Tariff Tsunami: Detroit's Auto Giants Prepare for Economic Showdown

Finance

2025-03-02 14:17:12

US Automakers Face Potential Trade Challenges in Global Market

The American automotive industry is preparing for potential economic headwinds as trade tensions continue to simmer on the global stage. Major manufacturers like Ford, General Motors, and Stellantis are closely monitoring international trade policies that could significantly impact their manufacturing and export strategies.

Recent discussions surrounding potential tariffs have sent ripples of concern through Detroit's automotive corridors. Industry leaders are strategically reassessing their global supply chains and exploring alternative manufacturing approaches to mitigate potential financial risks.

The complex landscape of international trade presents multiple challenges for US carmakers. Fluctuating tariff rates, geopolitical tensions, and shifting economic relationships demand unprecedented levels of adaptability and strategic planning.

Experts suggest that proactive measures, including diversifying supply chains and investing in domestic manufacturing capabilities, could help American automakers navigate these uncertain economic waters. The ability to quickly pivot and respond to changing trade dynamics will be crucial for maintaining competitive advantage.

As global markets continue to evolve, US automotive manufacturers are demonstrating remarkable resilience and innovation in the face of potential trade barriers. Their strategic approach will likely determine their success in an increasingly interconnected and competitive global automotive landscape.

MORE...Iran's Economic Shake-Up: Finance Minister's Ouster Signals Reformist Setback

Finance

2025-03-02 14:06:43

In a dramatic turn of political events, President Masoud Pezeshkian finds himself on the defensive following the recent impeachment of Abdolnaser Hemmati, a key figure in his administration. The political landscape has been thrown into turmoil as tensions rise and questions mount about the stability of the current government. Hemmati's removal has sent shockwaves through the political establishment, forcing Pezeshkian to address mounting criticism and concerns about his leadership. Sources close to the administration suggest that the impeachment stems from deep-seated disagreements over economic policy and governance strategies. The president is now working to maintain political cohesion and quell speculation about potential further administrative changes. Political analysts are closely watching how Pezeshkian will navigate this challenging moment, with many viewing it as a critical test of his political acumen and leadership resilience. Meanwhile, opposition groups are seizing the opportunity to challenge the president's credibility, calling for greater transparency and accountability in government operations. The political fallout continues to unfold, leaving many wondering about the long-term implications of this significant administrative shake-up. As the situation develops, Pezeshkian remains committed to stabilizing his administration and addressing the concerns that led to Hemmati's impeachment, though the path forward remains uncertain. MORE...

Wall Street's Hidden Gem: Broadridge Financial Delivers Jaw-Dropping 162% Investor Returns

Finance

2025-03-02 14:03:28

Investing in Stocks: Understanding Risk and Potential When you invest in the stock market, it's crucial to understand that every investment carries inherent risks. While it's true that a stock could potentially lose its entire value, dropping 100% in the worst-case scenario, savvy investors know that strategic decision-making can dramatically shift the odds in their favor. The beauty of stock investing lies in its incredible potential for growth. Unlike many other investment vehicles, stocks offer the opportunity to multiply your initial investment many times over. Successful investors don't focus on the potential losses, but instead develop robust strategies that maximize their chances of substantial returns. Key strategies to mitigate risk include: • Diversifying your investment portfolio • Conducting thorough research before investing • Understanding the companies and industries you're investing in • Setting realistic expectations and long-term goals Remember, every financial journey begins with knowledge, patience, and a calculated approach. The stock market isn't about guaranteed wins, but about making informed decisions that can potentially transform your financial future. MORE...

Wall Street's Crystal Ball: Decoding the Looming Economic Storm

Finance

2025-03-02 14:00:06

As February draws to a close, Wall Street is reflecting on a turbulent month that has left investors feeling cautious and strategic. The recent market volatility has sparked intense discussions among financial experts about potential shifts in investment approaches. Analysts are signaling a potential pivot towards more defensive investment strategies in the coming weeks. The challenging market conditions have prompted many investors to reassess their portfolios, seeking stability and protection against ongoing economic uncertainties. The month's performance has underscored the importance of adaptability in today's dynamic financial landscape. Investors are now carefully weighing their options, looking to minimize risks while positioning themselves for potential opportunities that may emerge in the near future. With market sentiment trending towards a more conservative outlook, financial professionals are advising clients to maintain a balanced and measured approach to their investment decisions. The key message is clear: prudence and strategic thinking will be crucial in navigating the complex market environment ahead. MORE...

