Breaking: Azerion Reveals Q4 Financial Snapshot, Signals Strong 2024 Performance

Finance

2025-02-27 06:40:00

Azerion's Stellar Financial Performance: Q4 FY 2024 Highlights

Driving Profitability Through Strategic Platform Investments

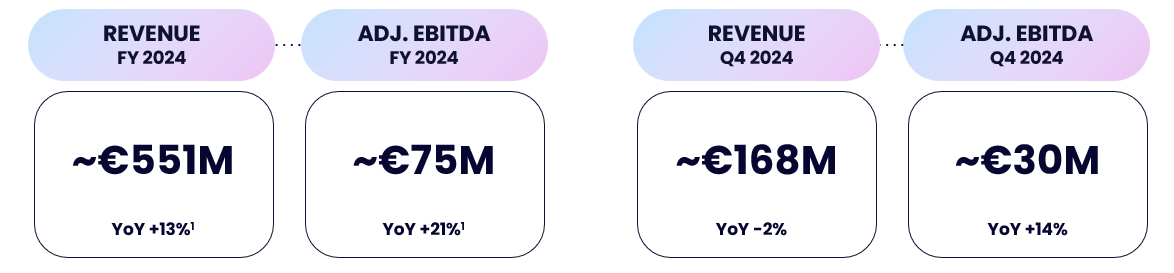

Azerion has demonstrated remarkable financial resilience in fiscal year 2024, showcasing a strategic commitment to efficiency and growth. The company's robust performance is a testament to its focused investments in advertising technology and operational optimization.

Fiscal Year 2024 Key Achievements:

- Revenue surged by 13%, climbing from €486.7 million to €551.2 million

- Adjusted EBITDA increased by an impressive 21% year-over-year, rising from €62.2 million to €75.1 million

Q4 2024: Strategic Focus on Synergy and Efficiency

During the fourth quarter, Azerion intensified its efforts to streamline operations, eliminate redundancies, and maximize cross-functional synergies. This targeted approach has been instrumental in driving the company's strong financial performance and positioning it for future growth.

The consistent year-long focus on platform performance and strategic investments continues to yield significant dividends, reinforcing Azerion's market leadership and financial strength.

MORE...Pacific Century Regional Developments Unveils Robust Financial Performance for 2024

Finance

2025-02-27 06:26:19

Pacific Century Regional Developments Navigates Challenging Financial Landscape in 2024

Pacific Century Regional Developments (SGX:P15) has released its full-year financial results for 2024, revealing a complex financial performance marked by significant challenges.

Key Financial Highlights

- Net Loss: The company reported a net loss of S$15.7 million, reflecting the ongoing economic pressures

- Revenue Dynamics: Detailed financial breakdown indicates strategic shifts and market adaptations

- Operational Resilience: Despite challenges, the company remains committed to its long-term strategic objectives

The financial results underscore the challenging business environment Pacific Century Regional Developments is navigating, with management likely focusing on cost optimization and strategic realignment to improve future performance.

Investors and stakeholders are advised to closely monitor the company's upcoming strategic initiatives and potential recovery plans.

MORE...Banking Boost: RBI's Lending Lifeline Sparks Indian Financial Stocks Rally

