Chip Investment Surge: Hong Kong Asset Manager Boosts Stake in Taiwan Semiconductor Giant

Manufacturing

2025-02-23 11:00:53

Yong Rong HK Asset Management Expands Investment in Taiwan Semiconductor Manufacturing

In a strategic move during the fourth quarter, Yong Rong HK Asset Management Ltd has established a new position in Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM). The institutional investor recently disclosed its investment through a filing with the Securities and Exchange Commission (SEC).

The firm acquired 7,589 shares of the leading semiconductor manufacturer, signaling confidence in the company's market potential and future growth prospects. This investment underscores Yong Rong HK Asset Management's interest in the dynamic semiconductor industry and its recognition of Taiwan Semiconductor Manufacturing's prominent role in global technology supply chains.

Investors and market analysts will likely be monitoring the performance of this strategic investment in the coming quarters.

MORE...Wall Street's Latest Move: Abound Financial Doubles Down on Taiwan Semiconductor's Tech Dominance

Manufacturing

2025-02-23 10:43:45In a strategic investment move, Abound Financial LLC has expanded its portfolio by acquiring a new stake in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). The investment firm recently disclosed its latest position through a filing with the Securities and Exchange Commission (SEC), revealing the purchase of 2,573 shares in the leading semiconductor manufacturer. This calculated addition to Abound Financial's investment strategy highlights the growing interest in Taiwan Semiconductor, a global powerhouse in the semiconductor industry. The modest stake demonstrates the firm's confidence in the company's potential and its ongoing technological leadership in the rapidly evolving tech landscape. Investors and market watchers will be closely monitoring how this new position might influence Abound Financial's investment approach and their perspective on the semiconductor sector's future prospects. MORE...

