Budget Battle in Greenwich: Finance Team Proposes Radical Cuts, Ice Rink Project on the Chopping Block

Finance

2025-03-06 10:00:00

I apologize, but you haven't provided the original article text that you want me to rewrite. Without the original content, I can't generate a fluent and engaging rewrite. Could you please share the full text of the article you'd like me to work on? Once you provide the original text, I'll be happy to help you rewrite it in an engaging manner and format it within HTML body tags. MORE...

Climate Breakthrough: UK Backs South Africa's Green Transition Despite US Withdrawal

Finance

2025-03-06 09:33:22

The landmark $9.3 billion climate partnership with South Africa is set to continue full steam ahead, despite the United States' withdrawal, according to the United Kingdom's climate envoy. The international collaboration, designed to support South Africa's transition to cleaner energy sources, remains robust with committed global partners. The ambitious deal, which represents a significant milestone in global climate cooperation, will proceed with unwavering determination. Other participating nations are signaling their continued support and commitment to helping South Africa transform its energy landscape, demonstrating a united front in addressing climate change challenges. By maintaining momentum on this critical initiative, the international community is showcasing its resilience and dedication to sustainable development. The partnership aims to help South Africa reduce its carbon emissions while simultaneously supporting economic transformation and creating green job opportunities. The UK's climate envoy emphasized that the withdrawal of one partner would not derail the broader strategic objectives of this groundbreaking climate transition project. The remaining countries involved remain steadfast in their commitment to supporting South Africa's green energy evolution. This development underscores the global commitment to collaborative climate action and the importance of international partnerships in addressing environmental challenges. MORE...

From Theory to Triumph: How Fama and Booth Revolutionized Financial Thinking

Finance

2025-03-06 09:00:01

In the dynamic world of financial theory, few concepts have been as transformative and controversial as the Efficient Market Hypothesis (EMH). Pioneered by Eugene Fama in the 1960s, this groundbreaking theory fundamentally challenged how investors and economists understand market behavior. Imagine a financial landscape where every piece of available information is instantly reflected in stock prices. This is the core premise of the Efficient Market Hypothesis. Fama proposed that markets are inherently rational, with stock prices always representing their true intrinsic value based on all known information. The hypothesis emerged from Fama's doctoral research at the University of Chicago, where he meticulously analyzed stock market patterns. His revolutionary work suggested that trying to consistently "beat the market" through stock picking or timing was essentially futile. According to EMH, markets are so efficient that no investor can systematically outperform them through skill alone. Fama's theory is typically divided into three forms: weak, semi-strong, and strong. The weak form suggests that past price movements cannot predict future prices. The semi-strong form argues that publicly available information is immediately incorporated into stock prices. The strong form claims that even insider information is reflected in market prices. While controversial, the Efficient Market Hypothesis profoundly influenced investment strategies, academic research, and financial regulations. It paved the way for index investing and challenged traditional approaches to stock market analysis. Though not without critics, Fama's hypothesis remains a cornerstone of modern financial economics, continuing to spark debate and inspire further research into market dynamics. MORE...

Market Pulse: FTSE 100 Trembles as Pound Surges and ECB Rate Decision Looms

Finance

2025-03-06 08:59:27

Global automotive manufacturers breathed a collective sigh of relief as President Trump signaled a potential easing of international trade tensions. The automotive industry, which has been navigating a complex landscape of tariffs and trade negotiations, saw immediate positive reactions across international markets. Automakers from Detroit to Tokyo quickly responded to the unexpected development, with stock prices climbing and industry leaders expressing cautious optimism. The potential reduction in trade barriers promises to alleviate some of the economic pressures that have been weighing heavily on the global automotive sector in recent months. Executives from major car manufacturers gathered to discuss the implications of this potential trade breakthrough, seeing it as a potential turning point in international economic relations. The news represents a welcome respite from the ongoing trade uncertainties that have challenged the industry's global supply chains and strategic planning. While details remain to be finalized, the automotive world is viewing this moment as a potential catalyst for renewed international cooperation and economic growth. Manufacturers are now eagerly anticipating the full details of the proposed tariff reductions and their potential impact on global trade. MORE...

Trade Tensions Ease: Trump Considers Agricultural Lifeline Amid Auto Tariff Standoff

Finance

2025-03-06 08:42:29

Trump's Tariff Saga: A Comprehensive Timeline of Trade Tensions

In the complex world of international trade, few topics have been as controversial and impactful as former President Donald Trump's tariff policies. Yahoo Finance brings you an in-depth exploration of the dramatic trade battles that reshaped global economic relationships during his administration.

The Tariff Strategy Unveiled

Trump's approach to international trade was anything but conventional. From the moment he entered office, he signaled a dramatic shift in America's trade strategy, targeting countries like China, Mexico, and Canada with unprecedented tariff measures. These weren't just economic policies; they were bold political statements that sent shockwaves through global markets.