Finance

2025-02-27 05:45:33

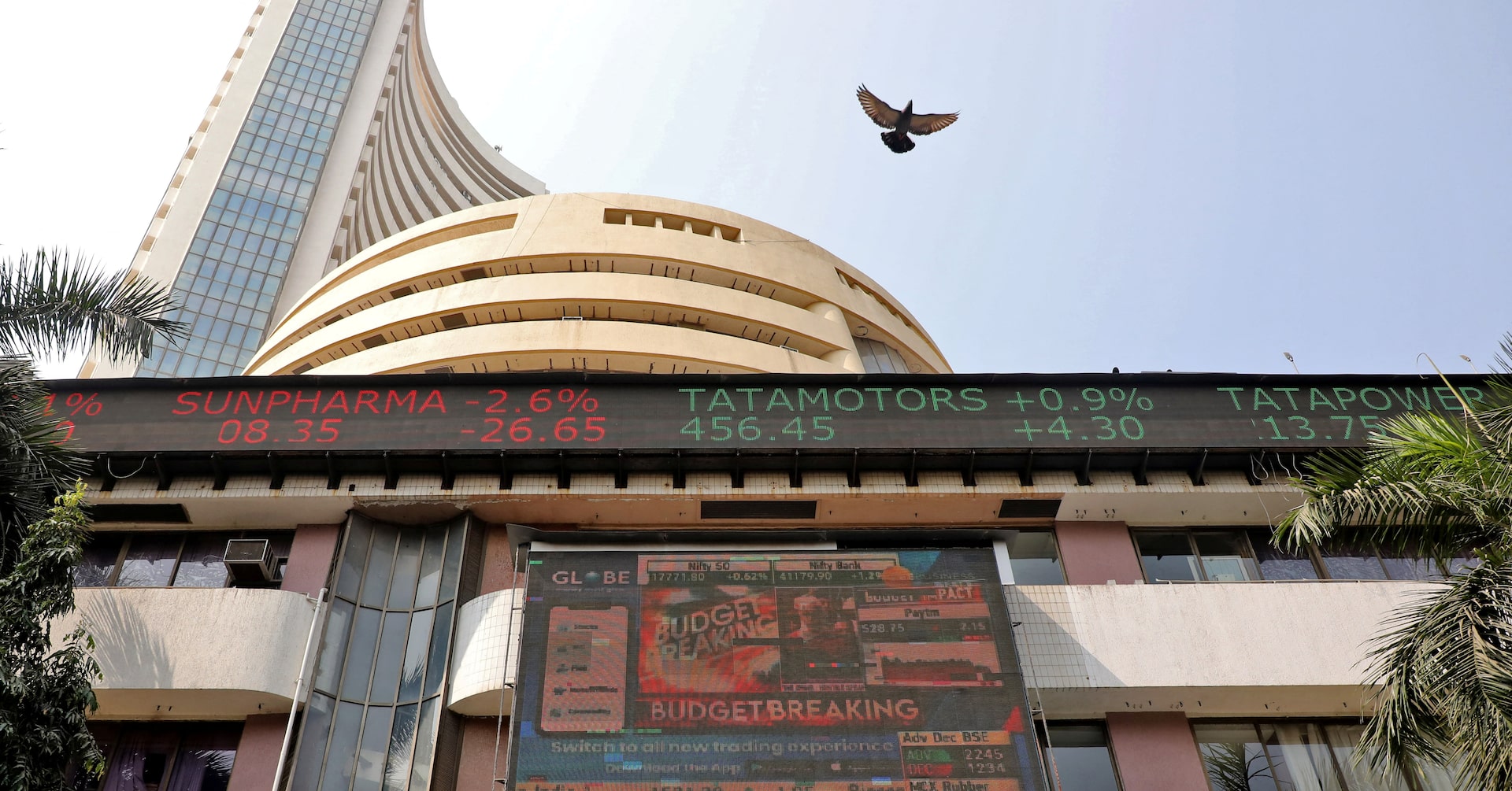

Indian financial markets witnessed a significant surge on Wednesday, with shares of non-bank and microfinance lenders soaring after the Reserve Bank of India (RBI) announced a further relaxation of capital requirements for micro loans and bank credit. The strategic move by the central bank sparked investor enthusiasm and triggered a notable rally in financial stocks. Investors and market analysts quickly responded to the RBI's policy adjustment, seeing it as a positive signal for the microfinance and lending sector. The eased capital norms are expected to provide more flexibility to financial institutions, potentially boosting their lending capabilities and overall financial performance. Shares of microfinance companies and non-banking financial corporations (NBFCs) experienced a substantial uptick, reflecting market optimism about the potential growth opportunities created by the central bank's decision. This development suggests a promising outlook for smaller financial institutions that play a crucial role in providing credit to underserved segments of the economy. The market's positive reaction underscores the significance of the RBI's regulatory approach in supporting financial inclusivity and creating a more dynamic lending ecosystem in India. MORE...

Green Finance Revolt: How EU Insiders Pulled Back from the Brink

Finance

2025-02-27 03:26:00

A proposed shift towards voluntary green investment standards has ignited a fierce internal debate within the European Union's executive branch, revealing deep divisions over environmental policy and sustainable finance. The controversial plan to make environmental investment guidelines optional has triggered significant tension among top EU officials, with some arguing that voluntary standards could undermine the bloc's ambitious climate goals. Proponents of the move suggest that a more flexible approach might encourage broader participation from businesses and investors, while critics warn it could weaken the EU's commitment to combating climate change. Sources close to the discussions describe the internal deliberations as a "huge fight," highlighting the complexity and high stakes of the proposed policy change. The debate reflects the ongoing challenge of balancing environmental protection with economic flexibility, a persistent tension at the heart of EU policymaking. While the exact details of the proposed standards remain under discussion, the potential shift represents a critical moment in the EU's approach to sustainable finance. Stakeholders are closely watching how this internal conflict will be resolved and what implications it might have for future environmental investment strategies. The controversy underscores the ongoing challenge of creating effective, implementable environmental policies that can gain widespread support across diverse economic interests within the European Union. MORE...

