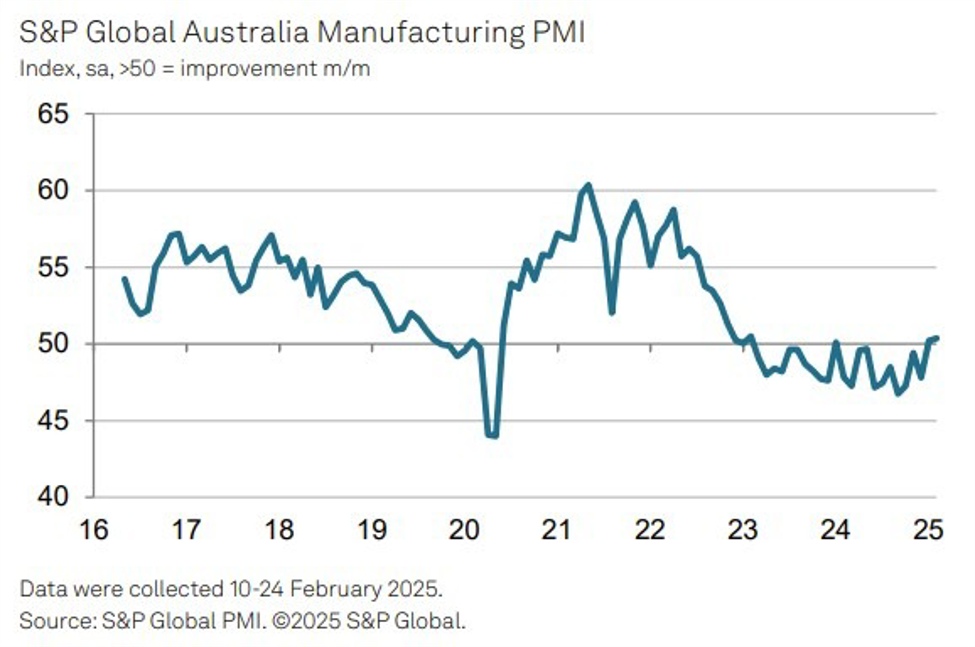

Manufacturing Momentum: Australia's Industrial Pulse Ticks Upward in February

Manufacturing

2025-03-02 22:42:09

Australian Manufacturing Sector Shows Resilience in February 2025

The Australian manufacturing sector demonstrated continued strength in February 2025, according to the latest S&P Global Final Manufacturing Purchasing Managers' Index (PMI). The report reveals a promising landscape of economic activity and business confidence in the industrial manufacturing domain.

Key Highlights

- The final Manufacturing PMI for February stood at a robust 52.5 points

- This figure represents a marginal improvement from January's performance

- The reading signals sustained expansion in the manufacturing sector

Economists note that the index remains comfortably above the critical 50-point threshold, which separates growth from contraction. This indicates that Australian manufacturers are experiencing positive momentum, with increasing production levels and growing new order volumes.

Sector Insights

The data suggests that businesses are adapting to current economic conditions with remarkable resilience. Key drivers of growth include improved domestic demand, strategic investments, and a gradually stabilizing global supply chain environment.

While challenges persist, the February figures paint an optimistic picture of Australia's manufacturing landscape, pointing towards potential economic recovery and sustained industrial development.

MORE...Economic Resilience: China's Business Activity Surges Past Expectations in February

Manufacturing

2025-03-02 22:11:14

China's manufacturing sector shows signs of resilience, with the official Purchasing Managers' Index (PMI) bouncing back to positive territory in February. The key economic indicator climbed to 50.2, marking a notable improvement from January's subdued reading of 49.1. This uptick signals a potential turning point for China's industrial landscape, suggesting that manufacturing activities are gradually gaining momentum. The PMI reading, which stands just above the critical 50-point mark separating expansion from contraction, offers a glimmer of hope for economic recovery. Economists and market analysts are closely watching this development, interpreting the modest but meaningful increase as a potential indicator of stabilizing industrial production and growing business confidence. The improvement comes at a crucial time, as China continues to navigate complex economic challenges and seeks to reinvigorate its manufacturing base. MORE...