Key Highlights of the Tariff Landscape

- China Trade War: Massive tariffs targeting hundreds of billions in Chinese goods

- Steel and Aluminum Tariffs: Global levies that challenged international trade norms

- USMCA Negotiations: Reworking trade agreements with key North American partners

Each tariff announcement became a high-stakes game of economic chess, with immediate ripple effects on stock markets, international relations, and domestic industries. Businesses, economists, and politicians watched closely as each new policy unfolded.

The Economic Impact

While supporters praised Trump's aggressive trade stance as protecting American jobs and industries, critics argued that the tariffs ultimately increased costs for consumers and created uncertainty in global markets. The real-world consequences were complex and far-reaching.

Stay tuned to Yahoo Finance for the most up-to-date and comprehensive coverage of these transformative trade policies that continue to shape our economic landscape.

MORE...China's Financial Firepower: Minister Signals Robust Economic Defense Strategy

Finance

2025-03-06 08:33:58

Keeping options open, he signals potential for additional economic stimulus measures, demonstrating a flexible approach to addressing potential economic challenges. By maintaining strategic flexibility, he remains prepared to deploy further financial interventions if market conditions warrant. MORE...

Green Finance Revolution: Global Business Titans Unite to Reshape Sustainable Investment

Finance

2025-03-06 08:00:00

In a significant collaborative effort, the United Nations Global Compact (UNGC) and Principles for Responsible Investment (PRI) recently hosted a pivotal Executive Roundtable, bringing together top-tier leaders to address critical global sustainability challenges. The high-profile gathering united influential decision-makers from across industries to explore innovative strategies for advancing responsible business practices and sustainable development. The roundtable served as a dynamic platform for meaningful dialogue, enabling executives to share insights, discuss emerging trends, and develop actionable approaches to integrating environmental, social, and governance (ESG) principles into corporate strategies. Participants engaged in robust discussions about the evolving landscape of responsible investment and the crucial role of private sector leadership in driving positive global change. By fostering collaboration and knowledge exchange, the event underscored the growing importance of sustainable business models and the collective responsibility of corporate leaders in addressing pressing global challenges. The UNGC and PRI continue to play a transformative role in promoting responsible business practices and encouraging meaningful corporate engagement with sustainability goals. MORE...

Fiscal Firepower: China Poised to Unleash Economic Stimulus Amid Global Turbulence

Finance

2025-03-06 07:49:01

In the face of mounting economic challenges, China's Finance Minister Lan Fo'an signaled the country's readiness to leverage fiscal policy as a powerful tool to navigate both domestic and international uncertainties. Speaking to reporters on Thursday, Lan emphasized that the government has substantial flexibility to implement strategic financial measures to support economic stability and growth. The minister's comments come at a critical time when China's economy is grappling with complex internal and external pressures. By highlighting the potential for fiscal policy interventions, Lan is sending a clear message that the government remains proactive and prepared to take decisive action to bolster economic resilience. With a comprehensive approach to economic management, China is positioning itself to address potential headwinds through targeted fiscal strategies that can stimulate economic activity, support key industries, and maintain overall economic momentum. The government's willingness to use fiscal policy as a dynamic instrument underscores its commitment to maintaining economic stability in an increasingly unpredictable global landscape. MORE...

Breaking: First National Financial Surges with Robust Q4 Performance, Defies Market Expectations

Finance

2025-03-06 07:09:57

First National Financial Corp Defies Market Headwinds with Impressive Mortgage Performance In a testament to its resilience and strategic positioning, First National Financial Corp (FNLIF) has demonstrated remarkable strength in the current complex financial landscape. Despite the challenging interest rate environment that has been testing many financial institutions, the company has achieved a significant milestone with robust mortgage originations and a record-breaking increase in mortgage administration. The company's ability to navigate through turbulent market conditions highlights its operational expertise and adaptability. By maintaining a strong focus on mortgage lending and administration, First National Financial Corp has not only weathered the economic challenges but has also positioned itself as a standout performer in the competitive financial services sector. Investors and market analysts are taking note of the company's impressive performance, which underscores its strategic approach to managing market fluctuations and continuing to deliver value in an uncertain economic climate. MORE...