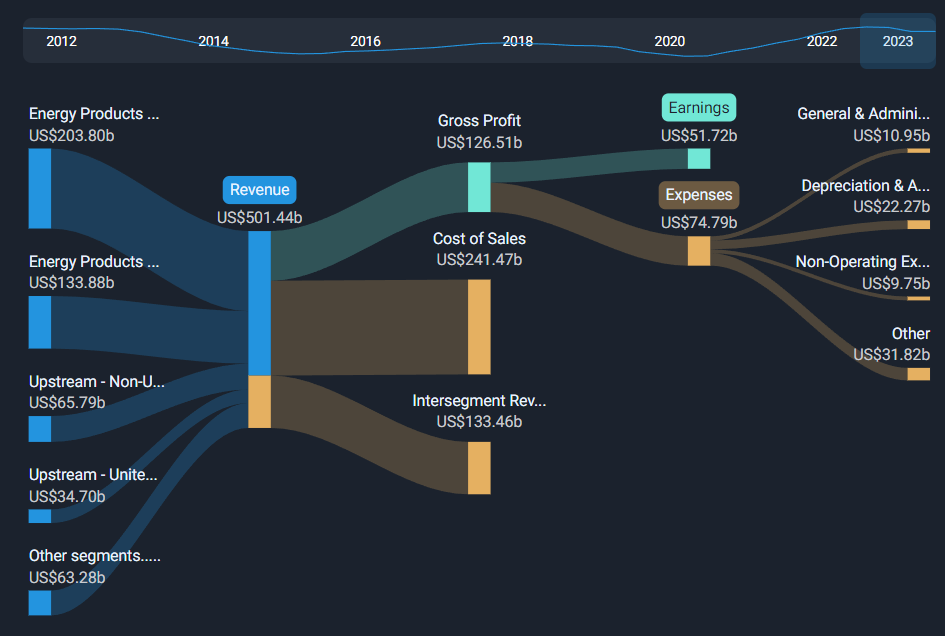

Wall Street Insiders Decode nLIGHT's Financial Roadmap: What the Numbers Really Tell Us

Finance

2025-03-02 13:46:44

Investors and shareholders of nLIGHT, Inc. (NASDAQ:LASR) likely took note of the company's recent full-year financial report, which was released just last week. The comprehensive financial disclosure offers a detailed glimpse into the company's performance and strategic positioning in the market. The annual results provide a crucial snapshot of nLIGHT's financial health, operational achievements, and potential future trajectory. Shareholders and market analysts are undoubtedly parsing through the numbers to understand the company's current standing and prospects for growth. While the specific details of the report were not elaborated in the initial text, such annual reports typically include key financial metrics like revenue, net income, earnings per share, and strategic insights into the company's business operations and outlook. Investors are advised to carefully review the full financial report to gain a comprehensive understanding of nLIGHT's performance and make informed investment decisions. MORE...

Goldman Sachs: Wall Street's Hidden Gem Trading at a Surprising Discount

Finance

2025-03-02 13:45:00

Goldman Sachs: A Powerhouse in Financial Services

In the dynamic world of financial services, few names resonate as powerfully as Goldman Sachs. Renowned for its strategic prowess in capital markets and deal-making, this Wall Street titan continues to set the standard for excellence in the industry.

As the stock currently trades below $650, investors are presented with an intriguing opportunity to consider this financial heavyweight. Goldman Sachs has consistently demonstrated its ability to navigate complex market landscapes, making it a compelling option for those seeking exposure to a top-tier financial institution.

With its robust track record of innovation, strategic partnerships, and global influence, Goldman Sachs remains a standout performer in the financial sector. Investors looking to add a strong, well-established financial stock to their portfolio might find this an opportune moment to take a closer look.

While past performance doesn't guarantee future results, Goldman Sachs has repeatedly proven its resilience and adaptability in an ever-changing financial ecosystem.

MORE...Breaking: Zai Lab's Financial Reveal Sparks Analyst Frenzy

Finance

2025-03-02 13:32:52

Investors in Zai Lab Limited (NASDAQ:ZLAB) have reason to smile this week, as the company's stock experienced a promising uptick. The shares climbed a solid 2.5%, closing at a respectable US$34.64, signaling positive momentum for the biotech firm. This recent performance suggests growing investor confidence in Zai Lab's strategic direction and potential market opportunities. The modest but meaningful rise reflects the company's ongoing efforts to establish itself as a significant player in the biotechnology sector. While short-term stock movements can be influenced by various factors, this week's performance offers a glimpse of the company's resilience and potential for future growth. Investors and market watchers will likely be keeping a close eye on Zai Lab's upcoming developments and financial reports. MORE...