Manufacturing Pulse: China's Economic Heartbeat Revealed in Latest PMI Snapshot

Manufacturing

2025-03-02 21:25:44

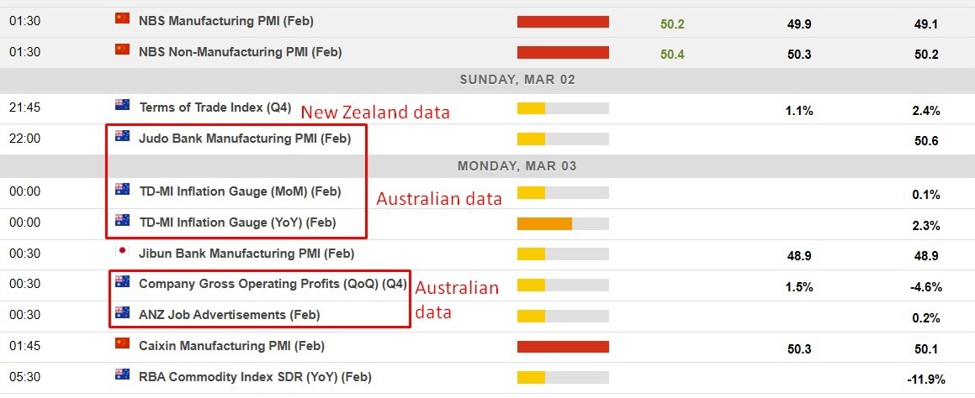

Asian Economic Calendar: Key Events and Consensus Expectations for 03 March 2025

As investors and market analysts gear up for a dynamic day of economic insights, the Asian financial landscape promises several critical events that could significantly impact regional and global markets. Here's a comprehensive overview of the key economic indicators and events scheduled for March 3rd, 2025.

Japan: Economic Indicators in Focus

The Bank of Japan (BOJ) will release its latest economic data, with particular attention on monetary policy indicators and potential shifts in the nation's economic strategy. Analysts are closely monitoring potential adjustments to the current monetary framework, which could have substantial implications for currency markets and regional investment trends.

China: Economic Performance and Policy Signals

China's National Bureau of Statistics is set to publish crucial economic metrics, including manufacturing performance and service sector activity. Investors will be keenly analyzing these reports for insights into the country's economic recovery trajectory and potential policy interventions.

Australia: Key Economic Releases

The Reserve Bank of Australia's latest economic assessment will provide valuable perspectives on the nation's economic health. Trade balance figures and employment data are expected to offer comprehensive insights into Australia's economic resilience and potential growth strategies.

Market Expectations and Potential Impacts

Financial markets are anticipating nuanced movements across various sectors. Potential volatility is expected in currency exchange rates, particularly for the Japanese Yen, Chinese Yuan, and Australian Dollar. Institutional investors and traders should remain vigilant and prepared for potential market recalibrations.

Global Context and Interconnectedness

While these events are regionally focused, their implications extend far beyond Asia. Global investors and economic strategists will be closely monitoring these developments for potential ripple effects in international markets.

Disclaimer: Economic forecasts and market predictions are subject to change. Investors are advised to conduct thorough research and consult financial professionals before making investment decisions.

MORE...Katha Manufacturers Defend Ammonia: "Not Against the Law" Says Industry Association

Manufacturing

2025-03-02 21:20:12

In a robust defense against recent allegations, the Himachal Pradesh Katha Manufacturers Association has emphatically rejected claims of illegal ammonia usage in refrigeration systems across the state's katha production facilities. Ashok Sharma, the association's president and owner of a manufacturing unit in Amb, Una district, categorically labeled these accusations as unfounded and misleading. Sharma emphasized that both ammonia and freon are utilized in strict compliance with established environmental regulations, highlighting that their use is fully sanctioned and transparently approved by the Pollution Control Board and Forest Department. The association stands firm in its commitment to maintaining legal and ethical manufacturing practices, challenging any suggestions of impropriety in their operational methods. By directly addressing the accusations and providing clear, transparent information, the Katha Manufacturers Association seeks to dispel any misconceptions about their industrial processes and reaffirm their dedication to responsible and lawful production standards. MORE...

AI Startup TRAiNED Disrupts Mortgage Industry with Groundbreaking Investment Campaign

Manufacturing

2025-03-02 19:48:00

Revolutionizing Mortgage Processing: TRAiNED, Inc. Opens Doors to Innovative AI Investment In a groundbreaking move that promises to reshape the mortgage industry, TRAiNED, Inc. is set to disrupt traditional lending processes through cutting-edge artificial intelligence technology. The company has just launched an exciting investment opportunity on StartEngine, inviting forward-thinking investors to be part of a transformative journey. TRAiNED, Inc. stands at the vanguard of technological innovation, developing sophisticated AI solutions designed to streamline and simplify mortgage manufacturing. By leveraging advanced algorithms and machine learning, the company aims to dramatically reduce processing times, minimize operational costs, and enhance the overall experience for both lenders and borrowers. This strategic investment round represents more than just a financial opportunity—it's a chance to be part of a technological revolution that could fundamentally reimagine how mortgages are processed in the digital age. With its pioneering approach, TRAiNED, Inc. is poised to bring unprecedented efficiency and transparency to one of the most complex financial transactions individuals encounter. Investors and industry observers alike are taking notice of TRAiNED's potential to create meaningful change in a sector ripe for technological disruption. MORE...

