Bond Market Shock: Japan's Finance Chief Warns of Rate Tsunami

Finance

2025-03-11 00:52:01

In a pivotal moment for Japan's economic landscape, Finance Minister Shunichi Kato has emerged as a key figure navigating the country's complex financial challenges. With a steady hand and strategic vision, Kato is working to stabilize Japan's economic trajectory and address critical monetary policy concerns. Kato brings a wealth of experience to his role, demonstrating a nuanced understanding of Japan's economic intricacies. His approach combines pragmatic policy-making with a forward-looking perspective, aiming to bolster Japan's financial resilience in an increasingly volatile global market. Recent statements from the minister have signaled a commitment to carefully managing economic pressures, including inflation concerns and currency fluctuations. Kato's leadership comes at a crucial time, as Japan seeks to reinvigorate its economic growth and maintain its position as a major global economic power. The finance minister has been particularly focused on implementing strategies that can stimulate economic recovery while maintaining fiscal responsibility. His balanced approach has garnered attention from both domestic and international economic observers, who see his leadership as potentially transformative for Japan's economic future. As Japan continues to navigate complex economic challenges, Minister Kato remains at the forefront, working to craft policies that will support sustainable growth and economic stability for the nation. MORE...

Lithium Deal Breakthrough: Rio Tinto's Bold $825M Bond Strategy to Secure Arcadium

Finance

2025-03-11 00:31:48

Mining giant Rio Tinto is making strategic financial moves to streamline its recent acquisition of Arcadium Lithium Plc. The company plans to issue bonds in the United States market, with the primary goal of refinancing a short-term bridging loan used to fund its $6.7 billion purchase. By tapping into the US bond market, Rio Tinto aims to convert its temporary financing into a more stable, long-term debt instrument. This approach demonstrates the company's proactive financial management and commitment to optimizing its capital structure following the significant lithium-focused acquisition. The move underscores Rio Tinto's continued investment in critical minerals and its strategic positioning in the growing lithium market, which is crucial for electric vehicle and renewable energy technologies. MORE...

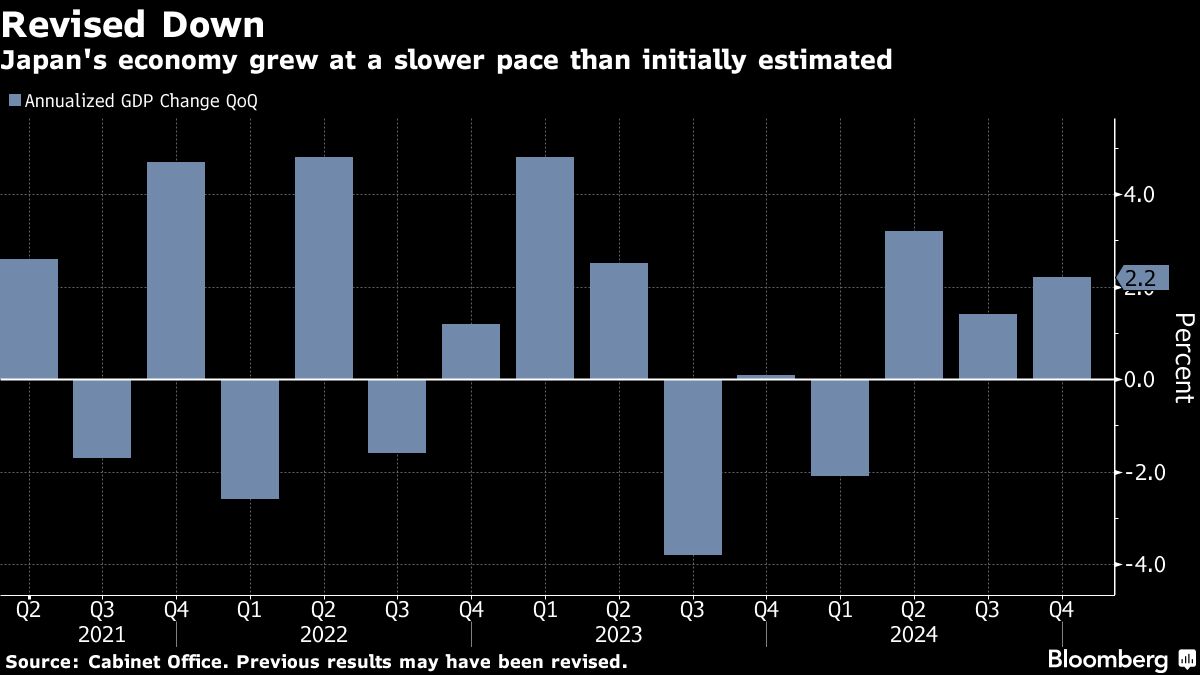

Japan's Economic Outlook Stumbles: Growth Forecast Slashed Before Central Bank Showdown