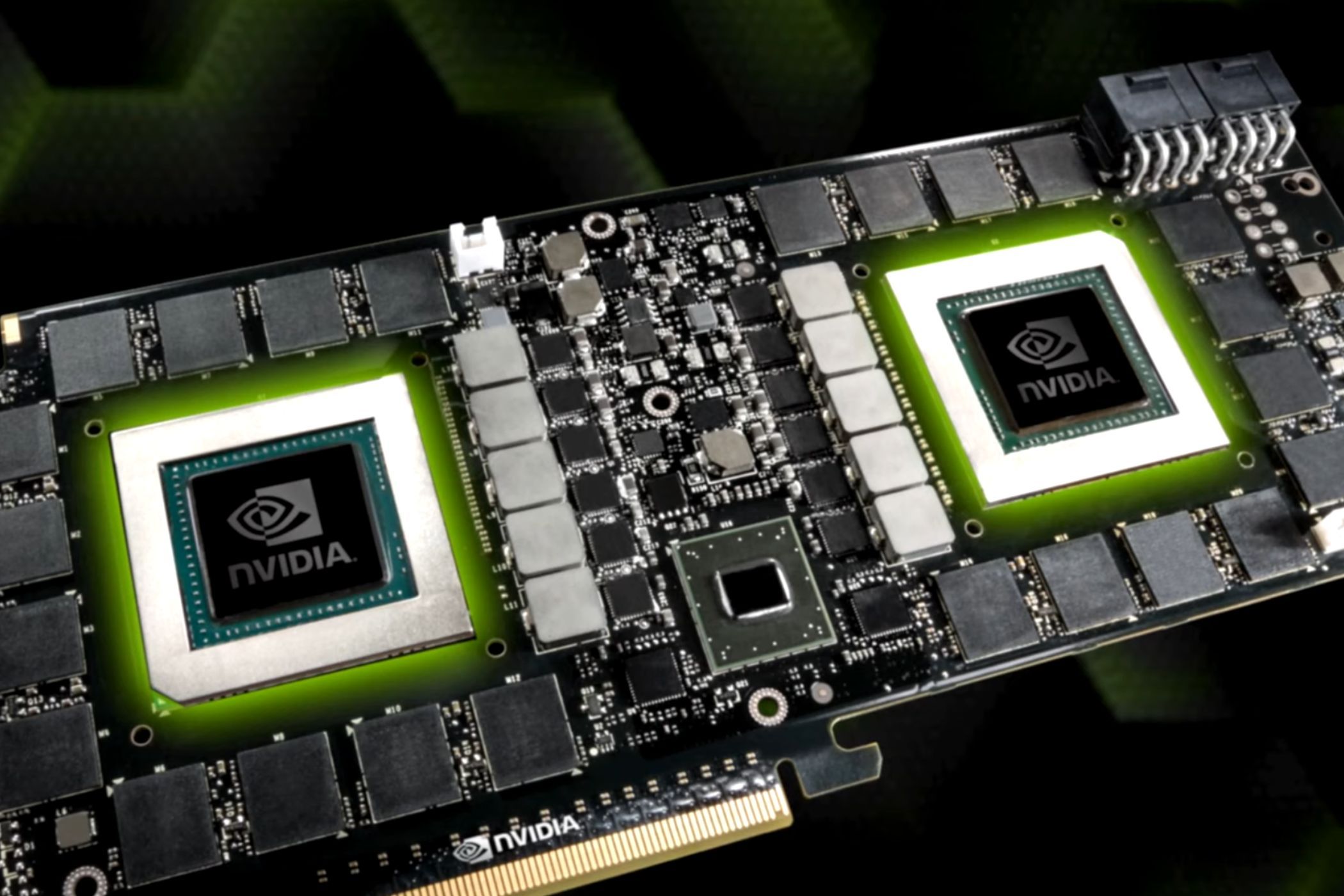

Nvidia's RTX 5070 Stumbles: Manufacturing Hiccups Reveal Surprising Silver Lining

Manufacturing

2025-02-23 03:47:54

When Plans Don't Quite Go as Expected

Life has a way of throwing unexpected curveballs, and sometimes what seems like a potential disaster turns out to be nothing more than a minor hiccup. Our recent team project encountered a few challenges that initially appeared overwhelming, but with quick thinking and collaborative problem-solving, we managed to navigate through the complexity.

At first glance, the obstacles seemed insurmountable. Tight deadlines, technical complications, and communication gaps threatened to derail our progress. However, instead of panicking, we took a step back and approached the situation strategically. Each team member brought their unique skills and perspectives to the table, transforming potential roadblocks into opportunities for creative solutions.

What could have been a catastrophic setback became a testament to our team's resilience and adaptability. We learned valuable lessons about communication, flexibility, and the importance of maintaining a positive attitude in the face of uncertainty. By staying calm and focused, we not only resolved the immediate challenges but also strengthened our collective problem-solving capabilities.

In the end, what initially seemed like a potential disaster became a powerful reminder that with the right mindset and teamwork, no challenge is truly insurmountable.

