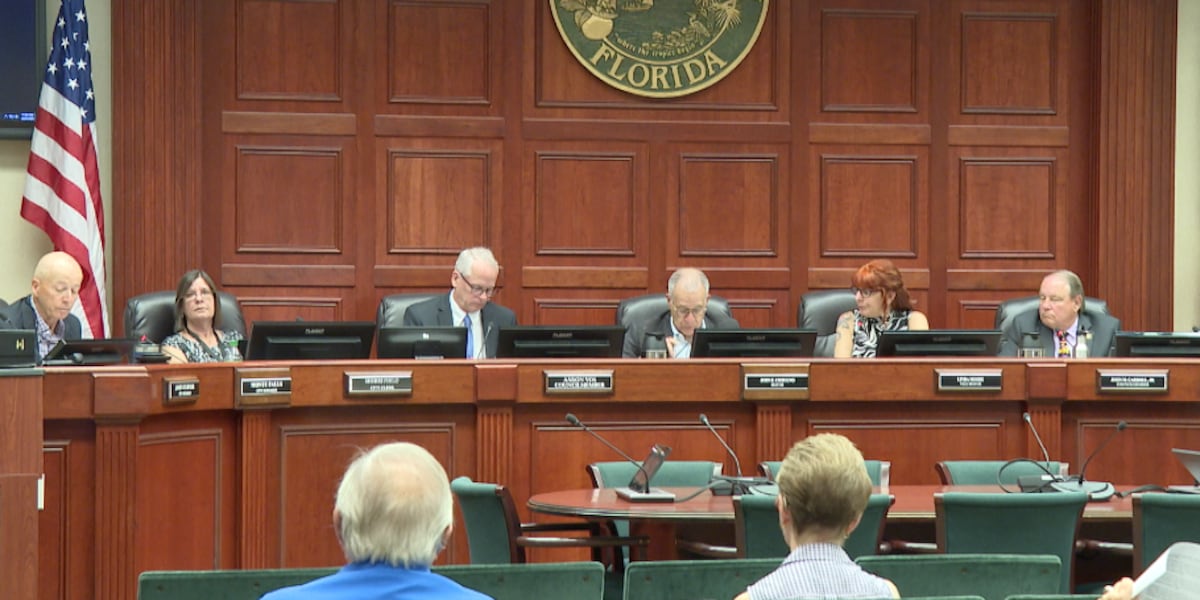

Financial Fallout: Vero Beach Director Axed for Audit Deadline Disaster

Finance

2025-02-25 23:46:00

In a swift response to recent financial challenges, the city has taken decisive action by appointing a new finance director. This proactive move demonstrates the city's commitment to financial stability and strategic planning. The newly appointed director is already diving deep into the city's financial landscape, with a primary focus on maximizing potential grant opportunities from the state. By bringing in fresh leadership and expertise, the city aims to ensure that no valuable funding sources are overlooked. The finance director is meticulously reviewing current grant applications and exploring additional funding avenues that could provide critical resources for municipal projects and community development. This strategic approach underscores the city's dedication to fiscal responsibility and proactive financial management. Residents can be confident that their local government is working diligently to secure every possible financial resource to support ongoing and future initiatives. MORE...