Finance

2025-03-11 00:09:04

Japan's Economic Growth Downshifts, Signaling Cautious Path for Central Bank In a recent economic update, Japan's economic expansion during the final quarter of 2024 has revealed a more modest growth trajectory than initially anticipated. This nuanced development could potentially influence the Bank of Japan's upcoming policy deliberations, suggesting a likelihood of maintaining current monetary strategies. The revised economic data provides a more tempered view of Japan's economic performance, reflecting the complex challenges facing the world's third-largest economy. Analysts and policymakers are closely examining these figures to gauge the nation's economic resilience and potential future monetary interventions. With the Bank of Japan set to convene next week, these latest economic indicators could play a crucial role in shaping their decision-making process. The more subdued growth figures might reinforce the central bank's current stance of cautious monetary policy management. Investors and economic observers are now keenly awaiting further insights into Japan's economic outlook, as the country navigates global economic uncertainties and seeks sustainable growth strategies. MORE...

Navigating Turbulent Waters: China's Financial Chief Confronts Economic Crossroads

Finance

2025-03-10 23:49:52

On Valentine's Day, Chinese investors were caught off guard by an extraordinary market development. Across the financial landscape, numerous listed companies simultaneously announced a significant shareholder update: Central Huijin had entered the scene. This strategic move by China's domestic sovereign wealth fund subsidiary, China Investment Corp, signaled a bold restructuring of state-owned enterprises (SOEs) with far-reaching implications for the country's financial ecosystem. The unexpected intervention suggests a calculated effort to consolidate and strengthen state-controlled financial entities. By taking control of multiple firms with diverse onshore market interests, Central Huijin is positioning itself to tackle China's most intricate financial challenges with unprecedented scale and coordination. This unprecedented consolidation represents more than just a routine corporate maneuver. It reflects a sophisticated approach to managing complex economic landscapes, potentially reshaping the dynamics of China's financial sector and demonstrating the government's proactive strategy in navigating economic uncertainties. Investors and market analysts are now closely watching how this newly empowered super-sized state-owned enterprise will leverage its expanded influence and resources to drive strategic economic objectives. MORE...

Breaking: The Silent Financial Anxiety Consuming Millennials and Gen X – Money Dysmorphia Explained

Finance

2025-03-10 23:31:01

Financial burnout isn't just a buzzword—it's a real emotional and mental exhaustion that transcends age groups and income levels. While millennials and Gen Z might seem most vocal about this phenomenon, the truth is that anyone can feel overwhelmed by the constant financial pressures of modern life. Whether you're living paycheck to paycheck or have a comfortable savings cushion, the stress of managing money, meeting financial expectations, and navigating an increasingly complex economic landscape can take a significant toll on your mental well-being. The relentless pursuit of financial stability can leave even the most financially secure individuals feeling drained and disconnected. From mounting student loans and rising living costs to the pressure of maintaining a certain lifestyle, financial burnout creeps in silently, affecting people across all socioeconomic backgrounds. It's not about how much money you have, but how the constant financial juggling act impacts your mental and emotional health. Recognizing and addressing financial burnout is crucial for maintaining overall life satisfaction and personal resilience in today's challenging economic environment. MORE...

Crypto Crossroads: How America's Digital Asset Boom Could Shake European Financial Foundations

Finance

2025-03-10 23:17:15

Cryptocurrency Concerns Loom: Euro Zone Ministers Warn of Potential Financial Disruption Euro zone finance ministers are sounding the alarm over the potential implications of the new U.S. administration's cryptocurrency-friendly approach. In a critical meeting on Monday, top officials expressed deep concerns about how emerging digital currency policies could fundamentally challenge the euro zone's monetary sovereignty and financial stability. The ministers are closely monitoring the shifting landscape of digital finance, recognizing that the United States' evolving stance on cryptocurrencies could have far-reaching consequences for traditional financial systems. Their apprehension stems from the potential for digital currencies to undermine established monetary frameworks and introduce unprecedented economic uncertainties. As the global financial ecosystem continues to transform, these euro zone leaders are determined to protect their economic interests and maintain robust financial controls in an increasingly digital world. The discussions highlight the growing tension between traditional financial institutions and the rapidly expanding cryptocurrency ecosystem. MORE...

