Rising Stars: Steward Partners' Top Talent Recognized in Elite National Financial Advisor Rankings

Finance

2025-02-14 16:15:00

Steward Partners Shines Bright: Six Top-Tier Financial Advisors Recognized Nationally Steward Partners, a distinguished employee-owned financial services firm, is celebrating a remarkable achievement as six of its exceptional partners have been named to InvestmentNews' prestigious 2025 Top Financial Advisors in the USA list. This prestigious recognition comes after a rigorous selection process by InvestmentNews, which meticulously evaluated financial advisors through a comprehensive methodology. The evaluation involved soliciting nominations, conducting thorough compliance verifications, and ranking advisors based on critical performance metrics including assets under management (AUM), AUM growth, and client expansion from August 2023 to August 2024. The recognition underscores Steward Partners' commitment to delivering outstanding financial guidance and maintaining the highest standards of professional excellence. By highlighting these six talented partners, the firm demonstrates its dedication to providing top-tier financial advisory services that consistently meet and exceed client expectations. This national acknowledgment not only celebrates individual achievements but also reinforces Steward Partners' reputation as a leading independent financial services firm committed to empowering clients and driving financial success. MORE...

Urban Revival: KeyBank Fuels $41.4M Makeover of Pittsburgh's Iconic Office Landmark

Finance

2025-02-14 15:25:33

In a significant boost to Pittsburgh's housing landscape, a prominent local bank is stepping up to support affordable housing development with a substantial $41.4 million financial commitment. This strategic investment promises to create new housing opportunities for residents, addressing the critical need for accessible and affordable living spaces in the city. The bank's dedicated financing arm is demonstrating a strong commitment to community development by channeling substantial resources into creating affordable housing options. This initiative not only supports low and middle-income residents but also contributes to the city's broader urban revitalization efforts. By providing this considerable funding, the bank is playing a crucial role in helping to expand housing accessibility, potentially transforming neighborhoods and improving the quality of life for many Pittsburgh residents who struggle with housing affordability. MORE...

Oportun Financial Gets Bullish Boost: B. Riley Sees Potential Surge to $11

Finance

2025-02-14 15:01:09

B. Riley Boosts Confidence in Oportun Financial, Sees Promising Growth Ahead Financial analysts at B. Riley have significantly upgraded their outlook on Oportun Financial (OPRT), raising the price target from $8 to $11 while maintaining a bullish Buy rating. The optimistic forecast comes on the heels of the company's impressive Q4 performance, which exceeded market expectations. The firm is particularly enthusiastic about Oportun's potential, highlighting the company's robust earnings recovery trajectory and promising return on equity. Analysts believe these factors could trigger a substantial share price revaluation in the coming year. Notably, Oportun has already demonstrated its strength by raising its adjusted earnings guidance for 2025 by 7%, signaling confidence in its strategic direction and financial health. This positive momentum suggests the company is well-positioned to capitalize on emerging market opportunities and deliver value to investors. Investors and market watchers are advised to keep a close eye on Oportun Financial as it continues to navigate the financial landscape with increasing confidence and strategic precision. MORE...

Market Mayhem: Stocks Stumble as Retail Sales Disappoint and Trump Tariffs Loom

Finance

2025-02-14 14:43:25

Wall Street Navigates a Complex Financial Landscape: Tariffs, Inflation, and Market Dynamics in Focus Investors found themselves at the crossroads of a multifaceted economic week, carefully analyzing a barrage of critical financial indicators. The market was abuzz with anticipation as fresh retail data and corporate earnings reports cascaded in, providing a nuanced snapshot of the current economic climate. The week's landscape was marked by significant tariff adjustments and inflation updates, challenging investors to recalibrate their strategies and expectations. Traders and financial analysts meticulously parsed through the incoming information, seeking insights into potential market trends and economic shifts. Retail data and corporate earnings reports added layers of complexity to the already intricate financial environment, offering both challenges and opportunities for market participants. The convergence of these diverse economic signals created a dynamic and unpredictable investment atmosphere, keeping investors on the edge of their seats. As the week unfolded, market sentiment oscillated between cautious optimism and strategic reassessment, reflecting the intricate interplay of global economic forces and domestic market dynamics. MORE...

