Chips and Challenges: Trump's Funding Threat Meets Legislative Complexity

Finance

2025-03-05 19:31:08

Despite the fanfare surrounding the CHIPS Act, former President Donald Trump's ambitious semiconductor manufacturing plans remain shrouded in uncertainty. While the initiative aims to bolster domestic chip production and reduce reliance on foreign manufacturers, the roadmap is far from clear. Trump's vision for revitalizing the semiconductor industry faces significant challenges. The complex landscape of technology manufacturing, coupled with intricate global supply chains, presents formidable obstacles. Key questions linger about funding mechanisms, implementation strategies, and the ability to attract major semiconductor companies to invest in U.S. production facilities. Industry experts remain skeptical about the feasibility of rapid domestic chip manufacturing expansion. The massive capital investments required, coupled with the sophisticated technological expertise needed, mean that Trump's plans could take years—if not decades—to fully materialize. Moreover, international dynamics, including ongoing tensions with China and competitive pressures from countries like Taiwan and South Korea, add layers of complexity to the proposed strategy. The semiconductor industry's global nature demands nuanced diplomatic and economic approaches that cannot be resolved through simple legislative mandates. While the intention to strengthen American technological independence is commendable, the path forward remains uncertain. Stakeholders will be watching closely to see how these ambitious plans might translate from rhetoric to tangible industrial transformation. MORE...

Financial Firepower: Hallowell Demands Fiscal Expertise in Next City Leader

Finance

2025-03-05 19:26:31

Hallowell is embarking on a critical search to find its next city leader, launching a comprehensive recruitment process to replace current City Manager Gary Lamb before his departure in three months. The city has initiated a strategic effort to identify a qualified professional who can seamlessly step into this pivotal municipal leadership role. With Lamb's tenure drawing to a close, city officials are committed to conducting a thorough and transparent selection process. The upcoming transition represents an important moment for Hallowell, as the new city manager will play a crucial role in guiding the community's administrative direction and addressing ongoing municipal challenges. The search committee is expected to review candidates carefully, seeking an individual with strong leadership skills, municipal management experience, and a vision for Hallowell's future development. Residents and stakeholders are anticipated to be engaged throughout the selection process, ensuring that the chosen candidate reflects the community's values and aspirations. MORE...

Auto Giants Breathe Easy: Trump Intervention Secures Crucial Tariff Reprieve

Finance

2025-03-05 19:20:50

In a recent address to Congress, President Donald Trump painted an optimistic picture of the automotive industry's future, claiming that Detroit automakers were "thrilled" about the administration's proposed plans. However, beneath the surface of this rosy narrative, a different story emerges—one of growing unease centered on the administration's controversial tariff policies. While the president's rhetoric suggested a harmonious relationship with auto manufacturers, the reality is far more complex. The ongoing uncertainty surrounding international trade regulations and potential tariffs has cast a long shadow over the industry's strategic planning and economic outlook. Automakers are increasingly concerned about how these policies might impact their global supply chains, production costs, and ultimately, their bottom line. The disconnect between the administration's confident statements and the industry's underlying apprehensions highlights the intricate challenges facing American automotive manufacturers in an increasingly interconnected global marketplace. MORE...

Wall Street's Maverick: B. Riley Financial Unveils Q4 Earnings with Bold Strategic Pivot

Finance

2025-03-05 19:00:28

B. Riley Financial Inc (RILY) is navigating turbulent financial waters, grappling with mounting challenges that test the company's resilience. Despite implementing strategic initiatives aimed at stabilizing its financial position, the firm continues to wrestle with significant economic headwinds, including a notable net loss and a substantial debt burden. The company's current financial landscape reveals a complex picture of strategic ambition confronting market realities. While B. Riley has been proactive in developing strategic approaches to mitigate its financial challenges, the persistent net loss underscores the depth of the obstacles facing the organization. Investors and market analysts are closely watching how the company will navigate these critical financial straits. The substantial debt weighing on B. Riley Financial suggests that innovative restructuring and aggressive cost management will be crucial in charting a path toward financial recovery and sustainable growth. As the firm moves forward, its ability to transform these challenges into opportunities will be paramount in restoring investor confidence and establishing a more robust financial foundation. MORE...