Pueblo's Financial Phoenix: City Rises from Economic Ashes with Bold Transformation Strategy

Finance

2025-02-27 02:41:29

In a strategic move to address ongoing financial challenges, the city of Pueblo has appointed Danny Nunn as its new Director of Finance. Nunn brings a wealth of experience and fresh perspective to tackle the city's budgetary complexities, signaling a proactive approach to fiscal management. The appointment comes at a critical time for Pueblo, as city leaders seek innovative solutions to stabilize and improve the municipal financial landscape. With Nunn at the helm of the finance department, officials are optimistic about implementing effective financial strategies that can help streamline spending and maximize resources. Nunn's background and expertise are expected to play a crucial role in developing comprehensive financial plans that will support the city's economic growth and address existing budget constraints. His arrival represents a significant step forward in Pueblo's commitment to sound financial governance and long-term fiscal health. MORE...

Singapura Finance Navigates Challenging Year: Earnings Per Share Dips Slightly to S$0.038

Finance

2025-02-27 00:01:25

Singapura Finance Delivers Strong Financial Performance in Full Year 2024

Singapura Finance (SGX:S23) has reported impressive financial results for the full year 2024, showcasing robust growth and financial resilience in a challenging economic landscape.

Key Financial Highlights

- Revenue Surge: The company achieved a notable revenue of S$23.7 million, representing an 8.5% increase compared to the previous fiscal year.

- Strategic Growth: The financial institution demonstrated its ability to expand and adapt in a competitive market.

These results underscore Singapura Finance's commitment to delivering value to shareholders and maintaining a strong market position. The company's strategic initiatives and operational efficiency have been key drivers of this positive financial performance.

Investors and market analysts will likely view these results as a positive indicator of the company's financial health and future potential.

MORE...Saving Earth's Blueprint: Why Global Leaders Must Unlock Biodiversity Funding Now

Finance

2025-02-27 00:00:00

The Promise of Conservation Finance: Turning Biodiversity Commitments into Reality The Kunming-Montreal Biodiversity Framework represents a critical global commitment to protecting our planet's precious ecosystems. However, these ambitious goals risk becoming mere wishful thinking without robust financial mechanisms to support them. Conservation finance is the key to transforming these noble intentions into tangible environmental progress. Without adequate funding and strategic financial investments, the framework's lofty objectives will remain nothing more than well-intentioned promises. Governments, private sector organizations, and international institutions must collaborate to create innovative financing models that can effectively support biodiversity conservation efforts. The challenge lies not just in making commitments, but in developing sustainable financial strategies that can translate conservation goals into meaningful action. This requires a comprehensive approach that includes targeted investments, economic incentives, and creative funding mechanisms that can support ecosystem protection and restoration. As we stand at a critical juncture in environmental protection, the success of the Kunming-Montreal Biodiversity Framework depends entirely on our ability to mobilize the necessary financial resources. Only through committed and strategic funding can we hope to preserve the world's biological diversity and create a sustainable future for our planet. MORE...

