Billion-Dollar Blunder: S.C. Digs Deeper into Financial Maze

Finance

2025-02-19 03:25:05

The investigation into South Carolina's staggering $1.8 billion financial mystery is far from over, according to state lawmakers. Determined to unravel the complex financial puzzle, legislators are committed to pursuing a thorough examination and identifying appropriate accountability measures. The ongoing probe continues to captivate public attention, with lawmakers signaling that they are not content to simply brush the issue aside. They are meticulously working to understand the full scope of the financial discrepancy and ensure that any potential misconduct or systemic failures are thoroughly addressed. While details remain limited, the lawmakers' persistence suggests that the investigation will leave no stone unturned. Their dedication reflects a commitment to transparency and fiscal responsibility, promising to shed light on this significant financial enigma that has raised numerous questions among South Carolina residents. The investigation represents a critical effort to protect public funds and maintain the integrity of the state's financial systems, with lawmakers promising to keep the public informed as their work progresses. MORE...

Market Pulse: 5 Stocks Poised to Surge in February's Final Trading Week

Finance

2025-02-19 02:17:00

Market Insights: Top Stock Picks for Savvy Investors

In the dynamic world of stock market investing, strategic recommendations can be a game-changer for investors seeking promising opportunities. Mehul Kothari from Anand Rathi Shares and Stock Brokers has shared compelling insights into three stocks that show significant potential for growth.

Recommended Stocks to Watch

1. ONGC: Energy Sector Opportunity

Oil and Natural Gas Corporation (ONGC) emerges as an attractive investment option. With its strong market presence in the energy sector, the stock presents a promising opportunity for investors looking to diversify their portfolio with a robust energy company.

2. Tata Motors: Automotive Potential

Tata Motors stands out as another compelling stock pick. The company's innovative approach and expanding market reach make it an intriguing choice for investors seeking exposure to the automotive industry's dynamic landscape.

3. Sundaram Finance: Financial Sector Strength

Rounding out the recommendations is Sundaram Finance, a solid performer in the financial services sector. The stock offers investors a chance to tap into the potential of a well-established financial institution with a track record of stability.

Disclaimer: Investors are advised to conduct their own research and consult financial experts before making any investment decisions. Market conditions can change rapidly, and past performance does not guarantee future results.

MORE...Stalemate Erupts: Lawmaker Pay Raise Proposal Hits Senate Finance Roadblock

