North Tamil Nadu Becomes Growth Hotspot: Sundaram Home Finance Unveils Aggressive Expansion Strategy

Finance

2025-03-04 17:49:00

Sundaram Home Finance Expands Emerging Business Footprint

Chennai-based Sundaram Home Finance (SHF), a strategic subsidiary of Sundaram Finance, is making significant strides in its growth strategy by inaugurating four new branches dedicated to its emerging business (EB) segment. This expansion demonstrates the company's commitment to broadening its market reach and serving a wider range of customers across different regions.

The newly established branches are strategically positioned to tap into growing market opportunities and provide tailored financial solutions to emerging customer segments. By extending its network, Sundaram Home Finance aims to strengthen its presence and offer more accessible and convenient financial services.

This calculated expansion reflects the company's robust growth plan and its adaptability in meeting the evolving financial needs of diverse customer groups. The move is expected to enhance SHF's competitive edge in the home finance market and support its long-term business objectives.

MORE...Bank Bonanza: Israel's Finance Chief Blasts Government Over Skyrocketing Profits

Finance

2025-03-04 17:07:02

In a bold move challenging Israel's banking sector, Moshe Gafni, the influential head of the parliamentary finance committee, launched a scathing critique of both the government and central bank on Tuesday. Gafni expressed deep concern over commercial banks' soaring profit margins, signaling potential regulatory intervention to curb what he perceives as excessive financial gains. The veteran lawmaker suggested he is prepared to explore various measures to rein in the banking institutions, though specific details remain undisclosed. His comments reflect growing frustration with the current financial landscape, where banks continue to generate substantial earnings while economic pressures mount for ordinary citizens. Gafni's public stance represents a significant challenge to the banking establishment, hinting at possible legislative or regulatory actions that could dramatically reshape the financial sector's operational dynamics. By publicly calling out the government and central bank, he is putting pressure on financial regulators to more closely scrutinize bank profitability and practices. MORE...

Tech Titans Tumble: Why This Financial Maverick Is Catching Investors' Eyes

Finance

2025-03-04 16:54:49

Tradeweb Markets is experiencing a remarkable surge, with its stock price hovering near record-breaking levels as institutional investors eagerly accumulate shares. The financial technology company has caught the attention of fund managers who see significant potential in its current market position. Investors are closely watching the stock's technical formation, which has established a compelling base with a strategic entry point at $141.69. This pattern suggests strong underlying momentum and potential for further growth. The increasing institutional interest signals confidence in Tradeweb's business model and future prospects, driving the stock's upward trajectory. As market dynamics continue to evolve, Tradeweb Markets stands out as an attractive investment opportunity, drawing the keen eye of sophisticated investors seeking robust financial technology stocks with promising growth potential. MORE...

Strategic Coup: BlackRock's Bold Maneuver Secures Critical Panama Canal Infrastructure

Finance

2025-03-04 16:47:21

In a significant strategic move, CK Hutchison Holding, a prominent Hong Kong conglomerate with extensive port operations near the Panama Canal, has announced the sale of its port-related shares to a high-profile investment consortium led by BlackRock Inc. This decision comes in the wake of heightened tensions following President Donald Trump's allegations of potential Chinese interference in the critical shipping lane. The company revealed in a recent filing its intention to divest all shares in Hutchison Port Holdings and Hutchison Port Group Holdings. These two units collectively control an impressive 80% of the Hutchison Ports group, which manages a global network of 43 ports spanning 23 countries. The sale represents a strategic repositioning in response to geopolitical pressures and concerns about international maritime infrastructure. By partnering with BlackRock, CK Hutchison is signaling its commitment to transparency and addressing potential national security concerns while maintaining its significant global port operations. This development underscores the complex interplay between international business, geopolitical tensions, and strategic investment in critical infrastructure sectors. MORE...

Wall Street Sends Stark Warning: Investors Lose Faith in Trump's Economic Vision

Finance

2025-03-04 16:43:13

Market Signals: Economic Expert Reveals Stark Investor Sentiment

In a revealing analysis, Justin Wolfers, a distinguished economics and public policy professor from the University of Michigan, offers critical insights into the current market dynamics and its relationship with the administration's policies.

During an interview with Catalysts hosts Madison Mills and Seana Smith, Wolfers delivered a striking assessment of market confidence. "The U.S. stock market, as measured by the S&P 500, is currently trading at a lower level than it was on the day before the election," he emphasized, highlighting a significant indicator of investor uncertainty.

