Motor Finance Scandal: Lloyds Braces for £700M Hit in Landmark Compensation Move

Finance

2025-02-20 07:11:48

Lloyds Banking Group Plc faced a challenging quarter as its financial performance fell short of market expectations, primarily due to a significant £700 million provision for potential regulatory challenges in its motor finance division. The unexpected reserve highlights the growing complexity of regulatory scrutiny facing major financial institutions and underscores the bank's proactive approach to managing potential legal and compliance risks. The additional financial buffer signals Lloyds' commitment to transparency and preparedness, even as it impacts the bank's quarterly earnings. Investors and analysts are closely watching how the bank will navigate these potential regulatory hurdles and mitigate the financial implications of the ongoing investigation into its motor finance practices. This development comes at a time when financial institutions are increasingly under pressure to demonstrate robust compliance and risk management strategies, reflecting the evolving landscape of banking regulation in the United Kingdom. MORE...

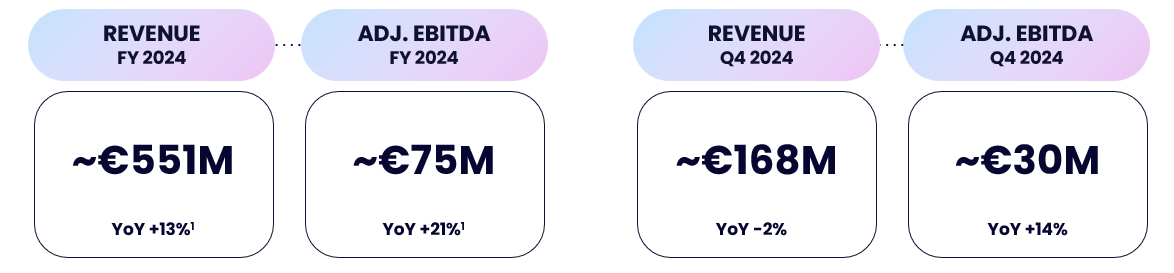

Biotech Breakthrough: EG 427 Secures €27M Funding Boost to Accelerate Medical Innovation

Finance

2025-02-20 07:00:00

EG 427, a pioneering biotechnology company, has secured significant funding to advance its groundbreaking neurological research. The company successfully raised capital with support from specialist fund SCI Ventures, which is backed by major spinal cord injury foundations. Existing investors also contributed to this promising investment round. The newly acquired funds will be strategically allocated to finance the phase 1b/2a clinical study of EG110A, with a primary focus on evaluating safety and early efficacy outcomes. This critical milestone opens promising pathways for clinical development across multiple medically significant neuro-urology conditions. Beyond the immediate clinical trial, the funding will also provide crucial support for the company's early-stage pipeline, which is built upon their innovative proprietary HERMES vector technology platform. This investment represents a significant step forward in potentially transformative neurological research and treatment development. The funding announcement was made in Paris, France, on February 20, 2025, signaling continued momentum in the biotechnology and medical research sectors. MORE...

Behind Closed Doors: Audit Committee Weighs Radical Governance Shake-Up

Finance

2025-02-20 06:42:15

In a pivotal meeting that could reshape the city's administrative landscape, the City Council Audit and Finance Committee explored potential streamlining of municipal governance on Wednesday. The committee carefully examined approximately two dozen boards, commissions, and governmental bodies, considering significant reductions in their scope and number. Despite thorough deliberations, committee members ultimately decided to pause and seek additional perspectives before making any definitive changes. The proposed restructuring aims to enhance governmental efficiency and reduce administrative overhead, but committee leaders recognized the importance of consulting with the various affected groups before implementing any modifications. The discussion highlighted the delicate balance between administrative optimization and maintaining comprehensive representation across city governance structures. While no immediate actions were taken, the committee signaled its commitment to a thoughtful, collaborative approach to potential organizational reforms. MORE...

Financial Storm Brewing: Devon Council Faces Unprecedented Budget Challenges

Finance

2025-02-20 06:07:30

Local Council Faces Critical Financial Strain Over Special Educational Needs Spending The local council is grappling with a dire financial situation, with its accounts described as "perilous" due to escalating expenditures on special educational needs (SEN) support. The mounting costs are pushing the council's budget to its breaking point, raising serious concerns about future financial sustainability. Mounting pressures from supporting students with special educational requirements have created a significant fiscal challenge for the local authority. The increasing demand for specialized educational services is outpacing the council's financial resources, creating a perfect storm of budgetary constraints. Experts warn that without immediate intervention and strategic financial planning, the council may face severe economic repercussions. The situation highlights the complex balance between providing essential support for vulnerable students and maintaining fiscal responsibility. Local officials are now urgently exploring potential solutions, including reviewing current spending patterns, seeking additional funding streams, and developing more cost-effective approaches to supporting students with special educational needs. The crisis underscores the broader national challenge of adequately funding special educational support while managing limited municipal resources. As the council navigates this critical financial landscape, the community watches closely, hoping for a sustainable resolution that doesn't compromise the educational support for its most vulnerable students. MORE...

Exposed: The Hidden Truth Behind the Car Finance Nightmare

Finance

2025-02-20 06:00:10

A brewing storm in the automotive finance industry threatens to unleash a massive wave of compensation claims, potentially costing lenders billions of pounds. The emerging scandal surrounding car loan sales has sent shockwaves through the financial sector, with consumers potentially set to receive substantial payouts. At the heart of the controversy are questionable lending practices that may have systematically misled car buyers about the true costs and terms of their vehicle financing. Financial experts suggest that the scale of potential compensation could reach unprecedented levels, with some estimates pointing to tens of billions of pounds in potential refunds. The scandal exposes deep-rooted issues in how car loans have been marketed and sold to unsuspecting consumers, raising serious questions about transparency and fairness in the automotive finance market. Lenders now face the prospect of a massive financial reckoning that could dramatically reshape the industry's approach to consumer lending. Consumer protection groups are calling for a comprehensive investigation, arguing that many borrowers may have been unfairly charged or misled about the true cost of their car financing arrangements. As the investigation gathers momentum, financial institutions are bracing themselves for what could be one of the most significant compensation challenges in recent financial history. MORE...

