Survive and Thrive: Smart Money Moves to Outsmart the Economic Downturn

Finance

2025-03-11 16:09:24

Navigating Economic Uncertainty: Smart Financial Strategies for Challenging Times The specter of a recession can send shivers down anyone's spine, particularly for those already struggling to make ends meet. But fear not – with the right approach, you can transform financial uncertainty into an opportunity for resilience and growth. Economic downturns don't have to be a financial death sentence. By adopting proactive strategies, you can shield yourself from potential economic turbulence and even position yourself to emerge stronger. The key is preparation, adaptability, and a strategic mindset. Start by building a robust emergency fund that can cushion unexpected financial shocks. Diversify your income streams, explore side hustles, and look for ways to enhance your marketable skills. Cut unnecessary expenses, prioritize debt reduction, and be strategic about your investments. Remember, recessions aren't just about survival – they're also about finding hidden opportunities. Some of the most successful businesses and personal financial turnarounds have been born during economic challenges. Stay informed, remain flexible, and view this period as a chance to reassess and reinvent your financial approach. With careful planning and a positive outlook, you can not only weather economic uncertainty but potentially thrive in the face of it. MORE...

Breaking: How AI is Revolutionizing Financial Management with Microsoft 365 Copilot

Finance

2025-03-11 16:00:00

Introducing Microsoft Copilot for Finance: Your AI-Powered Financial Assistant Revolutionize government financial operations with Microsoft Copilot for Finance, a cutting-edge AI solution tailored specifically for finance professionals in public sector agencies. This innovative preview release harnesses the power of artificial intelligence to dramatically accelerate your team's productivity and strategic impact. Designed as an intelligent, role-specific Copilot agent, this advanced tool is engineered to streamline complex financial processes, reduce administrative overhead, and empower government finance teams to work smarter and faster. By leveraging sophisticated AI capabilities, Microsoft Copilot for Finance helps agencies transform their financial management approach, enabling quicker decision-making and more efficient resource allocation. Experience the future of government financial technology – where intelligent automation meets strategic insight. Discover how Microsoft Copilot for Finance can help your agency unlock new levels of operational excellence and drive meaningful impact. MORE...

Market Mayhem: Trump's Steel Tariff Twist Sends S&P 500 and Dow Tumbling

Finance

2025-03-11 15:40:22

Global Stock Markets Reel as Recession Fears Intensify Investors are experiencing a turbulent week as stock markets worldwide continue to plummet, driven by mounting concerns about a potential economic downturn. The latest market selloff reflects growing anxiety among financial experts about the sustainability of current economic conditions. Major financial indices have been experiencing significant declines, with investors rapidly shifting their portfolios in response to increasing recession signals. The dramatic market volatility stems from multiple economic pressures, including persistent inflation, tightening monetary policies, and geopolitical uncertainties. Analysts are pointing to several key indicators that suggest a potential economic contraction. Central banks' aggressive interest rate hikes, designed to combat inflation, are creating additional pressure on corporate earnings and consumer spending. This delicate economic landscape is causing investors to reassess their investment strategies and seek safer financial havens. Technology and growth stocks have been particularly hard hit, with many sectors experiencing sharp corrections. The widespread market uncertainty is prompting investors to adopt a more cautious approach, moving capital toward more stable and defensive investment options. While market conditions remain challenging, financial experts advise maintaining a long-term perspective and avoiding panic-driven decision-making. The current economic landscape presents both risks and potential opportunities for strategic investors who can navigate the complex financial terrain. MORE...