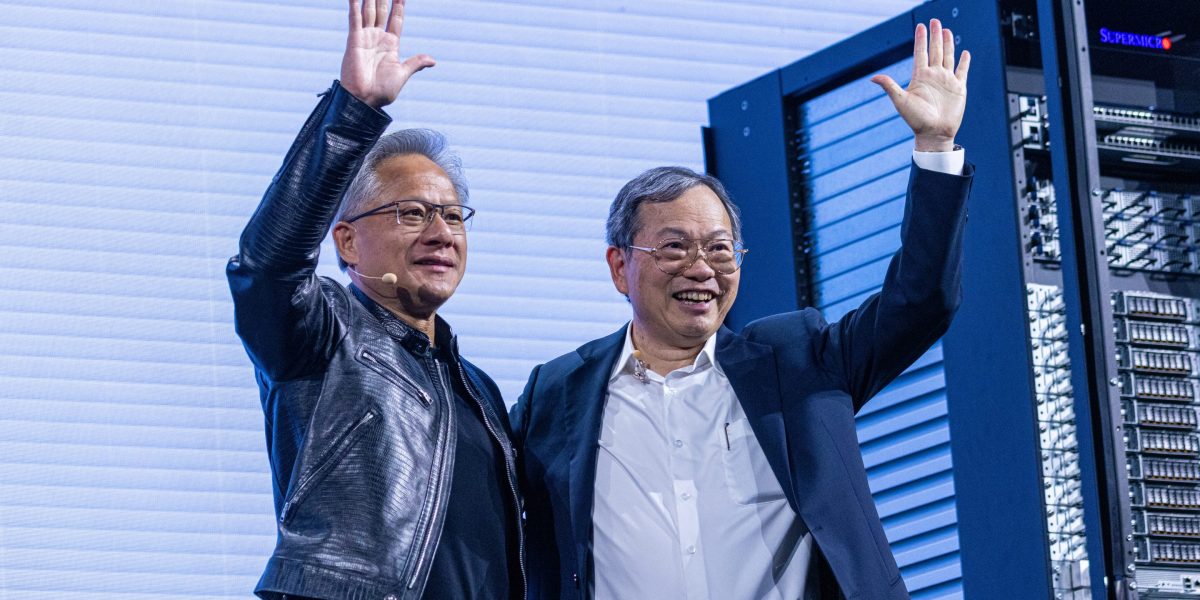

Delayed and Defiant: Super Micro's Financial Reveal Pins Blame on EY Audit Bottleneck

Finance

2025-02-25 23:31:22

Super Micro Computer, Inc. has proactively addressed market concerns by confirming its compliance with SEC financial reporting requirements. The technology company has emphatically stated that all of its financial filings remain current and accurate, with no need for any historical restatements. This announcement comes as a reassuring message to investors and stakeholders, underscoring the company's commitment to financial transparency and regulatory adherence. By promptly addressing potential uncertainties, Super Micro demonstrates its dedication to maintaining clear and reliable financial communications. The company's declaration serves to reinforce confidence in its financial reporting processes and ongoing corporate governance, signaling stability in its financial management approach. MORE...

Norway Steps In: Fueling Ukraine's Energy Lifeline Amid War

Finance

2025-02-25 23:21:27

In a strategic move to support Ukraine during its ongoing conflict with Russia, Norway has stepped forward to provide critical financial assistance for Ukraine's natural gas purchases. The announcement, made by Naftogaz, Ukraine's state energy company, comes at a crucial time when the country's energy infrastructure is under severe strain due to Russian military attacks. As Ukraine continues to face significant challenges to its energy system, Norway's financial support represents a lifeline for the nation's energy security. The increased natural gas imports are essential for maintaining Ukraine's energy stability amid the destructive impacts of the ongoing war. This gesture of solidarity not only provides practical economic support but also demonstrates international solidarity with Ukraine during its time of crisis. The financing arrangement is expected to help Ukraine maintain its energy supplies and mitigate the devastating effects of Russian attacks on its critical infrastructure, ensuring that Ukrainian citizens can continue to access essential energy resources during this difficult period. MORE...

Financial Shake-Up: EQB Reveals Strategic Leadership Transition

Finance

2025-02-25 22:35:00

EQB Inc. Announces Leadership Transition: Chadwick Westlake to Step Down as CFO In a strategic management update, EQB Inc. (TSX: EQB) revealed today that Chadwick Westlake will be departing from his role as Senior Vice President and Chief Financial Officer. Westlake is set to conclude his tenure effective March, marking a significant transition for the financial institution. The company's announcement signals a potential reshaping of its executive leadership team, with Westlake's departure creating an opportunity for new financial leadership. While specific details about his future plans or the immediate succession strategy were not disclosed, the move suggests EQB Inc. is preparing for potential organizational changes. Investors and stakeholders will likely be watching closely to see how the company navigates this leadership transition and who will be selected to fill the critical CFO position in the coming weeks. MORE...

Cava's Quarterly Rollercoaster: Investors Brace for Unexpected Turbulence

Finance

2025-02-25 22:13:32

Cava Group's Stock Takes a Dip After Mixed Earnings Report Mediterranean restaurant chain Cava Group experienced a stock pullback following its latest quarterly financial results, which presented a nuanced picture of the company's performance. While the restaurant brand exceeded revenue expectations, its earnings per share fell short of Wall Street predictions. The company reported impressive top-line revenue of $227.40 million, comfortably surpassing analysts' forecasts of $224.50 million. However, the bottom line told a different story, with adjusted earnings per share landing at $0.05, compared to the anticipated $0.07 projected by financial experts. Yahoo Finance Senior Reporter Brooke DiPalma delved into the earnings results, offering critical insights into how ongoing challenges like inflation and tariffs might shape Cava's strategic approach in the coming quarters. Her analysis provides investors and industry watchers with a comprehensive understanding of the restaurant chain's current financial landscape. For those seeking deeper market insights and expert analysis of the latest market movements, be sure to explore more coverage on Market Domination Overtime. MORE...