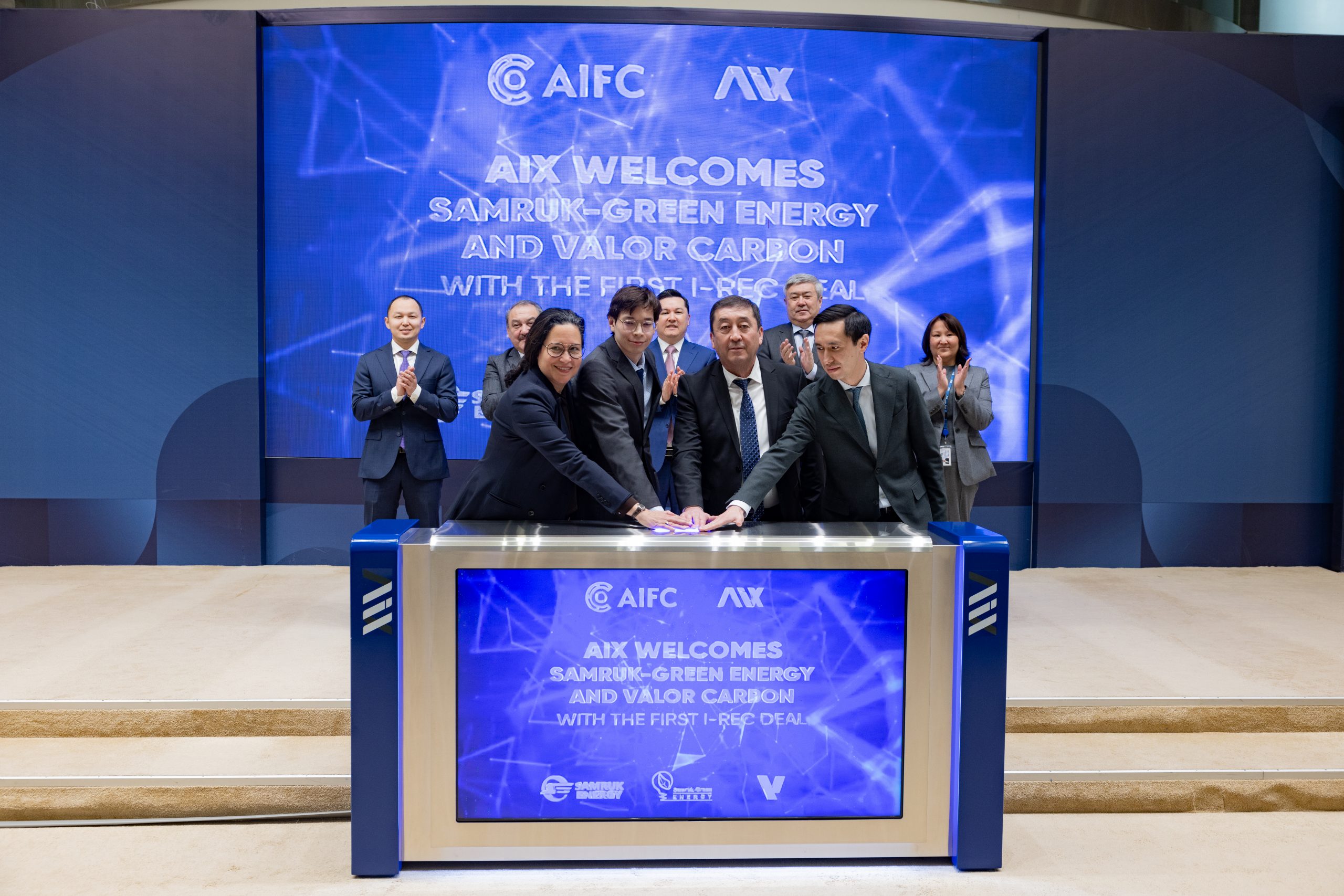

Green Energy Revolution: AIX Launches Renewable Certificates Trading Platform

Finance

2025-03-06 07:00:21

AIX Launches Innovative Platform for Renewable Energy Certificates, Pioneering Green Financial Solutions The Astana International Exchange (AIX) has taken a significant step forward in sustainable finance by introducing trading of renewable energy certificates, marking a groundbreaking moment for green energy markets in Kazakhstan and beyond. This strategic initiative aims to revolutionize how renewable energy is tracked, traded, and valued, providing a transparent and efficient mechanism for companies and investors to support clean energy development. By creating a dedicated marketplace for renewable energy certificates, AIX is empowering organizations to demonstrate their commitment to environmental sustainability and carbon reduction. The new trading platform enables businesses to purchase verified renewable energy certificates, which represent the environmental attributes of electricity generated from renewable sources like solar, wind, and hydroelectric power. Each certificate confirms that a specific amount of clean energy has been produced and introduced into the power grid, allowing companies to offset their carbon footprint and support the transition to a more sustainable energy ecosystem. "This launch represents a critical milestone in our mission to promote green finance and accelerate Kazakhstan's renewable energy sector," said an AIX spokesperson. The exchange's innovative approach is expected to attract both local and international investors interested in supporting sustainable energy infrastructure. By facilitating the trading of renewable energy certificates, AIX is not only creating new financial opportunities but also playing a crucial role in Kazakhstan's broader environmental strategy. The platform is poised to become a key driver in the country's efforts to diversify its energy portfolio and reduce reliance on traditional fossil fuel sources. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165