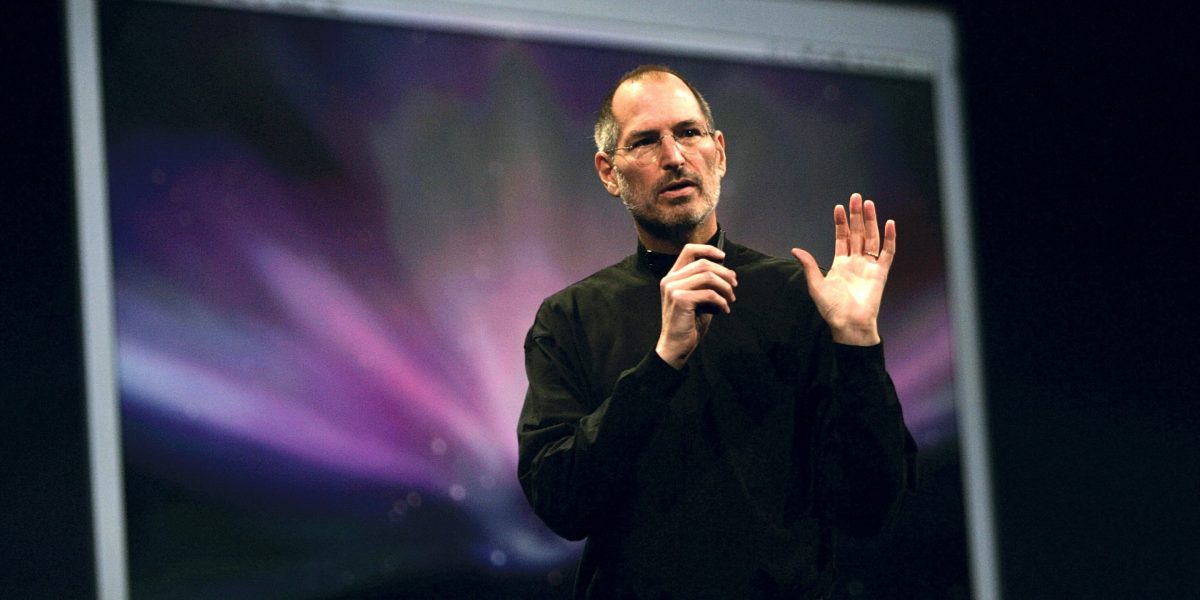

Breaking: AI Algorithms Revolutionize Financial Decision-Making, Wall Street Trembles

Finance

2025-03-11 15:35:41

AI-Powered Decision Intelligence Revolutionizes Financial Services

In the rapidly evolving landscape of financial services, artificial intelligence is driving a transformative revolution in how institutions make critical decisions. Decision intelligence powered by advanced AI technologies is reshaping the industry, offering unprecedented insights, transparency, and strategic capabilities.

Modern financial organizations are leveraging sophisticated AI algorithms to navigate complex risk landscapes with remarkable precision. These intelligent systems analyze vast amounts of data in real-time, identifying potential risks and opportunities that human analysts might overlook. By integrating machine learning and predictive analytics, financial institutions can now make more informed, data-driven decisions that minimize potential losses and maximize strategic outcomes.

The impact of AI-driven decision intelligence extends far beyond traditional risk management. It enables financial services to personalize customer experiences, optimize investment strategies, detect fraudulent activities, and streamline operational efficiency. By transforming raw data into actionable intelligence, AI is empowering financial professionals to make faster, more accurate decisions that drive competitive advantage.

As technology continues to advance, the synergy between human expertise and artificial intelligence will become increasingly critical in shaping the future of financial services. Organizations that embrace this technological transformation will be better positioned to thrive in an increasingly complex and dynamic global financial ecosystem.

MORE...Wall Street Confidence Crumbles: Finance Chiefs Sound Alarm on Trump's Economic Outlook

Finance

2025-03-11 15:20:08

Economic Headwinds Dampen Business Confidence: Tariffs, Interest Rates, and Inflation Take Their Toll Recent insights from the Journal of Accountancy reveal a complex economic landscape that is weighing heavily on business sentiment. The convergence of multiple economic challenges—including unpredictable tariff policies, fluctuating interest rates, and persistent inflationary pressures—has created a climate of uncertainty that is causing significant concern among business leaders. Entrepreneurs and executives are finding themselves navigating a particularly turbulent economic environment, where traditional forecasting models seem increasingly unreliable. The interplay of these economic factors is creating a ripple effect of caution and strategic recalibration across various industries. Tariff uncertainties continue to introduce volatility into global trade dynamics, while rising interest rates and stubborn inflation rates are compelling businesses to reassess their financial strategies and investment plans. This multifaceted economic pressure is contributing to a notable decline in overall business confidence and strategic optimism. As companies seek to maintain stability and chart a path forward, the ability to adapt quickly and make informed decisions has never been more critical in this increasingly complex economic landscape. MORE...

Spirits on the Agenda: Finance Panel to Scrutinize Trio of Liquor License Requests

Finance

2025-03-11 14:55:20

In a decisive move during Monday's session, the Cheyenne City Council forwarded three pending liquor license applications to the Finance Committee for further review. Following comprehensive public hearings, council members determined that additional evaluation was necessary before making a final determination on the proposed licenses. The decision reflects the city's commitment to carefully scrutinizing alcohol-related business proposals and ensuring they meet all local regulatory standards. MORE...