Wolfers didn't mince words, describing the market's response as "a very sharp vote of no confidence." He further elaborated that historically, presidents have been attentive to financial market signals, and in this case, the markets are sending a clear message of disapproval regarding recent administrative actions.

For those seeking deeper market analysis and expert perspectives, Wolfers recommends exploring additional Catalysts content to gain comprehensive insights into current market trends.

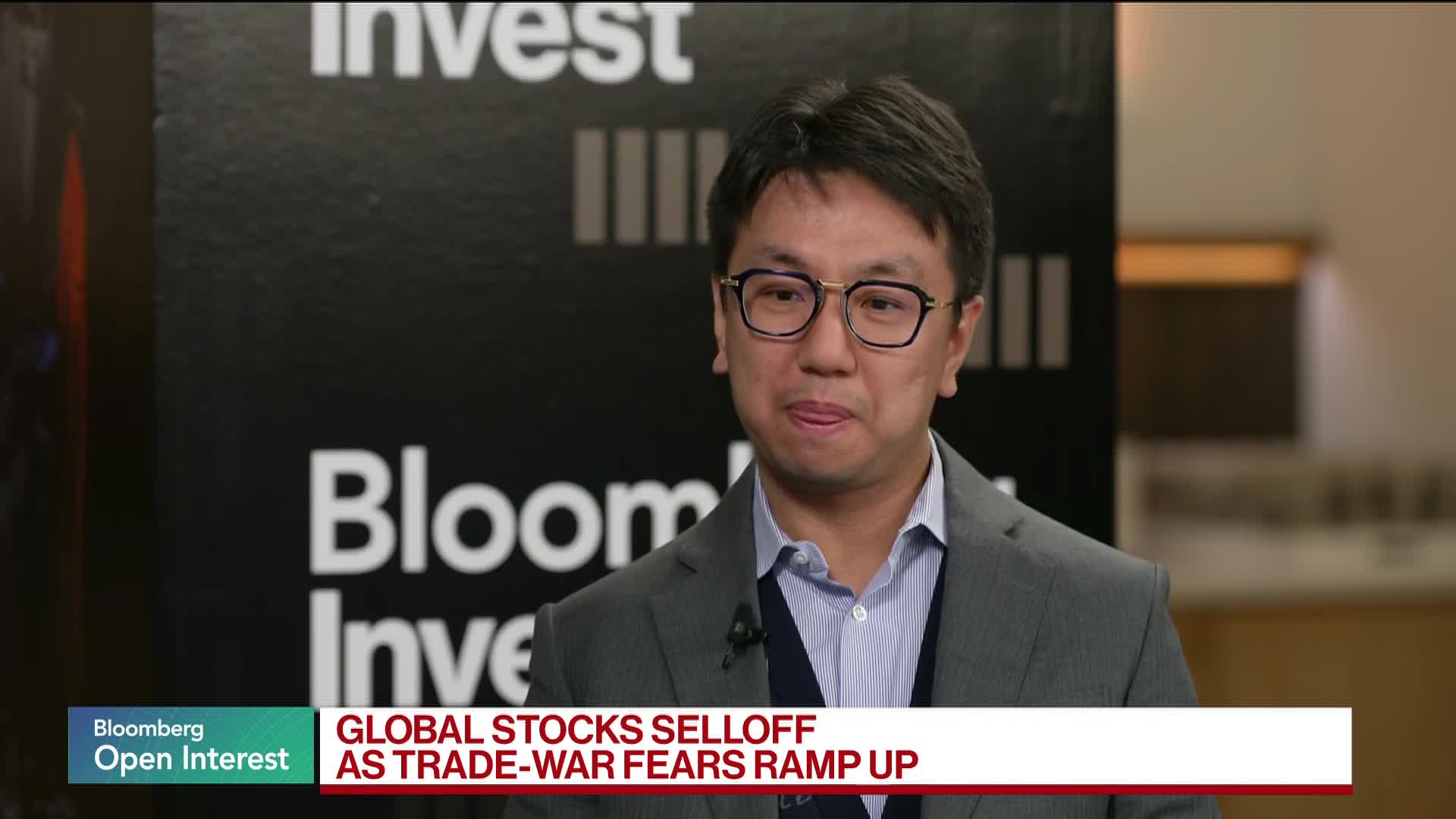

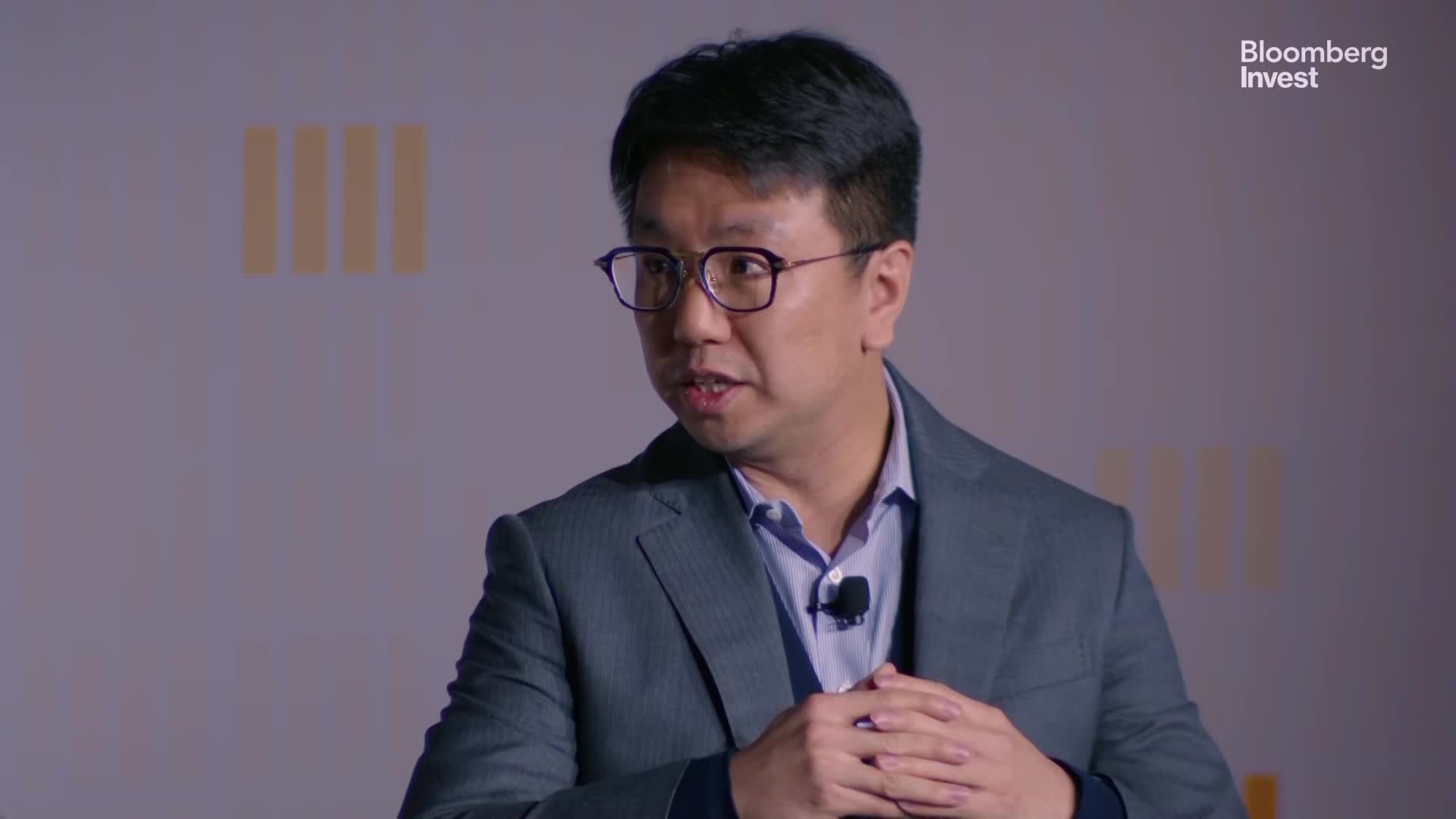

MORE...AI Revolution in Finance: SigTech's Bin Ren Reveals the Future of Investment Technology

Finance

2025-03-04 16:14:46

In a compelling discussion at Bloomberg Invest, Bin Ren, the visionary Founder and CEO of SigTech, delved into the transformative intersection of artificial intelligence and finance alongside Bloomberg's renowned journalists Katie Greifeld and Matt Miller. The conversation illuminated the cutting-edge ways AI is revolutionizing financial technology and investment strategies. Ren, a thought leader in the financial technology space, shared insights into how AI is reshaping traditional financial approaches, offering unprecedented analytical capabilities and innovative solutions for investors and financial professionals. His expertise highlighted the potential of AI to drive more intelligent, data-driven decision-making in an increasingly complex financial landscape. The Bloomberg Invest panel provided a critical platform for exploring the future of finance, with Ren at the forefront of discussing how technological innovation is fundamentally changing the way financial institutions and investors approach market analysis, risk management, and strategic planning. MORE...

