Wall Street Cheers: PNC Financial Smashes Earnings Forecast in Stellar 2024 Performance

Finance

2025-02-24 10:56:48

PNC Financial Services Group Delivers Steady Performance in 2024

PNC Financial Services Group (NYSE:PNC) has unveiled its full-year financial results for 2024, demonstrating resilience in a challenging economic landscape. The banking giant reported a stable financial performance that reflects strategic management and consistent operational excellence.

Key Financial Highlights

- Total Revenue: US$20.8 billion, maintaining the same level as the previous fiscal year

- Steady financial positioning despite market volatility

- Continued focus on operational efficiency and customer-centric strategies

The company's ability to maintain its revenue indicates a robust business model and effective risk management in an increasingly complex financial environment. Investors and analysts will likely view this performance as a testament to PNC's strategic approach to banking and financial services.

As the financial sector continues to evolve, PNC remains committed to delivering value to its shareholders and maintaining a strong market position.

MORE...Digital Hearts, Human Hands: The Banking Revolution You Didn't See Coming

Finance

2025-02-24 10:30:00

In the era of digital transformation, banks are navigating a delicate balance between technological convenience and personalized customer service. While digital banking platforms offer unprecedented ease and accessibility, they can't fully replace the human touch that many customers still crave. The digital revolution has undoubtedly streamlined financial transactions, allowing customers to manage accounts, transfer funds, and pay bills with just a few taps on their smartphones. However, this one-size-fits-all approach overlooks a significant segment of banking customers: those who are less comfortable with technology or require more nuanced financial guidance. Financial institutions are increasingly recognizing the need to bridge this digital divide. The solution lies not in abandoning digital platforms, but in creating a hybrid model that seamlessly integrates cutting-edge technology with empathetic, personalized support. This means offering multiple channels of interaction—from intuitive mobile apps to readily available human representatives who can provide expert advice and emotional reassurance. By embracing this balanced approach, banks can cater to diverse customer needs, ensuring that technology enhances rather than replaces the fundamental human elements of financial service. The goal is to make banking not just convenient, but genuinely supportive and accessible to everyone. MORE...

Green Finance Triumph: Standard Chartered Bags Nearly $1B in Sustainable Revenue

Finance

2025-02-24 10:20:46

Standard Chartered Surges Ahead in Sustainable Finance, Nearing $1 Billion Milestone In a remarkable display of commitment to green financial strategies, international banking powerhouse Standard Chartered has reported an impressive $982 million in sustainable finance income for 2024. The bank's latest annual report reveals a robust 36% year-over-year growth, positioning the institution tantalizingly close to its ambitious $1 billion annual income target. This significant financial achievement underscores Standard Chartered's strategic focus on sustainable and environmentally responsible banking practices. The substantial increase in sustainable finance revenue reflects growing global investor interest in green financial solutions and the bank's proactive approach to climate-conscious investment strategies. By continuing to expand its sustainable finance portfolio, Standard Chartered is not only driving financial performance but also contributing to global efforts to support environmentally friendly economic development. The bank's progress demonstrates a clear commitment to balancing profitable banking with meaningful environmental impact. MORE...

Cyber Siege: $1,000 Data Breach Exposes Massive Vulnerabilities in $5 Trillion Finance Sector

Finance

2025-02-24 10:18:19

Healthcare Cybersecurity: The New Frontline of Digital Threats

In a dramatic shift of cyber attack strategies, hackers are increasingly setting their sights on the healthcare sector, moving away from traditional financial targets. This emerging trend is raising serious concerns about patient data security and healthcare infrastructure vulnerability.

The healthcare industry has become an attractive target for cybercriminals due to several critical factors:

- Vast repositories of sensitive personal and medical information

- Often outdated and complex technological infrastructure

- High potential for ransom payments to restore critical systems

Healthcare organizations are now facing unprecedented cybersecurity challenges. Hospitals and medical facilities must rapidly evolve their digital defense strategies to protect patient data, maintain operational continuity, and prevent potentially life-threatening disruptions.

Key recommendations for healthcare providers include:

- Implementing robust, multi-layered cybersecurity protocols

- Conducting regular security audits and vulnerability assessments

- Investing in advanced threat detection and response technologies

- Training staff on cybersecurity best practices

As cyber threats continue to evolve, the healthcare sector must remain vigilant and proactive in safeguarding its digital ecosystem.

