Wall Street Meets Academia: MIT Guru Set to Supercharge Charles River Associates' Strategic Edge

Finance

2025-02-26 13:30:00

CRA International Bolsters Financial Expertise with Renowned MIT Professor's Appointment CRA International has strategically enhanced its financial dispute and corporate finance capabilities by bringing aboard Professor Christopher Palmer from the Massachusetts Institute of Technology (MIT). Palmer, a distinguished expert known for his sophisticated market research and expert witness experience, represents a significant addition to the firm's intellectual capital. With his deep academic background and specialized knowledge, Professor Palmer is expected to provide cutting-edge insights and analytical depth to CRA's financial consulting practice. His appointment underscores the firm's commitment to maintaining a high-caliber team of professionals who can navigate complex financial landscapes and deliver nuanced strategic guidance. Palmer's expertise is anticipated to strengthen CRA's ability to provide comprehensive financial analysis, dispute resolution, and corporate finance strategies across various industry sectors. His research-driven approach and academic credentials will likely elevate the firm's consulting capabilities and reinforce its reputation for excellence. MORE...

Tuition Dollars, Moral Dilemmas: NYU Students Confront Trustees Over Controversial Investments

Finance

2025-02-26 13:02:08

Tensions flared at New York University on Tuesday as approximately 20 passionate student protesters gathered outside the Finance Committee meeting, staging a powerful demonstration calling for the university to sever financial ties with companies linked to Israel. The protest, strategically timed during delicate ceasefire negotiations between Israel and Hamas in the ongoing Gaza conflict, was meticulously organized by NYU's Students for Justice in Palestine chapter. The demonstrators, united in their mission, stood resolute in their demand for institutional divestment, transforming the university's hallways into a platform for expressing their deep concerns about the humanitarian crisis in Gaza. Their presence underscored the growing student activism and commitment to using economic pressure as a tool for advocating political change. With signs raised and voices strong, the protesters sought to draw attention to the broader implications of NYU's financial investments and their potential connection to the ongoing conflict. Their peaceful picket represented a significant moment of campus political engagement, highlighting the role of young activists in challenging institutional financial practices. MORE...

Breaking: CIBC Clinches Top Global Investment Banking Crown in Prestigious Global Finance Rankings

Finance

2025-02-26 13:00:00

CIBC Shines Again: Recognized as Canada's Top Investment Bank and Sustainability Leader

CIBC has once again demonstrated its exceptional prowess in the financial world, securing the prestigious title of Best Investment Bank in Canada for the third consecutive year. The global financial publication Global Finance has honored the bank not only for its outstanding investment banking capabilities but also for its remarkable commitment to environmental and social sustainability.

In the Global Finance World's Best Investment Bank and Sustainable Finance Awards for 2025, CIBC stood out for its innovative approach to supporting clients' sustainability goals. The bank's strategic vision and dedication to responsible financial practices have set a new standard in the Canadian banking landscape.

This recognition underscores CIBC's ongoing efforts to blend financial excellence with meaningful environmental and social impact, positioning the bank as a forward-thinking leader in the industry.

MORE...Financial Shake-Up: OpenText Taps Chadwick Westlake as New CFO to Drive Strategic Growth

Finance

2025-02-26 13:00:00

OpenText™ Elevates Chadwick Westlake to Executive Leadership Role OpenText (NASDAQ: OTEX, TSX: OTEX) has announced a significant leadership appointment, naming Chadwick Westlake as the company's new Executive Vice President and Chief Financial Officer. The strategic move is set to take effect in March, marking an important milestone in the company's executive management structure. Westlake's appointment comes at a pivotal moment for OpenText, signaling the organization's commitment to strong financial leadership and strategic growth. As the incoming CFO, he is expected to bring fresh insights and expertise to the company's financial operations and strategic planning. The leadership transition underscores OpenText's ongoing efforts to maintain its competitive edge in the technology sector by bringing top-tier talent into key executive positions. Westlake's background and experience are anticipated to play a crucial role in driving the company's financial strategy and supporting its continued innovation and market expansion. MORE...

Dark Money, Darker Democracy: How Global Financial Shadows Threaten Free Societies

Finance

2025-02-26 12:56:50

My journey into investigating financial crime is a story of transformation, sparked by a pivotal moment in recent history. Those curious about the origins of my professional path can view my keynote address at the Royal United Services Institute FinSec conference, where I candidly share my personal narrative.