Trade War Escalates: Trump Ramps Up Tariffs on Canadian Metals as Cross-Border Tensions Flare

Finance

2025-03-11 14:25:56

Trump's Tariff Saga: A Comprehensive Timeline of Trade Tensions

In the complex world of international trade, few topics have been as controversial and impactful as former President Donald Trump's tariff policies. Yahoo Finance brings you an in-depth exploration of the dramatic trade battles that reshaped global economic relationships during his administration.

The Tariff Strategy Unveiled

Trump's approach to international trade was anything but conventional. From the moment he entered office, he signaled a dramatic shift in America's trade strategy, targeting countries like China, Mexico, and Canada with unprecedented tariff measures. These weren't just economic policies; they were bold political statements that sent shockwaves through global markets.

Key Highlights of the Tariff Landscape

- China Trade War: Massive tariffs targeting hundreds of billions in Chinese goods

- Steel and Aluminum Tariffs: Global levies that challenged international trade norms

- USMCA Negotiations: Reworking trade agreements with key North American partners

Each tariff announcement became a high-stakes game of economic chess, with immediate ripple effects on stock markets, international relations, and domestic industries. Businesses, economists, and politicians watched closely as each new policy unfolded.

The Economic Impact

While supporters praised Trump's aggressive trade stance as protecting American jobs and industries, critics argued that the tariffs ultimately increased costs for consumers and created uncertainty in global markets. The real-world consequences were complex and far-reaching.

Stay tuned to Yahoo Finance for the most up-to-date and comprehensive coverage of these transformative trade policies that continue to shape our economic landscape.

MORE...Trade War Escalates: Trump Targets Canadian Metals with Massive 50% Tariff Bombshell

Finance

2025-03-11 14:21:39

Trump Escalates Trade Tensions: Steel and Aluminum Tariffs on Canada Double

In a significant move that could further strain international trade relations, President Trump has announced a dramatic increase in tariffs on Canadian steel and aluminum imports. The tariffs, which were previously set at 25%, will now be raised to a substantial 50%, signaling an intensified economic pressure on one of America's closest trading partners.

Breaking the news on Yahoo Finance's Catalysts, reporter Madison Mills highlighted the potential implications of this unexpected tariff hike. The decision is likely to spark renewed debates about trade policies and international economic diplomacy.

For those seeking deeper insights into this developing story and its potential market impact, experts recommend following additional coverage on Yahoo Finance's Catalysts program.

As the situation continues to evolve, investors and trade analysts are closely monitoring the potential ripple effects of this significant tariff increase.

MORE...Rising Star: Daniel Gotay Crowned as HousingWire's Visionary Finance Leader for 2025

Finance

2025-03-11 13:38:00

Daniel Gotay Recognized as a 2025 Finance Leader by HousingWire

Asset Based Lending (ABL) is proud to announce that Daniel Gotay, Executive Vice President of Capital Markets and Operations, has been honored with the prestigious Finance Leader Award for 2025. This distinguished recognition celebrates top-tier finance executives who are revolutionizing financial performance and strategic capital market access.

Since joining ABL in 2019, Gotay has been a transformative force in the company's financial strategy. In just six remarkable years, he has demonstrated exceptional leadership by executing financing deals totaling over $450 million, significantly expanding the lender's capabilities and market reach.

The Finance Leader Award highlights professionals who excel in critical areas such as expanding profit margins, enhancing liquidity, and providing innovative pathways for businesses to access crucial capital markets. Gotay's strategic vision and operational expertise have positioned him as a standout leader in the financial sector.

His achievements at Asset Based Lending underscore his ability to drive meaningful financial growth and create sustainable value for the organization.

MORE...Wall Street Bloodbath: Stocks Plummet as Investors Brace for Market Turbulence

Finance

2025-03-11 13:32:07

After a tumultuous period of steep market declines, stock markets are showing tentative signs of recovery, carefully navigating the complex landscape of economic uncertainty. Investors are treading cautiously, closely monitoring potential recession indicators while seeking glimmers of hope in a volatile financial environment. The recent market turbulence, fueled by growing concerns about a potential economic downturn, has prompted traders and analysts to reassess their strategies. While apprehension remains high, there's a subtle undercurrent of optimism emerging as markets begin to stabilize and adapt to the challenging economic climate. Sophisticated investors are now parsing through economic data, looking for subtle signals that might indicate a potential market turnaround. The delicate balance between recession fears and potential economic resilience continues to drive market sentiment, creating a nuanced and dynamic investment landscape. As global economic indicators fluctuate, market participants remain vigilant, understanding that the path to recovery may be gradual and unpredictable. The current moment represents a critical juncture where strategic insight and measured approach could prove crucial in navigating the uncertain financial terrain. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165