Xometry's Financial Forecast: 2024 Earnings Hit the Mark

Finance

2025-03-02 13:23:04

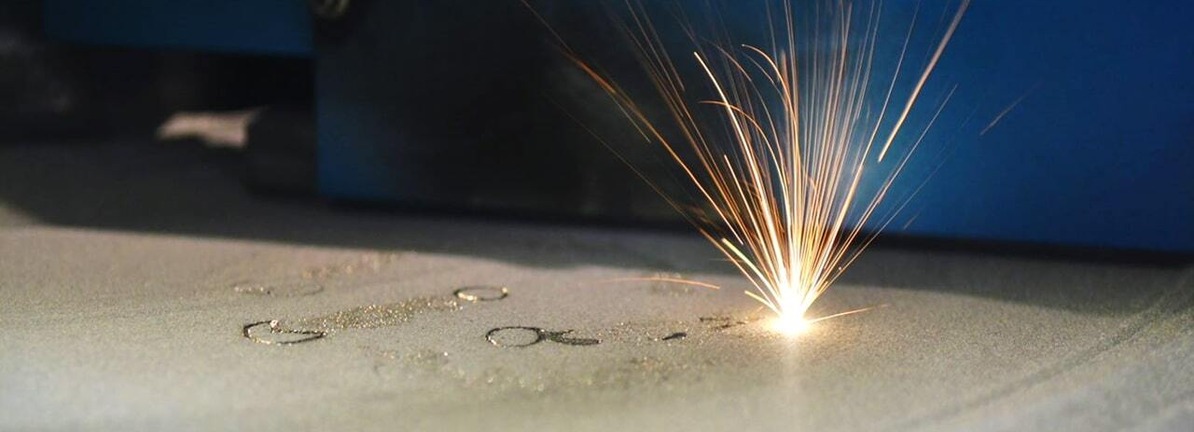

Xometry Delivers Strong Financial Performance in 2024, Showcasing Robust Growth

Xometry (NASDAQ: XMTR) has reported impressive financial results for the full year 2024, demonstrating the company's continued momentum and strategic market positioning. The digital manufacturing marketplace has achieved significant milestones that underscore its resilience and growth potential.

Key Financial Highlights

- Revenue: The company recorded $545.5 million in revenue, representing an impressive 18% year-over-year increase from 2023

- Market Performance: The results reflect Xometry's ability to navigate complex industrial manufacturing landscapes and leverage its innovative digital platform

The company's strong financial performance is a testament to its robust business model, which connects manufacturers with a vast network of suppliers through cutting-edge technology and streamlined procurement solutions.

Strategic Outlook

Xometry continues to position itself as a leader in the digital manufacturing ecosystem, with a clear focus on expanding its technological capabilities and market reach. The company remains committed to driving innovation and providing flexible, efficient manufacturing solutions for businesses across various industries.

MORE...Home Depot's Financial Forecast: 2025 Earnings Hit the Mark

Finance

2025-03-02 13:20:53

Home Depot Delivers Strong Financial Performance in Fiscal Year 2025

Home Depot (NYSE:HD) has reported impressive financial results for the full year 2025, demonstrating the company's resilience and strategic growth in the home improvement retail sector.

Key Financial Highlights

- Revenue: $159.5 billion, representing a solid 4.5% increase from the previous fiscal year

- Net Income: Robust growth reflecting the company's operational efficiency and market positioning

- Earnings Per Share (EPS): Continued strong performance, showcasing the company's financial strength

The results underscore Home Depot's ability to navigate challenging market conditions while maintaining steady growth. The company's strategic investments in digital infrastructure, customer experience, and supply chain optimization have played a crucial role in achieving these impressive financial outcomes.

Investors and industry analysts are optimistic about Home Depot's continued market leadership and potential for future expansion in the home improvement retail landscape.

MORE...Wall Street's Quiet Giant: How Institutional Investors Have Seized Control of Truist Financial

Finance

2025-03-02 13:00:15

Key Insights: Decoding Truist Financial's Stock Dynamics Institutional investors wield significant influence over Truist Financial's stock performance, revealing a complex landscape of market sentiment and strategic investment patterns. The remarkably high level of institutional ownership suggests that professional investors see substantial potential in the company's financial trajectory. This concentrated ownership means that the stock price is particularly sensitive to the strategic decisions, market perceptions, and investment movements of these large-scale investors. When major institutional players adjust their positions, it can trigger notable fluctuations in Truist Financial's market valuation. The implications are profound: institutional confidence can serve as a powerful indicator of the company's underlying strength, financial stability, and future growth prospects. Investors and market analysts closely monitor these institutional ownership trends as a critical barometer of the stock's potential performance. Understanding these dynamics provides valuable insights into the intricate world of financial markets and the strategic considerations that drive investment decisions for Truist Financial's stock. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165