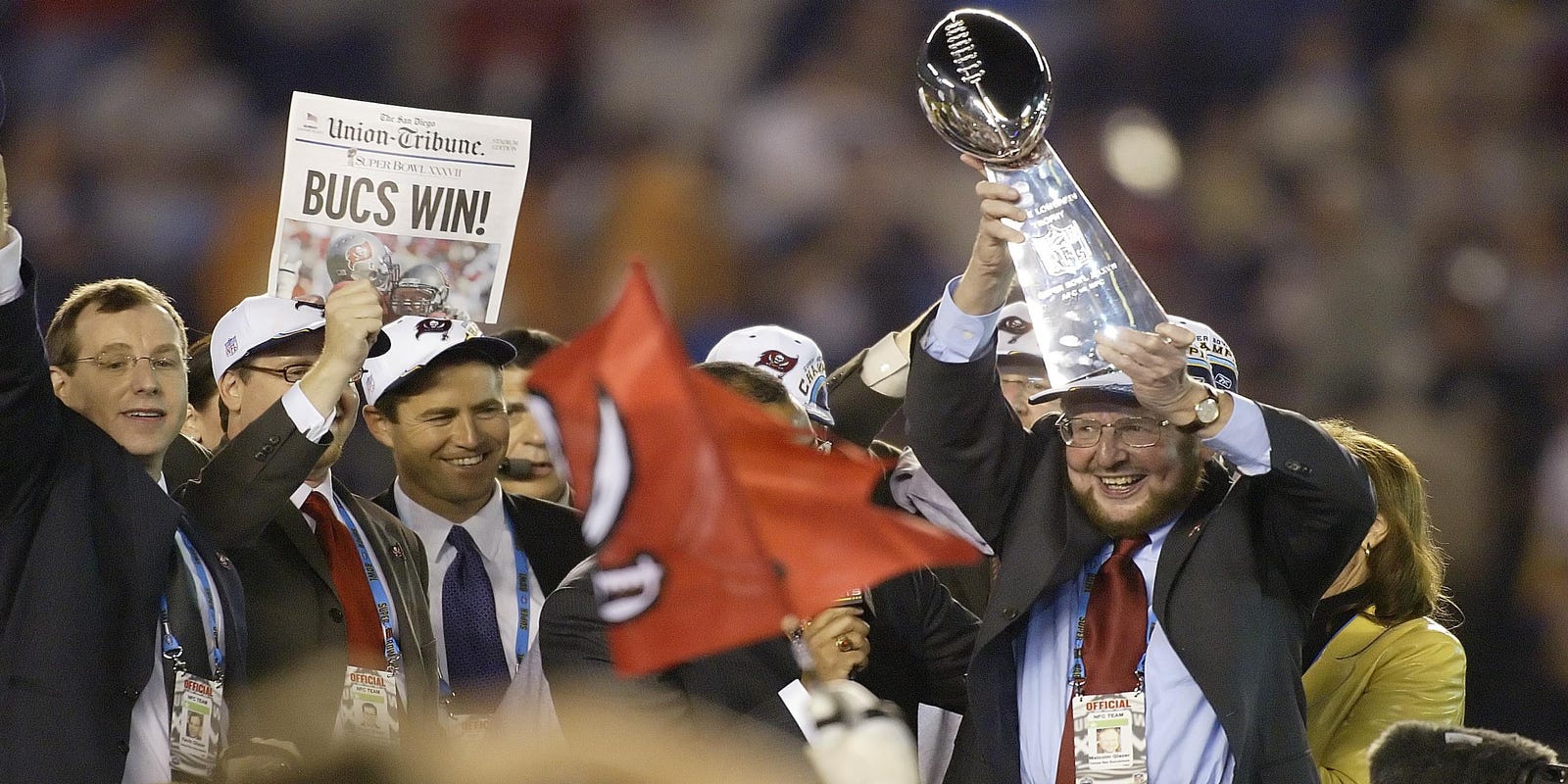

Wall Street's Secret Sauce: How Corporate Finance Is Reshaping the American Dream

Finance

2025-02-14 14:30:09

In his groundbreaking new book, Donald Chew explores the intellectual foundations that propelled the United States to become a global powerhouse of wealth creation. By delving deep into the innovative ideas and transformative concepts that shaped American economic success, Chew offers a compelling narrative of how unique intellectual frameworks distinguished the US from other nations. The book meticulously examines the key philosophical and economic principles that enabled the United States to not just generate unprecedented wealth, but to fundamentally reimagine economic potential. While traditional measures of economic growth provide one perspective, Chew's work illuminates the deeper intellectual currents that drove America's remarkable economic ascendancy. Through rigorous analysis and engaging storytelling, the author reveals how certain revolutionary ideas—ranging from entrepreneurial spirit to institutional innovation—became the cornerstone of American economic exceptionalism. Chew's insights challenge conventional wisdom and provide readers with a nuanced understanding of the intellectual engines that powered the nation's extraordinary economic journey. MORE...