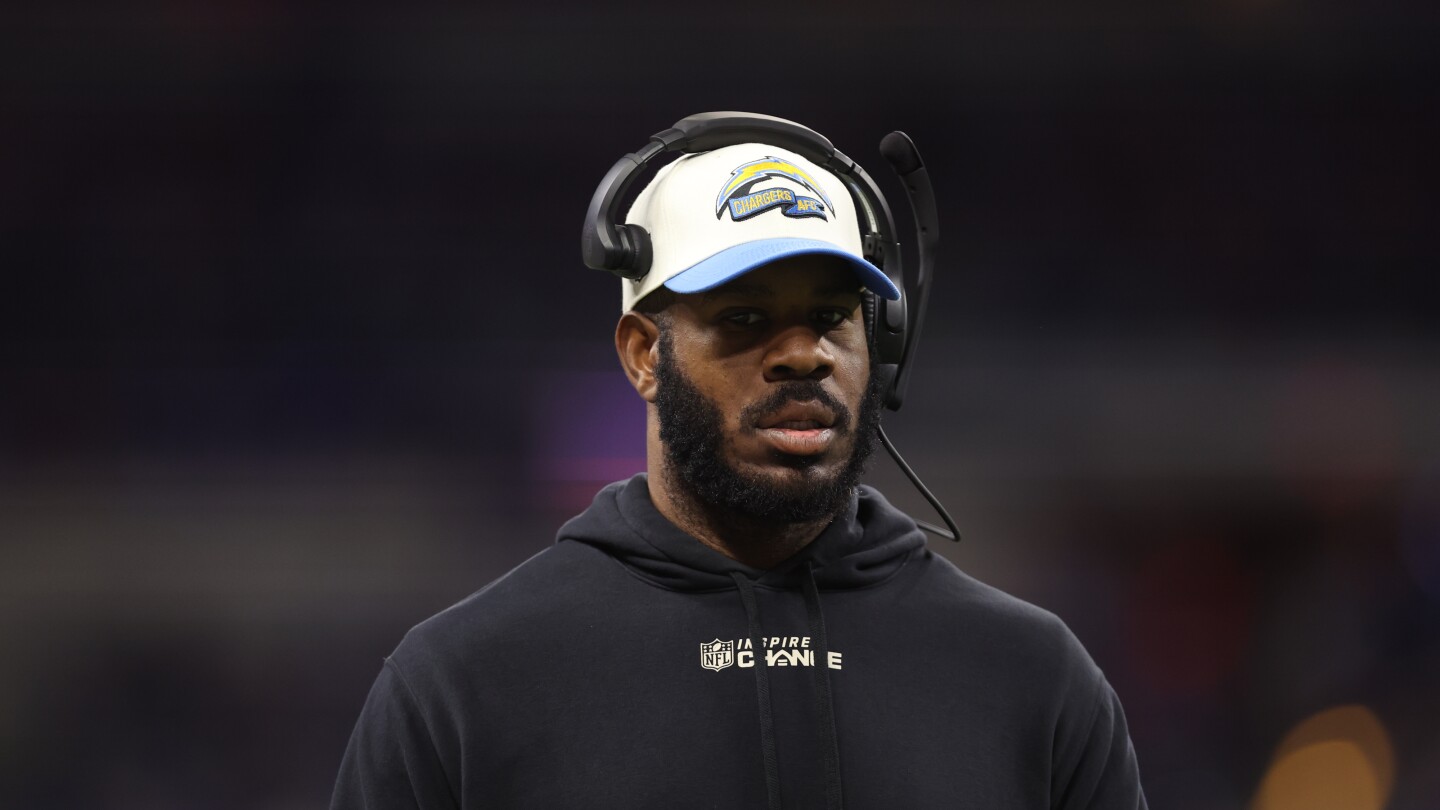

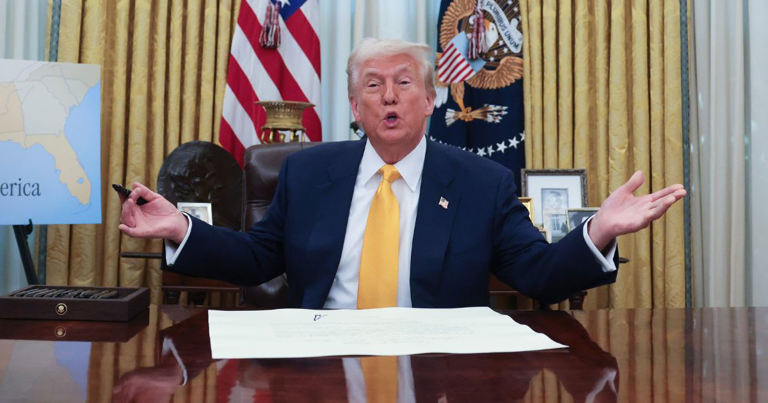

MORE...Manufacturing Exodus: Trump Claims Victory as Mexico Production Shifts Stateside

Manufacturing

2025-02-22 20:32:35

Apple to Boost US Manufacturing, Confirms Trump

In a bold announcement on Friday, President Donald Trump revealed promising developments in Apple's manufacturing strategy. During a meeting with state governors, Trump shared insights from a recent White House discussion with Apple CEO Tim Cook, highlighting the tech giant's commitment to expanding production within the United States.

According to a Bloomberg report, Cook reportedly pledged to increase Apple's domestic manufacturing footprint, signaling a potential shift away from international production sites like Mexico. The president enthusiastically emphasized the potential economic benefits of bringing more manufacturing jobs back to American soil.

While specific details of the manufacturing expansion were not immediately disclosed, Trump's announcement suggests a significant strategic move by Apple that could have far-reaching implications for the US manufacturing sector and the company's global production strategy.

MORE...Silicon Powerhouse: Flex Ltd. Supercharges AI Infrastructure with Massive Dallas Manufacturing Hub

Manufacturing

2025-02-22 19:06:04

Flex Ltd.: A Standout Player in the AI Stock Landscape

As the artificial intelligence revolution continues to reshape industries worldwide, investors are keenly watching the most promising AI stocks. Our recent comprehensive analysis of the Top 10 AI Stocks has put Flex Ltd. (NASDAQ:FLEX) under the spotlight, revealing its potential in this transformative technological era.

Artificial intelligence isn't just a technological trend—it's the driving force behind the fourth industrial revolution. With its unprecedented ability to disrupt and innovate across multiple sectors, AI is fundamentally changing how businesses operate, compete, and create value.