Dogecoin's Regulatory Roadblock: DOGE's Battle Against Consumer Finance Watchdog Loses Steam

Finance

2025-03-10 22:48:46

In a revealing court testimony on Monday, a senior Consumer Financial Protection Bureau (CFPB) official disclosed that the agency's aggressive dismantling efforts have been unexpectedly tempered by leadership appointed during the Trump administration. The dramatic shift suggests internal resistance to potentially radical restructuring plans, highlighting the complex dynamics within the regulatory agency. The official's testimony provides a rare glimpse into the behind-the-scenes negotiations and strategic maneuvers that have slowed down what was initially perceived as a swift and comprehensive attempt to fundamentally alter the CFPB's operations and mandate. By moderating the pace and intensity of proposed changes, Trump-era appointees appear to be maintaining a more measured approach to potential agency reforms. This development underscores the ongoing tension between different administrative perspectives and the challenges of implementing significant organizational transformations within established government institutions. MORE...

Wall Street Trembles: Trump's Latest Move Sparks Market Meltdown

Finance

2025-03-10 22:08:43

As economic uncertainties loom, President Biden faces a critical challenge: rebuilding investor confidence and charting a path forward for the American economy. The question on many minds is not just whether he can win back Wall Street's trust, but whether he truly aims to do so. Recent policy decisions have sent mixed signals to the investment community. While some initiatives show promise for economic growth, others have sparked concern about regulatory complexity and potential market interventions. The administration seems to be walking a delicate tightrope between progressive economic reforms and maintaining a business-friendly environment. Investors are closely watching for signs of a coherent economic strategy. They want clarity on tax policies, infrastructure spending, and the administration's approach to emerging industries like technology and green energy. The president's ability to communicate a balanced, predictable economic vision could be the key to restoring confidence. Yet, there's an underlying tension. Some of Biden's core supporters are less concerned with pleasing Wall Street and more focused on addressing income inequality and implementing bold structural changes. This creates a fascinating political calculus: Can the president satisfy both progressive demands and investor expectations? The coming months will be crucial. With global economic challenges and domestic political pressures, Biden must demonstrate a nuanced understanding of economic growth that goes beyond traditional partisan lines. The stakes are high, and the investment community is watching closely. MORE...

Breaking: Top Female Powerhouses Reshaping Global Banking in 2025 Revealed

Finance

2025-03-10 20:51:44

Calling All Rising Female Leaders in Banking: A Spotlight on Emerging Talent

Are you a dynamic woman under 40 making waves in the financial services industry? We're seeking exceptional female professionals who are reshaping the landscape of banking and financial institutions.

This is your opportunity to be recognized for your innovative leadership, groundbreaking strategies, and transformative contributions to the world of finance. We want to celebrate the trailblazers who are breaking barriers, driving change, and inspiring the next generation of women in banking.

Who We're Looking For:

- Ambitious women aged 40 and younger

- Emerging leaders in banks and financial institutions

- Professionals demonstrating exceptional leadership and innovation

- Change-makers who are redefining traditional banking practices

If you're passionate about your work, driving meaningful impact, and ready to showcase your unique journey, we want to hear from you. This is more than just a submission—it's a chance to inspire, connect, and elevate women in the financial sector.

Don't miss this incredible opportunity to share your story and be recognized as a rising star in banking!

MORE...Wall Street's Hidden Gem: Why TRTX Is Catching Analysts' Eyes in the Real Estate Market

Finance

2025-03-10 20:36:27

Top Real Estate Stocks: A Deep Dive into TPG RE Finance Trust

In our latest analysis of the most promising real estate investments, we've taken a comprehensive look at TPG RE Finance Trust, Inc. (NYSE:TRTX) and its performance within the dynamic landscape of real estate stocks.

Navigating the US Real Estate Market

As uncertainty continues to cast its shadow over the United States real estate sector, investors are increasingly seeking strategic opportunities that can weather market fluctuations. TPG RE Finance Trust emerges as a compelling candidate in this complex investment environment.

Our in-depth research reveals the unique positioning of TRTX among top-performing real estate stocks, offering investors valuable insights into its potential for growth and stability.

Key Highlights

- Comprehensive analysis of TPG RE Finance Trust's market performance

- Comparative assessment against other leading real estate stocks

- Expert insights into current market trends and investment potential

Stay tuned as we unpack the intricate details of this promising real estate investment opportunity.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165