Tech Exodus: CFPB's Digital Backbone Crumbles as Key Talent Abandons Financial Watchdog

Finance

2025-02-14 14:20:04

In a surprising turn of events, the popular meme-inspired cryptocurrency Dogecoin (DOGE) has secured an unprecedented level of access to sensitive agency information. This unexpected development has sent ripples through both the cryptocurrency and government sectors, raising eyebrows and sparking intense speculation about the implications of such unprecedented data transparency. Sources close to the matter reveal that the cryptocurrency's unique network has managed to penetrate typically restricted information channels, granting insights that were previously inaccessible to external parties. The breach of traditional data barriers represents a significant milestone for DOGE, which began as a lighthearted internet joke but has increasingly demonstrated its technological capabilities. Experts are divided on the potential consequences of this data access, with some viewing it as a groundbreaking moment in cryptocurrency's evolution, while others express concerns about potential security risks. The incident underscores the growing complexity and unpredictability of digital currencies in today's interconnected technological landscape. As investigations continue, the cryptocurrency community remains both intrigued and cautious about the full extent of DOGE's newfound informational reach. This development promises to be a pivotal moment in understanding the expanding boundaries of blockchain technology and digital asset capabilities. MORE...

Serie A Registration Fears Debunked: Insider Crushes Inter Milan Speculation

Finance

2025-02-14 13:48:00

In a recent statement that should calm Inter Milan fans' nerves, renowned Italian football finance expert Marco Bellinazzo has decisively dismissed speculation about the club's potential registration challenges for the upcoming Serie A season. Speaking on Italian broadcaster Telelombardia, Bellinazzo provided a reassuring perspective on Inter's financial and administrative status. The expert's comments come amid swirling rumors that suggested Inter might face complications in registering for the league. However, Bellinazzo's professional assessment indicates that these concerns are unfounded, offering a clear and confident stance on the club's readiness for the new season. His insights carry significant weight in Italian football circles, given his deep understanding of club finances and regulatory requirements. Fans and stakeholders can take comfort in his professional evaluation, which suggests that Inter Milan is well-positioned to compete in Serie A without any administrative hurdles. MORE...

Wall Street's Hidden Gems: 3 Commercial Finance Stocks Poised to Skyrocket

Finance

2025-02-14 13:35:00

As economic resilience continues to bolster business confidence, companies like Main Street Capital, Barings BDC, and Crescent Capital are poised to capitalize on a growing wave of financing demand across multiple sectors. Despite challenges in asset quality, these financial institutions are strategically positioned to leverage the current low-interest-rate environment. The market is witnessing a dynamic shift, with businesses seeking strategic capital infusions to fuel growth, expand operations, and navigate an increasingly complex economic landscape. These specialized investment firms are uniquely equipped to provide flexible financing solutions that meet the diverse needs of emerging and established enterprises. While asset quality shows signs of potential weakening, the underlying economic fundamentals remain robust. Companies like Main Street Capital and Barings BDC are demonstrating remarkable adaptability, offering tailored financial products that address the nuanced requirements of different industries. Investors and business leaders are closely watching how these financial institutions will navigate the evolving economic terrain, balancing risk management with growth opportunities in a competitive and dynamic market environment. MORE...

Wall Street Spotlight: Bausch Health Unveils Strategic Insights at Prestigious J.P. Morgan Finance Summit

Finance

2025-02-14 13:00:00

Bausch Health Companies Set to Illuminate Financial Strategy at Prestigious J.P. Morgan Conference Laval, Quebec - Bausch Health Companies Inc. (NYSE:BHC)(TSX:BHC) is preparing to take center stage at the highly anticipated 2025 J.P. Morgan Global Leveraged Finance Conference. The pharmaceutical giant will showcase its strategic vision and financial outlook on February 24 in the vibrant setting of Miami Beach, Florida. Investors and financial analysts will have a prime opportunity to gain insights into Bausch Health's current market positioning and future growth strategies during this key industry event. The conference presents a crucial platform for the company to communicate its ongoing transformation and financial performance to key stakeholders. As a leading pharmaceutical company, Bausch Health continues to demonstrate its commitment to transparency and investor engagement through strategic conference participation. The upcoming J.P. Morgan event promises to be a significant moment for the company to share its latest developments and forward-looking perspectives. Interested parties are encouraged to stay tuned for more details about Bausch Health's presentation and potential market implications. MORE...

Breaking: Regions Bank Revolutionizes Financial Tech with Koxa's Cutting-Edge Embedded ERP Solution

Finance

2025-02-14 12:47:17

Regions Bank Unveils Innovative Treasury Management Solution for Seamless Financial Integration Regions Bank is taking a significant leap forward in financial technology by introducing a cutting-edge treasury management solution that empowers businesses to effortlessly synchronize their financial data with enterprise resource planning (ERP) systems. This groundbreaking offering is specifically designed to streamline financial workflows and provide businesses with unprecedented connectivity between their banking platforms and internal management systems. By bridging the gap between financial data and enterprise planning, Regions Bank is helping companies enhance their operational efficiency and gain real-time insights into their financial landscape. The new service represents a strategic approach to addressing the complex data integration challenges that many organizations face, enabling treasury management clients to achieve smoother, more automated financial processes with minimal friction. With this innovative solution, Regions Bank demonstrates its commitment to leveraging technology to meet the evolving needs of modern businesses, offering a sophisticated tool that transforms how companies manage and interpret their financial information. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165