Sick Time Shake-Up: Local Finance Pros Reveal Game-Changing Workplace Reforms

Finance

2025-02-25 22:06:17

In the wake of recent workplace transformations, employers are rapidly adapting to the growing demand for paid sick leave. The pandemic has fundamentally reshaped how companies approach employee wellness and workplace policies. Forward-thinking organizations are now recognizing that comprehensive sick leave isn't just a benefit—it's a critical component of maintaining a healthy, productive workforce. Employees increasingly expect comprehensive health support that goes beyond traditional healthcare coverage. Key strategies employers are implementing include: • Developing flexible sick leave policies that accommodate various health scenarios • Creating clear communication channels about sick leave rights and procedures • Offering comprehensive paid time off that supports both physical and mental health • Implementing digital tracking systems to manage sick leave efficiently Companies that proactively address these workforce expectations are finding significant advantages. They're experiencing improved employee morale, reduced workplace transmission of illnesses, and enhanced overall organizational resilience. The shift towards robust sick leave policies represents more than a trend—it's a fundamental reimagining of workplace culture. Employers who embrace these changes are positioning themselves as employers of choice in an increasingly competitive talent marketplace. MORE...

AI Finance Startup Auditoria.AI Secures Massive $38M Funding to Revolutionize Enterprise Intelligence

Finance

2025-02-25 21:24:25

Auditoria.AI Secures Substantial $38 Million Funding to Revolutionize Enterprise Finance with Intelligent AI Agents In a significant milestone for enterprise artificial intelligence, Auditoria.AI has successfully closed a Series B funding round, raising an impressive $38 million. The investment signals strong market confidence in the company's innovative approach to transforming financial operations through advanced agentic AI technology. The funding will enable Auditoria.AI to accelerate its development of cutting-edge AI solutions specifically designed to empower finance teams across various industries. By leveraging sophisticated artificial intelligence, the company aims to streamline complex financial processes, enhance operational efficiency, and provide intelligent automation capabilities that can adapt and learn from intricate business workflows. With this substantial financial backing, Auditoria.AI is poised to expand its technological capabilities, strengthen its market presence, and continue pushing the boundaries of AI-driven financial intelligence. The company's commitment to developing intelligent, context-aware AI agents represents a pivotal advancement in how enterprises can optimize their financial management strategies. MORE...

EU's Missile Boost: Von der Leyen's Bold Plan to Arm Europe's Defenses

Finance

2025-02-25 21:05:45

In the wake of escalating geopolitical tensions, Europe is rapidly transforming its defense landscape, racing to bolster military production and strengthen strategic capabilities. The continent is experiencing a dramatic shift, with nations across the European Union and NATO urgently investing in advanced weaponry, ammunition, and defense infrastructure. Driven by recent security challenges and the ongoing conflict in Ukraine, European countries are implementing unprecedented measures to rapidly expand their military readiness. Governments are breaking through bureaucratic barriers, increasing defense budgets, and collaborating with defense manufacturers to accelerate production timelines. Key strategic initiatives include streamlining procurement processes, establishing new manufacturing facilities, and creating innovative funding mechanisms to support rapid military equipment development. Countries like Germany, France, and Poland are leading the charge, committing substantial resources to modernize their armed forces and create a more robust collective defense capability. This military transformation represents more than just a response to immediate threats—it signals a fundamental reassessment of Europe's defense strategy. The continent is moving from a historically passive defense posture to a more proactive and self-reliant approach, recognizing the critical importance of maintaining strong, technologically advanced military capabilities in an increasingly unpredictable global environment. MORE...

Finance of America's Q4 Earnings: Investors Brace for Crucial Financial Reveal

Finance

2025-02-25 21:05:00

First of America (FOA) is set to unveil its financial performance for the fourth quarter and full year 2024 in an upcoming earnings release. Investors and market analysts can mark their calendars for March 11, when the company will share its comprehensive financial results after the market closes. Following the release, FOA will host a detailed conference call at 5:00 pm Eastern Time, providing management an opportunity to dive deeper into the company's financial highlights, strategic achievements, and future outlook. This presentation will offer stakeholders valuable insights into the organization's performance and potential growth trajectory. Shareholders, financial professionals, and interested parties are encouraged to tune in to gain a comprehensive understanding of FOA's recent financial landscape and strategic positioning for the upcoming year. MORE...

Tech Titans Tumble: Nvidia and Tesla Drag Nasdaq Down as Market Confidence Crumbles

Finance

2025-02-25 21:01:35

The tech sector faced another challenging day as market uncertainty and mounting pressures weighed heavily on investor sentiment. Nvidia, a key player in the semiconductor industry, found itself at the center of growing concerns, with investors closely monitoring potential tariff implications and broader market risks. Tech stocks continued their downward trajectory, reflecting the complex landscape of global trade tensions and technological sector volatility. The market's unease was palpable, with traders and analysts carefully assessing the potential ripple effects on major technology companies and their supply chains. Nvidia, in particular, emerged as a focal point of market speculation, with investors scrutinizing the company's potential vulnerabilities amid escalating geopolitical and economic challenges. The semiconductor giant's stock performance became a bellwether for broader tech sector sentiment, highlighting the delicate balance of innovation and market dynamics. As uncertainty loomed, tech investors remained on high alert, watching for any signs of stabilization or potential market shifts that could impact the sector's near-term performance. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165