Finance

2025-02-19 01:15:00

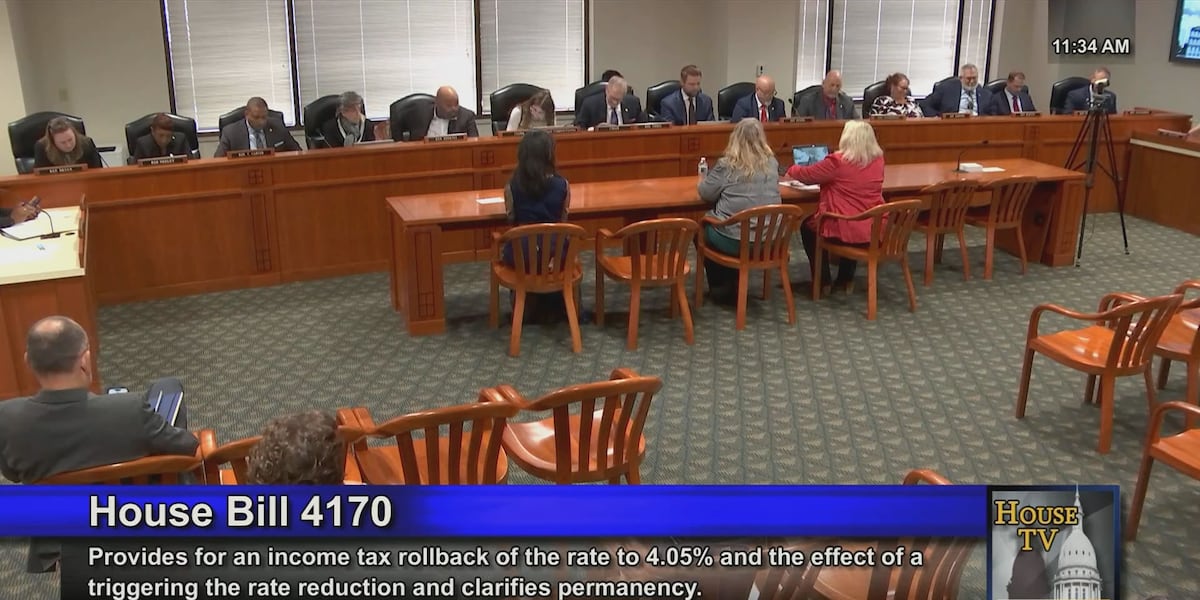

In a dramatic turn of events, the influential legislative committee deadlocked on a critical constitutional amendment, with the vote ending in a surprising 5-5 split. The unexpected outcome came when two Democratic members unexpectedly aligned with three Republican colleagues, effectively throwing the proposed legislation into uncertainty and potentially derailing its path forward. This razor-thin margin has created significant political tension, casting doubt on the amendment's future and highlighting the deep divisions within the committee. The unexpected cross-party collaboration has shocked political observers and may signal a complex negotiation process ahead for the proposed constitutional change. MORE...

Wall Street Awakens: Futures Climb as Markets Reach Uncharted Heights

Finance

2025-02-19 01:14:08

Building on the S&P 500's historic record close, market momentum continued to surge in after-hours trading, with stocks maintaining a steady upward trajectory. Investors remained optimistic as the market demonstrated resilience and sustained positive sentiment following the benchmark index's impressive performance. The after-market movement reflected growing confidence among traders, who saw the continued gains as a promising sign of underlying economic strength. Traders and analysts alike watched closely as individual stocks built upon the day's earlier momentum, signaling potential continued growth in the near term. This sustained positive trend suggests that market participants are feeling increasingly bullish about the current economic landscape, with expectations of further potential gains in the coming sessions. The consistent performance across various sectors underscores the market's current robust and dynamic nature. MORE...

Wall Street's Spotlight: TRTX Earnings Reveal Surprising Financial Landscape

Finance

2025-02-19 00:30:05

Diving Deep into TPG RE Finance Trust's Quarterly Performance Investors and market watchers are taking a closer look at TPG RE Finance Trust (TRTX) to understand its recent financial trajectory. While revenue and earnings per share (EPS) provide a snapshot of the company's performance for the quarter ending December 2024, a comprehensive analysis requires a nuanced comparison with Wall Street expectations and previous year benchmarks. The financial metrics reveal more than just numbers—they tell a story of the company's strategic positioning, market adaptability, and potential future growth. By examining how current results stack up against analyst predictions and historical performance, investors can gain valuable insights into TRTX's financial health and market potential. Comparing quarter-over-quarter and year-over-year data offers a more holistic view of the company's progress, highlighting trends, challenges, and opportunities that raw figures alone might not immediately illuminate. Savvy investors know that context is key when evaluating financial performance. Stay tuned for a detailed breakdown of TPG RE Finance Trust's latest financial results and what they might signal for the company's future. MORE...

Warehouse Real Estate Giant Dream Industrial REIT Crushes Q4 Expectations, Signals Robust Growth Ahead

Finance

2025-02-19 00:11:00

Dream Industrial Real Estate Investment Trust Reveals Strong Financial Performance for 2024 Toronto, February 19, 2025 - Dream Industrial Real Estate Investment Trust (DIR.UN-TSX) is set to share its comprehensive financial results for the fourth quarter and full year of 2024. The company will host an investor conference call to provide detailed insights into its financial performance. Investors and financial analysts are invited to join the conference call on February 19, 2025, at 11:00 a.m. Eastern Time, where management will break down the key financial highlights and strategic developments of the past year. The Trust, known for its robust industrial real estate portfolio, continues to demonstrate resilience and strategic growth in a dynamic market landscape. Detailed financial statements will offer a transparent view of the company's operational achievements and financial health. Stay tuned for comprehensive insights into Dream Industrial REIT's performance and future outlook. MORE...