Breakthrough Year: Zealand Pharma Reveals Robust Financial Performance in 2024 Annual Report

Finance

2025-02-20 06:00:00

Zealand Pharma Unveils Remarkable Progress in Obesity Research for 2024

Zealand Pharma has marked 2024 as a pivotal year of transformation, showcasing significant clinical breakthroughs in its innovative obesity treatment pipeline. The company has made substantial strides that position it for accelerated growth in the coming years.

Key Highlights:

- Successfully completed a promising 16-week Phase 1b trial with the long-acting amylin analog petrelintide

- Advanced to a comprehensive Phase 2b trial targeting individuals with overweight and obesity

- Achieved positive topline results with its groundbreaking GLP-1/GLP-2 combination therapy

These developments underscore Zealand Pharma's commitment to developing cutting-edge therapeutic solutions that address critical metabolic health challenges. By focusing on differentiated and innovative approaches, the company continues to push the boundaries of obesity treatment research.

The successful progression of clinical trials and strategic advancements signal a promising trajectory for Zealand Pharma in addressing global health needs related to obesity and metabolic disorders.

MORE...Financial Quicksand: Tampa Emerges as a Hotspot for Economic Struggle

Finance

2025-02-20 03:52:06

From Grocery Aisles to Bank Accounts: The Widespread Pinch of Financial Strain Americans are experiencing a financial squeeze that touches nearly every aspect of daily life, with rising costs and economic pressures creating a challenging landscape for consumers and businesses alike. Egg prices have skyrocketed, shocking shoppers who've watched the cost of a dozen eggs climb to unprecedented heights. This dramatic increase is just one visible symptom of a broader economic strain that's rippling through households and industries. The financial distress isn't limited to grocery bills. Interest rates have been climbing, making borrowing more expensive and putting additional pressure on families and businesses trying to manage their budgets. Mortgages, car loans, and credit card debt have become more burdensome, forcing many to reassess their financial strategies and tighten their belts. From small businesses to individual consumers, people are feeling the economic pinch in multiple ways. Savings are being stretched thin, investment decisions are becoming more cautious, and the overall sense of financial uncertainty is palpable. The current economic climate demands creativity, resilience, and careful financial planning from everyone navigating these challenging times. While the situation remains complex, understanding these economic pressures can help individuals make more informed decisions about spending, saving, and financial management in an increasingly unpredictable economic environment. MORE...

Senate Finance Panel Clears Path for Community Investment Fund

Finance

2025-02-20 03:03:00

In a significant legislative breakthrough, the Senate Finance Committee has approved the Community Benefit Fund, a pivotal element of the Clear Horizons Act. This landmark decision marks a promising step forward for community development and economic empowerment. The fund, designed to support local infrastructure, social programs, and economic initiatives, represents a strategic investment in communities across the region. Senators praised the measure as a critical mechanism for addressing regional disparities and promoting sustainable growth. By passing through the Senate Finance Committee, the Community Benefit Fund has cleared a crucial hurdle in its journey toward becoming law. Supporters argue that the fund will provide much-needed resources to underserved areas, creating opportunities for education, job training, and community enhancement. As the legislation moves forward, stakeholders are optimistic about its potential to drive meaningful change and foster economic resilience in communities that have historically been overlooked. MORE...

Financial Calm: China Holds Steady on Lending Rates Amid Economic Balancing Act

Finance

2025-02-20 01:02:23

In a strategic move to stabilize China's currency, the People's Bank of China (PBOC) is taking decisive action to shield the yuan from potential depreciation pressures. Anticipating potential increases in tariff rates, the central bank is implementing robust measures to maintain the yuan's strength and economic resilience. The PBOC's proactive approach reflects a careful balancing act, demonstrating China's commitment to protecting its currency's value amid complex global economic challenges. By prioritizing defense against potential downward pressures, the central bank aims to instill confidence in international markets and provide a buffer against external economic uncertainties. This strategic intervention underscores the PBOC's sophisticated monetary policy, which seeks to navigate the intricate landscape of international trade tensions and currency fluctuations with precision and foresight. MORE...

Wall Street Braces: Market Futures Dip as Investors Await Fed's Next Move

Finance

2025-02-20 00:25:21

Wall Street's Attention Rivets on White House as Economic Tensions Escalate Investors are closely monitoring the latest developments from the White House as ongoing tariff tensions continue to send ripples through financial markets. The economic landscape is experiencing significant shifts, with recent defense spending announcements creating substantial momentum for military contracting corporations. The intricate dance of international trade policies and government spending is keeping market participants on the edge of their seats. As geopolitical strategies unfold, investors are carefully analyzing the potential impacts on various sectors, particularly those with strong ties to government contracts and international trade. Military contractors are experiencing notable volatility, with new defense budget allocations promising to reshape the competitive landscape. These strategic spending decisions are not just numbers on a spreadsheet, but potential game-changers for companies positioned at the intersection of national security and technological innovation. The current economic environment demands unprecedented attention, as each policy announcement and trade negotiation could trigger significant market movements. Savvy investors are staying alert, ready to navigate the complex and dynamic financial terrain. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165