In this deep dive, we'll explore Flex Ltd.'s position in the dynamic AI stock market, examining its unique strengths, strategic initiatives, and potential for growth. As companies race to integrate cutting-edge AI technologies, Flex Ltd. stands out as a compelling option for investors seeking exposure to this game-changing sector.

Stay tuned as we unpack the details that make Flex Ltd. a noteworthy contender in the AI stock arena.

MORE...From Trade War to Industrial Triumph: Canada's Bold Path to Manufacturing Dominance

Manufacturing

2025-02-22 18:00:00

Trump's Tariff War: A Wake-Up Call for Canadian Manufacturing The ongoing trade tensions between the United States and Canada have exposed a critical vulnerability in our economic landscape. President Trump's aggressive tariff policies are more than just a diplomatic challenge—they're a stark reminder of Canada's overreliance on the American market and our need for economic resilience. For too long, Canada has been content to play a supporting role in North American manufacturing, primarily serving as a supply chain partner to U.S. industries. The current trade turbulence presents a pivotal moment for Canadian businesses and policymakers to reimagine our industrial strategy. We must seize this opportunity to diversify our manufacturing base, invest in innovation, and develop robust domestic production capabilities. By reducing our economic dependence on the United States, Canada can transform this challenge into a catalyst for national economic transformation. Strategic investments in advanced manufacturing, technology, and skills training can position Canada as a global competitor, not just a peripheral player. The time has come to break free from our traditional economic model and forge a more independent, dynamic industrial future. The tariff war is not just a threat—it's an invitation to reinvent our economic potential and chart a bold new course for Canadian manufacturing. MORE...

Chip Giant TSM Takes a Slight Dip: What's Driving Taiwan Semiconductor's Market Pullback?

Manufacturing

2025-02-22 16:52:23

Taiwan Semiconductor Manufacturing (TSM): Navigating Market Volatility

Investors are closely watching Taiwan Semiconductor Manufacturing (TSM) as the stock experiences a modest 1.2% decline in recent trading. This movement has sparked discussions about the company's current market position and potential investment strategies.

Understanding the Market Dynamics

TSM, the world's largest semiconductor foundry, continues to play a critical role in the global technology supply chain. Despite the recent share price dip, the company remains a cornerstone of the semiconductor industry, supplying chips to major tech giants like Apple, Nvidia, and Qualcomm.

Key Considerations for Investors

- The semiconductor industry is experiencing significant volatility due to global economic uncertainties

- TSM's robust technological capabilities and strategic market position provide underlying strength

- Long-term investors may view this price movement as a potential buying opportunity

Analyst Perspectives

Market experts suggest that while short-term fluctuations are normal, TSM's fundamental business model remains solid. The company's continued investment in advanced manufacturing technologies and its dominant market share offer promising long-term prospects.

Recommendation

Investors should carefully evaluate their individual investment goals and risk tolerance. Consulting with a financial advisor can provide personalized insights into whether TSM aligns with your investment strategy.

MORE...Revolutionizing Industry: How Next-Gen Tech is Reshaping Manufacturing's Future