The catalyst for my professional pivot was the Ukrainian Maidan revolution of 2014 - a watershed moment that fundamentally reshaped my understanding of global dynamics and systemic corruption. What began as writing about diverse topics evolved into a passionate commitment to exposing the intricate networks of financial misconduct.

This unexpected transformation was not merely a career shift, but a profound awakening to the complex ways financial systems can be manipulated, obscured, and exploited. The events in Ukraine revealed to me the deep interconnections between political upheaval, economic instability, and the shadowy world of financial crime.

My work now focuses on unraveling these complex narratives, bringing transparency to systems often designed to remain opaque, and shedding light on the mechanisms that enable financial malfeasance on both local and global scales.

MORE...Diplomatic Absence: US Sidelines Itself as G20 Financial Powerhouses Converge in South Africa

Finance

2025-02-26 12:48:04

Cape Town Becomes Global Financial Hub as G20 Leaders Converge for Critical Economic Talks The picturesque city of Cape Town is buzzing with economic anticipation as finance ministers and central bank governors from the world's most influential economies gather for a pivotal two-day summit. Representatives from the Group of 20 (G20) nations have descended upon South Africa's legislative capital to engage in high-stakes discussions that could shape global economic strategies. This landmark meeting brings together financial leaders from both developed and emerging economies, signaling a critical moment for international economic cooperation. Against the backdrop of Cape Town's stunning landscape, these key decision-makers are set to address pressing global financial challenges, potential collaborative solutions, and strategies for sustainable economic growth. The summit represents a unique opportunity for nations to align their economic perspectives, negotiate complex financial policies, and explore innovative approaches to addressing worldwide economic uncertainties. With tensions and economic disparities continuing to challenge global markets, this G20 meeting holds significant potential for meaningful dialogue and strategic planning. As discussions unfold, the world watches closely, anticipating potential breakthrough agreements and insights that could influence international economic dynamics in the coming months and years. MORE...

Earnings Spotlight: Chicago Atlantic Real Estate Finance Reveals Q4 Financial Insights Next Month

Finance

2025-02-26 12:00:00

Chicago Atlantic Real Estate Finance Prepares to Unveil Q4 2024 Financial Results

Chicago Atlantic Real Estate Finance, Inc. (NASDAQ: REFI), a prominent commercial mortgage real estate investment trust, is set to release its comprehensive financial performance for the fourth quarter and full year ending December 31, 2024.

The company has strategically scheduled its earnings release and detailed supplemental financial information to be published before market opening on Wednesday, March 12, 2025. Following the release, Chicago Atlantic will host an interactive conference call and live audio webcast to provide investors and analysts with deeper insights into their financial achievements.

Investors and interested parties are encouraged to stay tuned for this important financial disclosure, which will offer a comprehensive overview of the company's performance and strategic positioning in the real estate investment landscape.

Additional details regarding the conference call and webcast will be announced in the upcoming earnings release.

MORE...Cannabis REIT's Financial Reveal: REFI's Q4 Earnings Countdown Begins

Finance

2025-02-26 12:00:00

Investors and financial analysts, mark your calendars! Refinitiv (REFI) is set to unveil its fourth-quarter and full-year 2024 financial results on March 12, 2025. The company will release its comprehensive financial report before the market opens, followed by an informative conference call and live webcast at 9:00 a.m. Eastern Time. This upcoming earnings announcement promises to provide valuable insights into the company's performance, strategic initiatives, and financial health for the past quarter and the entire year. Stakeholders and market watchers are encouraged to tune in and gain a deeper understanding of Refinitiv's recent business developments. MORE...

Global Trade Tremors: How Tit-for-Tat Tariffs Threaten to Unravel $9.7 Trillion Financial Lifeline

Finance

2025-02-26 11:53:41

The global banking landscape is undergoing a seismic transformation, buffeted by a series of unprecedented challenges that have tested the resilience of financial institutions worldwide. From the devastating aftershocks of the 2008 financial crisis to the unprecedented economic disruption caused by the Covid-19 pandemic, banks have been navigating treacherous waters. Now, a new potential game-changer emerges on the horizon: the escalating tensions surrounding international trade policies and the growing trend of reciprocal tariffs. These protectionist measures are not merely economic footnotes, but powerful forces that threaten to fundamentally reshape the intricate web of global financial interactions. As nations increasingly prioritize domestic economic interests, the traditional frameworks of international banking and trade are being challenged, forcing financial institutions to adapt to an increasingly complex and unpredictable global environment. The implications are far-reaching, potentially redrawing economic boundaries and compelling banks to develop more agile, strategic approaches to navigate this volatile landscape. What was once a relatively stable global banking ecosystem is now a dynamic arena of constant adaptation and strategic recalibration. MORE...