Factory Floor Titans: 5 Manufacturing Stocks Poised to Revolutionize Industry Investments

Manufacturing

2025-03-02 19:09:24

Top 7 Manufacturing Stocks Investors Should Keep an Eye On Today

In today's dynamic market landscape, savvy investors are turning their attention to a select group of manufacturing stocks that are showing significant potential. According to MarketBeat's sophisticated stock screener tool, seven standout companies are capturing the spotlight:

- Taiwan Semiconductor Manufacturing

- Salesforce

- Oracle

- Exxon Mobil

- Lam Research

- Applied Materials

- ServiceNow

These companies represent the cutting edge of manufacturing, spanning diverse sectors from semiconductor production to enterprise software and energy. Each brings unique strengths and innovative capabilities that make them compelling options for investors seeking exposure to the manufacturing sector.

Investors are advised to conduct thorough research and consider their individual investment strategies before making any financial decisions.

MORE...Inside the Innovation Factory: How Manufacturing's Future is Being Reimagined

Manufacturing

2025-03-02 19:00:00

Nestled within an unassuming warehouse at El Paso International Airport, a hub of bustling air cargo activity, an exciting innovation ecosystem is taking shape. Eight dynamic startup companies are pioneering groundbreaking solutions in advanced manufacturing, aerospace, and defense technologies, transforming this industrial space into a crucible of cutting-edge innovation. These emerging enterprises are not just occupying space; they are reimagining the future of industrial and technological development. By leveraging the strategic location of El Paso and the airport's robust infrastructure, these companies are positioning themselves at the forefront of next-generation manufacturing and defense technologies. The warehouse serves as more than just a physical location—it's a collaborative incubator where creativity, engineering expertise, and entrepreneurial spirit converge to develop products that could potentially reshape industries and drive economic growth in the region. MORE...

Manufacturing Lifeline: Rep. Brian Jack Secures Breakthrough Bill to Protect Spalding County's Economic Backbone

Manufacturing

2025-03-02 18:56:25

In a significant legislative move, Congressman Brian Jack successfully spearheaded a bipartisan effort to pass H.J. Res. 20, a joint resolution aimed at overturning a controversial regulation introduced during the Biden Administration. The resolution targets a specific rule that would have effectively banned non-condensing tankless technologies, marking a notable victory for lawmakers who prioritize technological innovation and consumer choice. The bipartisan support for the resolution underscores the collaborative spirit in addressing regulatory challenges that could potentially impact industry and consumers. By repealing this regulation, Congressman Jack and his colleagues have demonstrated a commitment to preventing overly restrictive policies that might hinder technological advancement and economic flexibility. This legislative action highlights the ongoing dialogue between policymakers and technological sectors, emphasizing the importance of balanced and thoughtful regulatory approaches that support innovation while maintaining necessary safeguards. MORE...

Power Revolution: Massive 400K Sq. Ft. Facility Transforms Grid-to-Chip Technology

Manufacturing

2025-03-02 12:00:31

Flex, the innovative Austin-based global electronics manufacturing powerhouse, is preparing to make a significant mark on Dallas's industrial landscape. The company is set to unveil a cutting-edge manufacturing facility in East Dallas, signaling a major expansion of its operational footprint in the region. This substantial new facility represents a strategic move for Flex, promising to bring advanced manufacturing capabilities and potential job opportunities to the local community. The state-of-the-art complex will likely showcase the company's commitment to technological innovation and economic growth in the Dallas-Fort Worth metroplex. While specific details about the facility's size and production focus remain under wraps, the announcement underscores Flex's continued growth and its importance in the global electronics manufacturing sector. Local economic development officials are expected to welcome this significant investment in the area's industrial infrastructure. MORE...

Investment Giant SBI Securities Doubles Down on Taiwan Semiconductor's Global Tech Dominance

Manufacturing

2025-03-02 11:59:02In a strategic investment move, SBI Securities Co. Ltd. has expanded its portfolio by acquiring a new position in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). The investment details were revealed in the company's latest 13F filing with the Securities and Exchange Commission, which disclosed the purchase of 95,530 shares of the leading semiconductor manufacturer. This investment highlights the growing interest of financial institutions in Taiwan Semiconductor Manufacturing, a global leader in advanced chip production. The move suggests SBI Securities sees potential value and growth prospects in the technology sector, particularly in the semiconductor industry. The acquisition reflects the ongoing importance of semiconductor companies in the global technology landscape, with Taiwan Semiconductor Manufacturing being a key player in supplying cutting-edge chips to major tech companies worldwide. MORE...