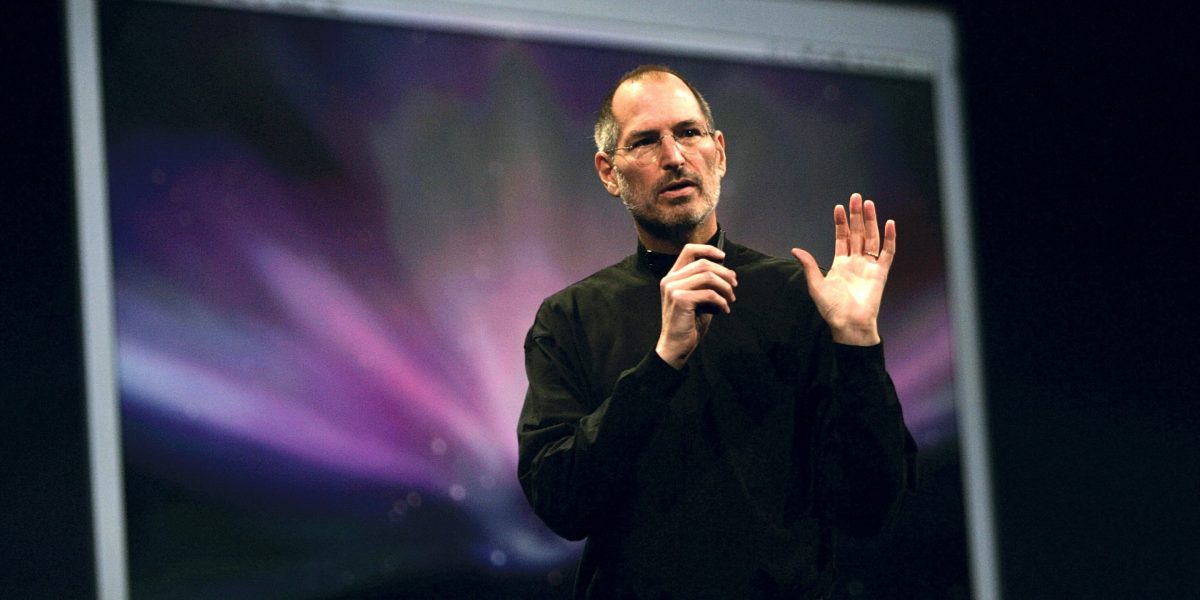

MORE...Defying Buffett: How Steve Jobs' Maverick Instincts Trumped Wall Street Wisdom

Finance

2025-02-24 10:17:00

In a revealing conversation that showcases the strategic thinking of two business legends, Warren Buffett once presented Steve Jobs with four distinct options for managing Apple's massive cash reserves. This extraordinary exchange highlights the deep respect and intellectual rapport between two of the most influential business minds of their generation. Buffett, known for his legendary investment acumen, approached Jobs with a thoughtful breakdown of potential strategies for Apple's substantial cash pile. The options ranged from strategic reinvestment to shareholder-friendly approaches, demonstrating Buffett's nuanced understanding of corporate financial management. While the specific details of each option remain somewhat private, the conversation underscores the unique relationship between Buffett and Jobs. Both were visionaries who transformed their respective industries - Buffett in investing and Jobs in technology - and shared a profound respect for intelligent financial decision-making. The discussion reflects a pivotal moment in Apple's corporate history, when the company was sitting on an unprecedented amount of cash and needed strategic guidance on how to most effectively utilize its financial resources. Buffett's input was particularly valuable, given his reputation for making shrewd financial decisions that create long-term value. This interaction between Buffett and Jobs serves as a powerful reminder of how top-tier business leaders collaborate and think strategically about corporate finances, even across different sectors and business models. MORE...

Campaign Cash Crackdown: Local Politician's $10K Fine Sparks Fresh Ethical Scrutiny

Finance

2025-02-24 10:09:09

In a developing legal saga, Councilwoman Donna Purvis has narrowly avoided a potentially hefty $20,000 fine through a strategic settlement. However, her legal challenges are far from over, as new complaints of potential violations have emerged, casting a shadow over her current political standing. After successfully negotiating a reduced financial penalty in her previous legal encounter, Purvis now finds herself confronting a fresh wave of allegations that could further complicate her professional reputation. The new complaints suggest ongoing scrutiny of her conduct and raise questions about potential ethical breaches. While the specifics of the new violations remain unclear, the repeated legal challenges highlight the increasing pressure on the councilwoman to maintain transparency and adhere to strict ethical standards. Political observers are closely watching how Purvis will navigate these latest accusations and whether they will impact her effectiveness as a public servant. The unfolding situation underscores the intense scrutiny faced by local government officials and the importance of maintaining impeccable professional conduct in public office. MORE...