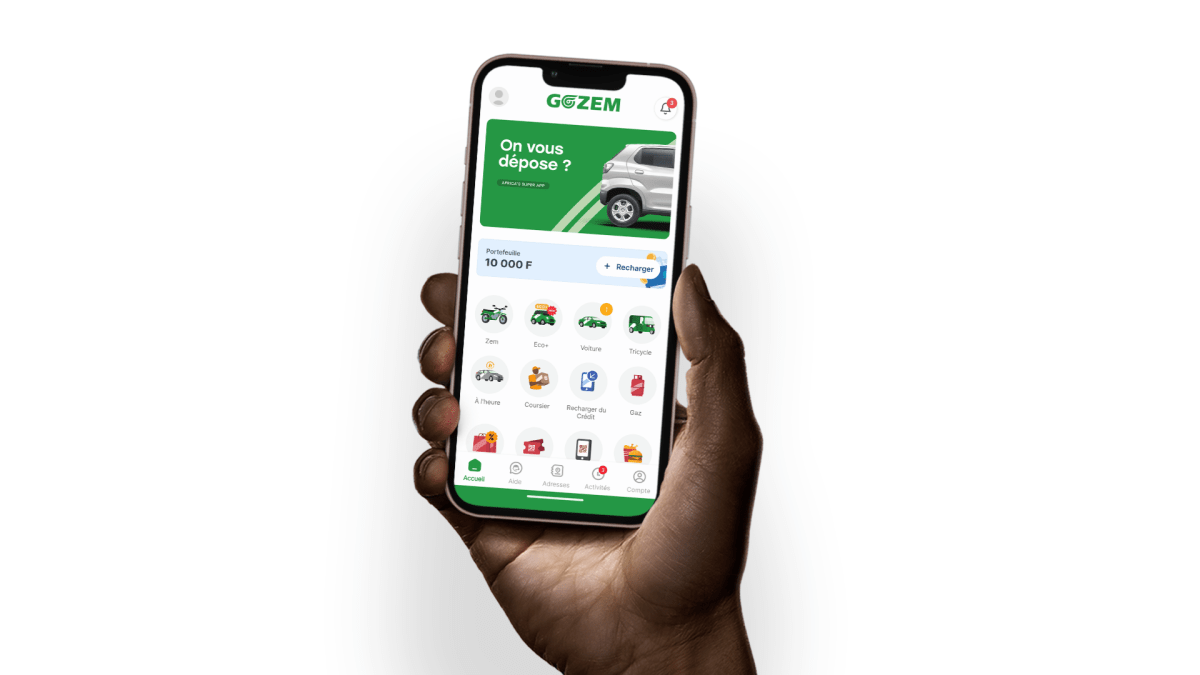

Gozem Drives Financial Innovation: $30M Boost Transforms Mobility and Banking in Francophone Africa

Finance

2025-02-26 10:36:38

Gozem, the innovative mobility platform transforming transportation across Francophone Africa, has just secured a significant $30 million Series B funding round, marking another milestone in its ambitious expansion strategy. What began as a ride-hailing service has rapidly evolved into a comprehensive super app, demonstrating the company's remarkable growth and adaptability in the competitive African tech landscape. The latest investment signals strong investor confidence in Gozem's vision to become a multi-service digital ecosystem. By strategically expanding beyond traditional ride-sharing, the company has successfully integrated services like delivery, e-commerce, and financial solutions, creating a one-stop platform for users across multiple West and Central African markets. Since its inception, Gozem has been reimagining urban mobility in Francophone Africa, addressing critical transportation challenges while simultaneously providing economic opportunities for local drivers and entrepreneurs. The new funding is expected to accelerate the company's technological innovation, geographic expansion, and service diversification. With this substantial Series B round, Gozem is poised to further solidify its position as a leading digital platform, connecting millions of users and transforming the way people move, shop, and access services in the region. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165