Banking Goes Family-Friendly: WSFS Joins Forces with Greenlight to Revolutionize Kids' Financial Learning

Finance

2025-03-05 19:00:00

Empowering the Next Generation of Financial Savvy: Greenlight's Innovative Approach to Youth Banking In today's digital age, teaching kids and teens about financial responsibility has never been more critical. Greenlight's cutting-edge debit card and mobile app are revolutionizing the way parents help their children learn essential money management skills. More than just a simple payment tool, Greenlight provides a comprehensive financial education platform that guides young people through the fundamental principles of smart money management. The innovative system allows parents to actively supervise and support their children's financial learning journey, creating opportunities to earn, save, give, and spend money wisely. With real-time parental controls and interactive features, Greenlight transforms financial education from a dry lecture into an engaging, hands-on experience. Kids and teens can develop crucial money skills, build financial confidence, and learn valuable life lessons about responsible spending and saving—all under the watchful guidance of their parents. By combining technology, education, and family collaboration, Greenlight is helping to raise a generation of financially intelligent young adults who understand the true value of money. MORE...

Finance Transformation Breakthrough: NTT DATA Clinches Elite SAP Certification

Finance

2025-03-05 18:59:11

NTT DATA Business Solutions has elevated its financial technology offerings by securing the prestigious SAP-qualified partner packaged solution certification for its innovative Finance Accelerated for GROW with SAP solution. This cutting-edge financial platform is strategically designed to empower high-growth businesses with a scalable and transformative approach to financial management. Leveraging the robust capabilities of SAP S/4HANA Cloud and incorporating industry-leading best practices, Finance Accelerated provides organizations with a powerful toolkit to streamline their financial operations. The solution promises not just incremental improvements, but a comprehensive transformation of financial processes through advanced analytics and intelligent automation. By focusing on rapid implementation and operational efficiency, NTT DATA Business Solutions is enabling businesses to quickly adapt to changing market dynamics and make data-driven decisions. The certification underscores the solution's reliability, performance, and alignment with SAP's stringent standards, offering businesses a trusted pathway to digital financial excellence. MORE...