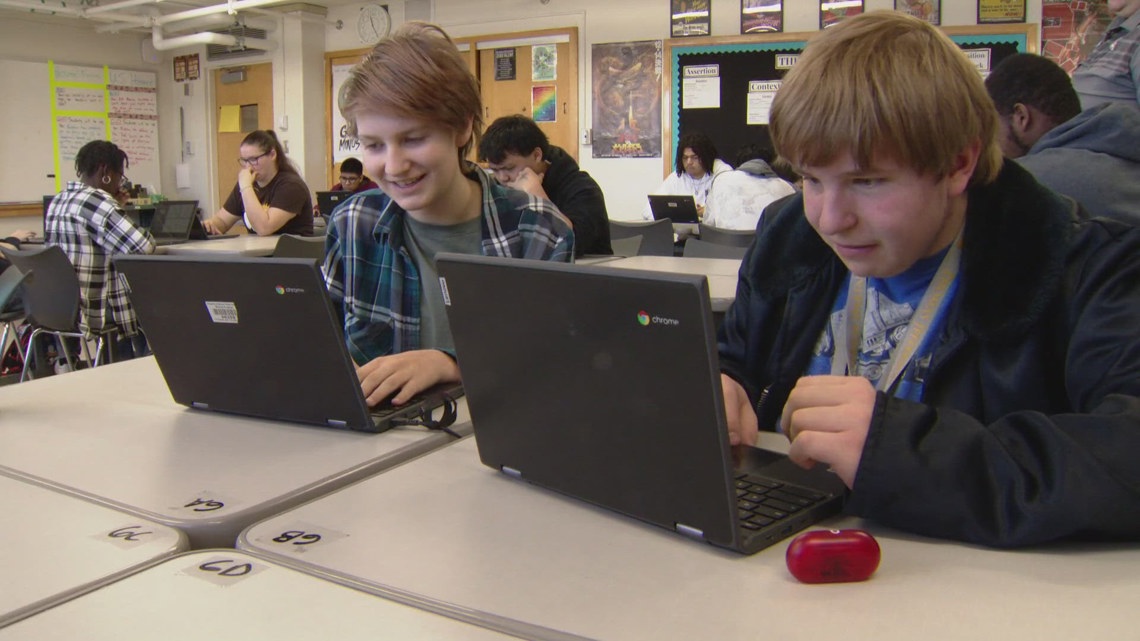

Money Smarts Mandate: State Poised to Require Financial Know-How for Diplomas

Finance

2025-02-26 23:46:00

Colorado lawmakers are taking a proactive step to empower high school students with essential financial literacy skills. A bipartisan group of legislators is championing a new initiative aimed at ensuring teenagers graduate with a solid understanding of personal finance, preparing them for real-world financial challenges. The proposed measure would require high schools across Colorado to incorporate comprehensive financial education into their curriculum. This groundbreaking approach recognizes that understanding money management, budgeting, investing, and financial decision-making are crucial life skills that extend far beyond the classroom. By mandating financial literacy courses, lawmakers hope to equip young adults with the knowledge needed to make informed financial choices, avoid common money pitfalls, and build a strong foundation for future economic success. From understanding credit scores to learning about savings and investments, students will gain practical insights that can help them navigate the complex financial landscape of adulthood. This bipartisan effort demonstrates a commitment to preparing Colorado's youth for financial independence and responsible money management, ensuring they are well-equipped to face economic challenges with confidence and competence. MORE...

Steady Yields Ahead: NexPoint's Dividend Strategy Unveiled for Income Seekers

Finance

2025-02-26 23:00:00

New Residential Investment Corp (NREF) continues its commitment to shareholder value by announcing its upcoming quarterly dividend distribution. Investors can look forward to receiving a steady $0.50 per share dividend on March 31, 2025, with eligibility determined for stockholders registered as of March 14. This consistent payout underscores the company's dedication to providing a reliable income stream for its shareholders, reinforcing its reputation as a dependable investment vehicle in the real estate investment trust (REIT) sector. MORE...

AI Chip Boom: Nvidia Smashes Expectations with Blockbuster Q4 Sales

Finance

2025-02-26 21:48:23

Nvidia Soars to New Heights with AI Chip Breakthrough In a stunning display of technological prowess, Nvidia has once again demonstrated its dominance in the artificial intelligence semiconductor market. The company reported an extraordinary surge in fourth-quarter profits, driven by unprecedented demand for its cutting-edge Blackwell chips that are revolutionizing AI capabilities. For the quarter ending January 26th, Nvidia delivered a remarkable financial performance, generating a staggering $39.3 billion in revenue. This represents an impressive 12% increase from the previous quarter and a jaw-dropping 78% jump compared to the same period last year. Nvidia's founder, Jensen Huang, eloquently captured the excitement surrounding their latest innovation, stating, "The demand for Blackwell is nothing short of phenomenal. We're witnessing a transformative moment in AI, where increased computational power is directly translating to more intelligent and sophisticated reasoning systems." The Blackwell chips are not just another technological advancement; they represent a quantum leap in AI computing, enabling more complex and nuanced artificial intelligence applications across various industries. As AI continues to reshape our technological landscape, Nvidia stands at the forefront of this revolutionary wave. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165