Manufacturing

2025-02-22 15:15:42

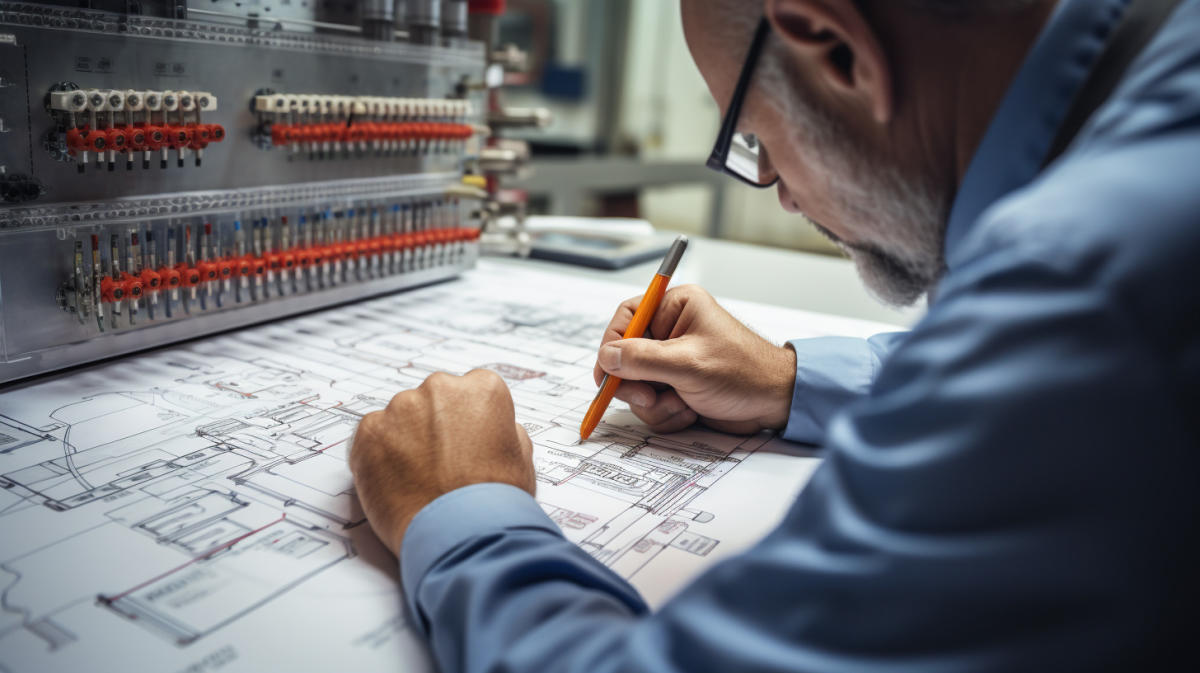

Empowering Next-Generation Manufacturing: Cutting-Edge EPC Solutions for Critical Infrastructure In the rapidly evolving landscape of advanced technology, our partnership delivers comprehensive Engineering, Procurement, and Construction (EPC) solutions that drive innovation across three critical sectors: semiconductor fabrication, electric vehicle infrastructure, and data center development. We specialize in transforming complex technological challenges into seamless, precision-engineered solutions. Our expertise ensures that semiconductor fabs, EV charging networks, and data center facilities are built with unparalleled reliability, speed, and technical sophistication. By combining advanced engineering techniques with strategic procurement and expert construction methodologies, we enable our clients to: • Accelerate technological infrastructure development • Maximize operational efficiency • Implement state-of-the-art manufacturing capabilities • Reduce time-to-market for critical technological projects Our commitment goes beyond traditional project management—we're strategic partners in building the technological foundations that power tomorrow's digital and sustainable ecosystems. From intricate semiconductor manufacturing lines to expansive EV charging networks and mission-critical data centers, we deliver integrated solutions that meet the most demanding performance and reliability standards. MORE...

Investors' Golden Run: Hammond Manufacturing's Stunning 42% Annual Returns Revealed

Manufacturing

2025-02-22 13:17:36

The Smart Investor's Guide to Long-Term Stock Success

Successful investing isn't about chasing quick gains or timing the market perfectly. Instead, it's about identifying and holding onto exceptional companies that demonstrate consistent growth and resilience over multiple years.

While not every stock in your portfolio will be a home run, strategic selection and patience can significantly enhance your investment returns. The key is to focus on high-quality companies with strong fundamentals, innovative leadership, and proven track records of creating shareholder value.

By adopting a long-term perspective, investors can ride out market volatility and potentially benefit from compounding returns. This approach requires careful research, disciplined decision-making, and the ability to resist emotional reactions to short-term market fluctuations.

Remember, building wealth through stock investments is a marathon, not a sprint. Choose wisely, stay informed, and remain committed to your investment strategy.

MORE...Behind the Trade Walls: Why Trump's Tariff Gamble Fails to Revive U.S. Manufacturing

Manufacturing

2025-02-22 12:00:25

The erosion of manufacturing jobs is a global phenomenon sweeping across developed economies, far beyond the borders of the United States. While politicians like Donald Trump have attempted to frame this trend as a unique American challenge, the reality is far more complex. His proposed tariffs, touted as a solution, are more likely to cause economic harm than provide meaningful relief to workers. The transformation of manufacturing is a worldwide trend driven by technological advances, automation, and shifting global economic dynamics. Countries from Germany to Japan are experiencing similar declines in traditional manufacturing employment. Rather than being a problem exclusive to one nation, this is a structural economic shift that requires nuanced, forward-thinking strategies. Trump's protectionist approach of imposing tariffs represents a simplistic and potentially destructive response to this intricate economic challenge. Such measures risk triggering retaliatory actions, disrupting international trade relationships, and ultimately causing more economic damage to the very workers they claim to protect. A more effective approach would involve investing in workforce retraining, technological innovation, and creating pathways for workers to transition into emerging industries. MORE...