Wall Street Stumbles: TPG RE Finance Trust Falls Short in Q4 Financial Performance

Finance

2025-02-18 23:55:03

TPG RE Finance Trust (TRTX) recently unveiled its quarterly financial performance, and the numbers are sparking investor curiosity. The company reported a significant earnings surprise of -64.29%, which fell short of market expectations, alongside a more promising revenue increase of 12% for the quarter ending December 2024. These mixed financial signals are prompting investors to dig deeper and assess the potential trajectory of TRTX's stock. The substantial earnings miss could be a red flag, suggesting potential challenges in the company's operational efficiency or market positioning. Conversely, the 12% revenue growth indicates some underlying strength and resilience in the company's core business model. Investors and analysts are now closely examining these results to understand whether this is a temporary setback or a sign of more profound structural issues. The stark contrast between revenue growth and earnings performance underscores the complexity of TRTX's current financial landscape. While the numbers alone don't tell the complete story, they certainly provide valuable insights into the company's short-term financial health and potential future performance. Careful monitoring of subsequent quarters will be crucial in determining whether TPG RE Finance Trust can overcome its earnings challenges and capitalize on its revenue momentum. MORE...

Tech Titans Clash: Meta's Comeback Sparks Wall Street's Record-Breaking Rally

Finance

2025-02-18 23:02:55

Market Domination Overtime: Unpacking Wall Street's Latest Moves

In the latest episode of Market Domination Overtime, hosts Julie Hyman and Alexandra Canal dive deep into the current market landscape, bringing viewers cutting-edge insights and expert perspectives.

Carson Group's chief market strategist Ryan Detrick takes center stage, breaking down the S&P 500's impressive record-breaking close. He offers a nuanced analysis of the market's current dynamics, addressing critical challenges including valuation concerns and the ongoing impact of trade policies.

Adding depth to the discussion, Yahoo Finance's Washington Correspondent Ben Werschkul and Senior Columnist Rick Newman explore the Department of Government Efficiency's (DOGE) strategic initiative to enhance federal data accessibility.

For those hungry for more in-depth market analysis and expert commentary, don't miss additional segments of Market Domination Overtime. Stay informed, stay ahead.

MORE...Dividend Dynamos: SinoPac Financial's Winning Strategy Unveiled

Finance

2025-02-18 23:02:25

Navigating Market Uncertainty: The Rising Appeal of Dividend Stocks In today's turbulent financial landscape, investors are increasingly turning to a strategic approach that offers both stability and steady income: dividend stocks. As U.S. inflation accelerates and major stock indexes hover near record-breaking levels, savvy investors are seeking refuge in companies that provide consistent financial returns. Amidst the market's unpredictable waves, dividend-paying stocks like SinoPac Financial Holdings emerge as beacons of financial resilience. These investments offer a compelling proposition for those looking to balance potential growth with reliable income streams. By focusing on companies with strong dividend histories, investors can create a more robust and predictable portfolio that weathers market volatility. The current economic climate demands a nuanced investment strategy. Dividend stocks represent more than just a passive income source; they signal a company's financial health, stability, and commitment to shareholder value. For investors seeking to mitigate risk while maintaining potential for appreciation, these stocks provide an attractive alternative to more speculative investment approaches. As global markets continue to evolve, the importance of strategic, income-generating investments becomes increasingly clear. Dividend stocks stand out as a smart choice for those looking to build a resilient and dynamic investment portfolio. MORE...

Real Estate Finance Giant TPG Reveals Q4 Performance: Investors Take Note

Finance

2025-02-18 22:55:20

NEW YORK - TPG RE Finance Trust Inc. (TRTX) unveiled its latest financial performance on Tuesday, offering investors a comprehensive look at the company's recent quarterly results. The real estate investment trust provided a detailed breakdown of its financial standing, highlighting key metrics and strategic developments. The company's financial report offers insights into its current market position and ongoing business strategies. Investors and market analysts are closely examining the details to understand the trust's performance and potential future trajectory. While specific numerical details were not provided in the original brief, the announcement signals TPG RE Finance Trust's continued engagement with its financial reporting and commitment to transparency in its operations. The report comes at a time of ongoing market fluctuations, making such financial disclosures crucial for stakeholders seeking to understand the company's financial health and strategic direction. Investors and financial professionals are encouraged to review the full detailed report for a comprehensive understanding of the company's current financial status. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165