Green Steel Revolution: India's Climate Challenge Meets Financial Innovation

Finance

2025-02-24 09:14:38

India's steel industry stands at a critical crossroads in the fight against climate change. As the largest industrial carbon emitter, the sector currently accounts for a staggering 10-12% of the country's total greenhouse gas emissions. However, a promising solution emerges through transition finance—a strategic approach that can catalyze a gradual, sustainable transformation of steel production. Transition finance offers a pragmatic pathway to decarbonization, providing the financial support needed to bridge the gap between current high-carbon practices and future green technologies. By strategically investing in incremental improvements and innovative low-carbon technologies, the steel industry can begin its journey toward a more sustainable future. This approach recognizes the complex challenges of immediate decarbonization, offering a nuanced strategy that supports industries in their gradual shift to cleaner production methods. As cutting-edge green technologies continue to develop, transition finance provides the critical financial and technological support needed to make meaningful progress in reducing carbon emissions. The potential for change is significant. By embracing transition finance, India's steel sector can lead the way in sustainable industrial transformation, balancing economic growth with environmental responsibility. MORE...

Car Finance Fallout: Bank of Ireland Earmarks Massive €172M for Customer Compensation

Finance

2025-02-24 09:10:52

A Potential Windfall: Millions of Drivers Set to Receive Compensation for Car Finance Fees Drivers across the country could be in for a pleasant surprise as a massive compensation claim takes shape over previously undisclosed charges in car finance agreements. Experts estimate that potentially millions of motorists may be eligible for significant payouts related to hidden fees that have gone unnoticed for years. The emerging legal challenge centers on controversial pricing practices within the automotive financing industry, where additional charges were allegedly concealed from consumers. Financial analysts suggest that many car buyers may have been unknowingly overcharged during their vehicle financing arrangements. Affected motorists are being advised to review their past car finance agreements carefully and gather documentation that could support a potential claim. Consumer protection groups are actively investigating the matter, promising to help drivers recover potentially substantial amounts of money. While the full details of the compensation process are still being finalized, this development represents a potentially game-changing moment for consumers who may have been unfairly charged. Drivers are encouraged to stay informed and prepare to take action as more information becomes available in the coming weeks. Financial experts recommend keeping all relevant documentation and staying alert to official announcements regarding the compensation process. This could be a significant opportunity for many car owners to reclaim unexpected additional costs from their vehicle financing. MORE...

Financial Frontier: Qatar's Bold Bid to Lure Global Banking Titans

Finance

2025-02-24 08:29:07

Qatar is making bold strides to establish itself as a premier investment destination, with Deerfield Management Co. and B Capital preparing to launch their regional headquarters in Doha. This strategic move underscores the country's ambitious efforts to compete with other Middle Eastern financial hubs and attract global investment firms. The decision by these prominent investment companies signals growing confidence in Qatar's economic landscape and its potential as a regional financial center. By setting up regional offices in Doha, Deerfield and B Capital are not only expanding their geographical footprint but also validating Qatar's commitment to becoming a competitive player in the international investment arena. This development is part of Qatar's broader strategy to diversify its economy and position itself as an attractive destination for global investment firms. The country is actively working to create a robust, investor-friendly environment that can rival established financial centers like Dubai and Abu Dhabi. As Qatar continues to invest in infrastructure, technology, and business-friendly policies, the arrival of these prestigious investment firms represents a significant milestone in the nation's economic transformation and global financial integration. MORE...

Global TV Titans: How Cross-Border Partnerships Are Revolutionizing Drama Production

Finance

2025-02-24 08:00:00

In the ever-evolving landscape of global streaming, content providers are getting creative to keep drama series production alive amid challenging market conditions. Streaming platforms like Stan, BritBox, and the innovative Scandi Alliance are pioneering new financing strategies to continue delivering compelling content to audiences. As traditional production funding becomes increasingly complex, these streaming services are exploring collaborative approaches and alternative investment models. They're breaking down geographical barriers and finding inventive ways to pool resources, ensuring that high-quality drama series continue to reach viewers despite economic uncertainties. The streaming industry is witnessing a remarkable shift, with platforms demonstrating remarkable resilience and adaptability. By forming strategic partnerships, sharing production costs, and leveraging international co-production opportunities, these companies are not just surviving but potentially reshaping the global entertainment financing landscape. These emerging strategies highlight the industry's determination to maintain creative output and meet audience demands, even in the face of significant economic challenges. The future of drama series production looks increasingly collaborative and internationally connected. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165