Financial Lifeline: How TCW's Leader Spots Gold in Distressed Lending

Finance

2025-03-04 16:14:12

In a compelling statement at the Bloomberg Invest conference in New York, Katie Koch, president and CEO of the TCW Group, highlighted the firm's strategic approach to rescue finance. "We are currently seeing significant opportunities in the rescue finance sector," Koch explained, "and we're deploying unprecedented levels of capital to capitalize on these promising prospects." Her remarks underscore TCW Group's proactive investment strategy, demonstrating the firm's confidence in navigating challenging financial landscapes by strategically allocating resources where others might see risk. MORE...

Financial Survival Guide: 15 Strategic Moves to Protect Your Wealth During Divorce

Finance

2025-03-04 16:00:40

Navigating the Emotional and Practical Landscape of Divorce Divorce is more than just a legal process—it's a life-altering journey that reshapes every aspect of your existence. In an instant, your world can be turned upside down, transforming your relationship status, living situation, and financial foundation. While the path through divorce can seem overwhelming, it doesn't have to be a hopeless experience. With the right mindset, strategic planning, and supportive resources, you can successfully transition through this challenging chapter of your life. The key to weathering this significant life change lies in three critical elements: 1. Education: Understanding the legal and emotional complexities of divorce 2. Strategic Planning: Preparing for practical and financial shifts 3. Personal Resilience: Maintaining emotional strength and forward momentum By approaching divorce with knowledge, preparation, and determination, you can transform a potentially devastating experience into an opportunity for personal growth and renewal. Remember, the end of a marriage isn't the end of your story—it's simply a new beginning waiting to unfold. MORE...

AI and Finance: A Symbiotic Future? SigTech's CEO Reveals the Insider Perspective

Finance

2025-03-04 15:40:56

At Bloomberg Invest, SigTech's visionary Founder and CEO Bin Ren unveiled MAGIC, the company's groundbreaking GenAI product that promises to revolutionize investment strategies. In a compelling conversation with Bloomberg's Tim Stenovec, Ren passionately explored the transformative potential of artificial intelligence in enhancing financial performance and operational efficiency. By highlighting the synergistic relationship between human expertise and AI capabilities, Ren demonstrated how cutting-edge technology can unlock unprecedented levels of insight and innovation in the investment landscape. MORE...

Spring Home Buying Secrets: 5 Money Moves That Could Save You Thousands

Finance

2025-03-04 15:30:08

Spring Home Buying: Your Financial Roadmap to Success Dreaming of owning your first home? The key to a smooth home-buying journey starts with smart financial preparation. This spring, take strategic steps to strengthen your financial foundation and position yourself as a confident, competitive buyer. First, dive deep into your credit score. This three-digit number is your financial passport to homeownership. Request a free credit report, review it carefully, and address any discrepancies. A higher credit score can unlock better mortgage rates and save you thousands over your loan's lifetime. Next, build a robust savings strategy. Aim to accumulate funds for a substantial down payment—ideally 20% to avoid private mortgage insurance. Create a dedicated savings account and automate monthly contributions. Consider cutting discretionary expenses and exploring side hustles to accelerate your savings goal. Budget planning is crucial. Calculate your potential mortgage, property taxes, insurance, and maintenance costs. Use online mortgage calculators to understand what price range aligns with your financial comfort zone. Remember, just because you're approved for a certain amount doesn't mean you should max out your budget. Get pre-approved for a mortgage before house hunting. This not only clarifies your buying power but also demonstrates to sellers that you're a serious, prepared buyer. Shop around with multiple lenders to compare rates and terms. Lastly, maintain financial stability. Avoid major purchases or opening new credit lines during your home-buying process. Lenders scrutinize your financial behavior, and consistency is key. By following these strategic steps this spring, you'll transform your home-buying dream from a distant goal to an achievable reality. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165