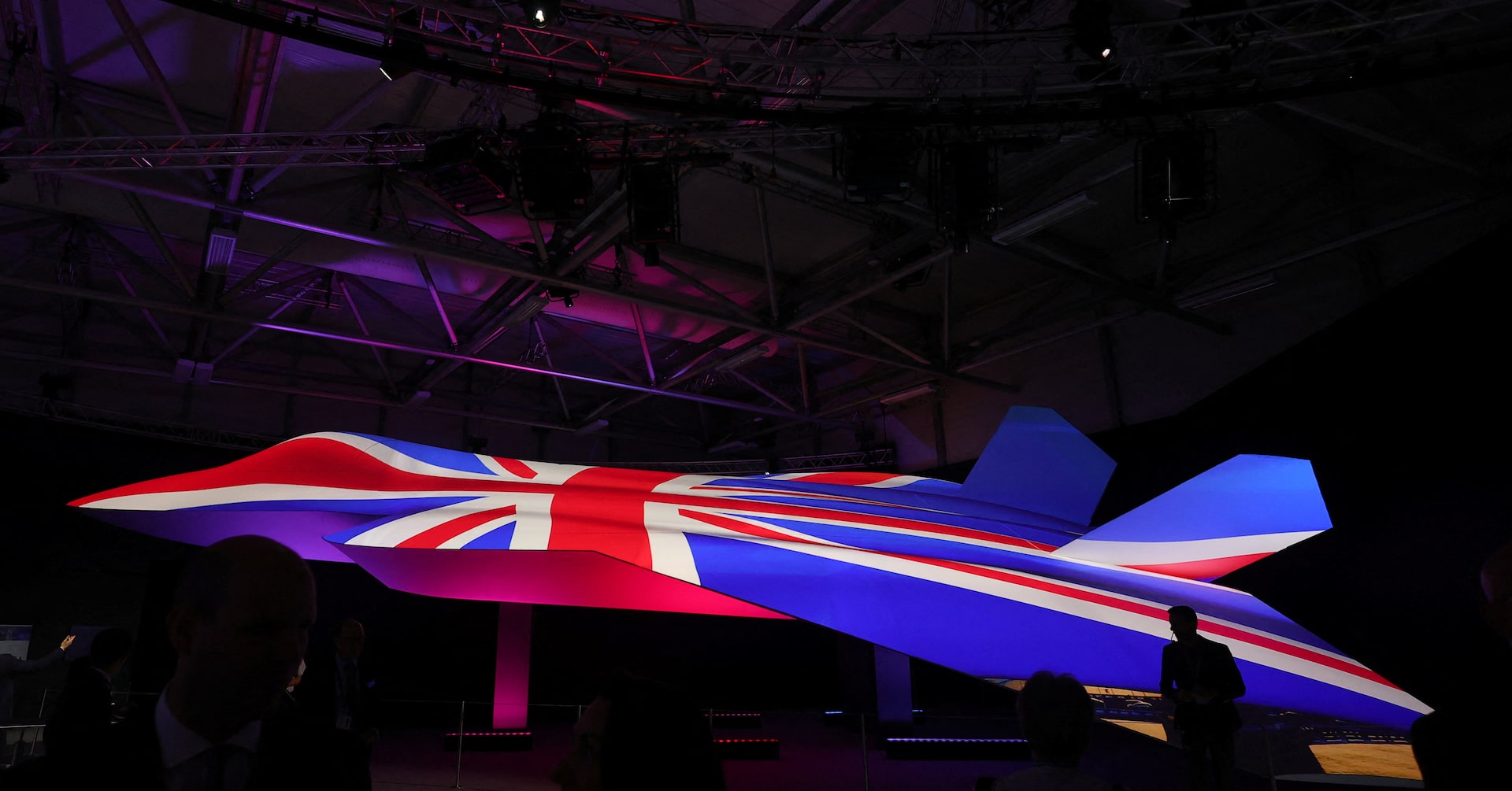

Strategic Surge: UK Finance and Defense Sectors Unveil Groundbreaking Arms Investment Roadmap

Finance

2025-03-05 18:51:48

In a strategic meeting this week, leading trade associations representing Britain's financial services and defence industries joined forces to develop a comprehensive roadmap for policy reforms. Their ambitious goal: to unlock new streams of debt financing and equity investment specifically targeted at bolstering the nation's defence sector. Insider sources revealed that the collaborative effort aims to create a more attractive investment landscape for defence-related businesses, potentially driving significant economic growth and strengthening the country's strategic capabilities. The trade bodies are working closely to identify and propose policy changes that could incentivize private capital to flow more readily into this critical industry. By bringing together financial experts and defence industry leaders, the initiative signals a proactive approach to addressing funding challenges and creating a more robust ecosystem for defence-related investments. The proposed reforms could mark a pivotal moment in supporting Britain's defence innovation and economic resilience. MORE...

Breaking: Fair Lending Watchdogs Expose Critical Banking Compliance Failures

Finance

2025-03-05 18:23:35

In a recent publication of its Consumer Compliance Outlook, the Federal Reserve has shed light on the most critical fair lending violations that demand immediate attention from financial institutions. The central bank's comprehensive review highlights four key areas where lenders are most likely to fall short of equitable lending practices. The Federal Reserve's insights serve as a crucial guide for banks and financial institutions, offering a transparent look into the most common compliance challenges in the lending landscape. By identifying these critical violations, the Fed aims to promote fairness, transparency, and equal access to financial opportunities for all consumers. Financial institutions are urged to carefully review these highlighted areas, implementing robust compliance mechanisms to prevent discriminatory lending practices and ensure that credit decisions are based on merit and financial capability, rather than any form of bias or discrimination. MORE...

Social Security at Risk: Trump's Mass Layoffs Threaten Millions of Americans' Benefits

Finance

2025-03-05 18:02:33

Social Security Payments at Risk: Former Administrator Sounds Alarm on Staffing Cuts

Martin O'Malley, the former head of the Social Security Administration, is raising critical concerns about potential disruptions to Social Security payments due to planned workforce reductions. In a stark warning, O'Malley suggests that a proposed 12% staffing cut could compromise the agency's ability to process payments efficiently.

Yahoo Finance Senior Reporter Jordan Weissmann highlighted the potential risks, emphasizing that the significant workforce reduction might lead to a critical loss of essential technological support. This could potentially trigger unprecedented payment delays, marking a first in the program's long history.

While some experts remain optimistic that payments will continue uninterrupted, others are deeply worried about the long-term stability of the Social Security program. The proposed cuts could create systemic challenges that extend far beyond immediate administrative concerns.

For more in-depth analysis and expert insights into this developing story, viewers are encouraged to explore additional coverage on Wealth.

MORE...Credit Unions Get a Boost: FM PulsePoint Revolutionizes Member Connection Strategies

Finance

2025-03-05 17:52:00

Franklin Madison Launches Innovative Member Engagement Benchmarking Tool

BRENTWOOD, Tenn. - In a groundbreaking move to revolutionize credit union member engagement, Franklin Madison has unveiled FM PulsePoint, a cutting-edge benchmarking solution that promises to transform how financial institutions understand and connect with their members.

This sophisticated data-driven tool empowers credit unions to gain unprecedented insights into member interactions, engagement levels, and potential growth opportunities. By providing comprehensive analytics and comparative metrics, FM PulsePoint enables financial institutions to develop more targeted, personalized strategies that enhance member satisfaction and loyalty.

"Our new PulsePoint platform represents a significant leap forward in how credit unions can measure and improve their member relationships," said a senior executive at Franklin Madison. "We're giving financial institutions the intelligence they need to create more meaningful, responsive member experiences."

The innovative benchmarking solution leverages advanced data analytics to help credit unions identify strengths, address potential gaps, and develop more effective engagement strategies in an increasingly competitive financial landscape.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

.jpg)