Wealth Management Revolution: Payfinia and TAPP Engine Unleash Instant Financial Empowerment

Finance

2025-02-18 12:45:00

In a groundbreaking collaboration, Payfinia has joined forces with TAPP Engine to revolutionize the financial technology landscape. The strategic partnership aims to deliver a cutting-edge, embedded instant payments solution that will empower financial institutions and wealth management providers with seamless, state-of-the-art transaction capabilities. Announced today in Portland, Oregon, this innovative alliance promises to transform how financial services integrate rapid payment technologies, offering a comprehensive suite of instant payment services that will streamline transaction processes and enhance customer experiences across the industry. By combining Payfinia's expertise with TAPP Engine's advanced technological infrastructure, the partnership is set to introduce a game-changing approach to financial service delivery, marking a significant milestone in the evolution of digital payment ecosystems. MORE...

DIFC Soars: 20 Years of Triumph Crown Financial Dominance in Middle East

Finance

2025-02-18 12:41:00

Dubai International Financial Centre (DIFC) has solidified its status as the premier financial hub in the Middle East, Africa, and South Asia (MEASA) region during its milestone 20th year. The centre continues to play a pivotal role in strengthening Dubai's reputation as the financial services capital of the region, demonstrating remarkable growth and strategic importance. As a beacon of financial innovation and economic development, DIFC has consistently pushed boundaries, attracting global financial institutions and fostering an ecosystem of cutting-edge financial services. Throughout its two decades of operation, the centre has transformed Dubai into a world-class destination for international finance, creating a dynamic and robust financial landscape that draws top-tier global talent and investment. The 20-year journey of DIFC reflects Dubai's ambitious vision of becoming a global financial powerhouse, showcasing the emirate's commitment to economic diversification and sustainable growth. By providing a sophisticated, regulated environment that supports financial excellence, DIFC has become a critical driver of Dubai's economic success and regional financial leadership. MORE...

Rocket Launch Startup Maritime Services Secures Major Financial Boost, Extends Debt Timeline

Finance

2025-02-18 12:00:00

Halifax, Nova Scotia - Maritime Launch Services Inc. (Cboe CA: MAXQ, OTCQB: MAXQF) announced today a significant financial milestone, successfully securing critical financing agreements totaling approximately $1.6 million. The strategic funding round, priced at $0.05 per share, includes $331,525 in short-term, interest-free loans previously provided by existing shareholders over the past five months. The company's latest financial achievement represents a crucial step in advancing its strategic objectives, demonstrating strong investor confidence and support. By obtaining necessary regulatory approvals and finalizing the financing agreements, Maritime Launch Services continues to strengthen its financial position and momentum in the aerospace and launch services sector. This capital infusion will enable the company to continue its ongoing operations and pursue key strategic initiatives, reinforcing its commitment to innovation and growth in the competitive space technology market. MORE...

Visteon's Financial Roadmap: Navigating Profits and Potential in 2024-2025

Finance

2025-02-18 11:55:00

Visteon Corporation Unveils Strong Financial Performance for Q4 and Full Year 2024

Visteon Corporation (NASDAQ: VC) has released its comprehensive financial results for the fourth quarter and full year of 2024, showcasing robust performance and strategic achievements. The automotive technology company delivered a compelling financial overview that highlights its continued growth and market resilience.

Key Financial Highlights

- Detailed financial metrics demonstrate the company's solid positioning in the competitive automotive technology landscape

- Fourth quarter results reflect Visteon's strategic initiatives and operational efficiency

- Full-year performance underscores the company's ability to navigate complex market dynamics

Investors and industry analysts are closely examining the comprehensive financial report, which provides insights into Visteon's strategic direction and potential for future growth in the rapidly evolving automotive technology sector.

Further details of the financial results will be discussed in the upcoming investor conference call, where company executives will provide deeper insights into the performance and future outlook.

MORE...Breaking: How Fintech Will Revolutionize Your Money by 2025

Finance

2025-02-18 11:30:00

The fintech landscape continues to evolve, with eight innovative personal finance startups making waves this year. Moving beyond traditional digital banking, these companies are now crafting ingenious solutions that target specific financial challenges. One particularly noteworthy trend is the emergence of specialized services designed to support families navigating complex financial situations, such as managing finances for loved ones dealing with dementia. These startups are demonstrating remarkable creativity by identifying niche market needs and developing tailored financial technologies that address unique personal finance pain points. By focusing on specific demographic challenges and life circumstances, they're transforming how individuals and families approach financial planning, management, and support. The diversity of solutions reflects a growing understanding that one-size-fits-all financial services are no longer sufficient in today's dynamic economic environment. From specialized care-related financial tools to targeted digital banking experiences, these eight fintech innovators are reshaping the personal finance ecosystem with their forward-thinking approaches. MORE...

Driving Forward: The Auto Finance Landscape Reshaping 2025

Finance

2025-02-18 11:30:00

In a shifting automotive landscape, affordability is driving significant changes in car buying and financing strategies. As economic pressures mount, consumers are increasingly turning to leasing and older vehicle options to manage their transportation costs. The current market is witnessing a notable surge in leasing, with more drivers finding it an attractive alternative to traditional car ownership. This trend is particularly pronounced among budget-conscious consumers seeking lower monthly payments and reduced long-term financial commitments. Simultaneously, the used car market is experiencing renewed interest, with older vehicles gaining traction as practical and economical transportation solutions. Buyers are recognizing the value of well-maintained, slightly older models that offer reliability at a fraction of the cost of brand-new vehicles. Lending institutions are responding to these market dynamics by becoming more cautious. Banks and financial services are pulling back on high-risk auto loans, implementing stricter qualification criteria and more conservative lending practices. This shift is designed to protect both lenders and borrowers in an uncertain economic environment. The convergence of these trends reflects a broader consumer strategy: maximizing value, minimizing financial risk, and finding creative solutions to transportation needs. As the automotive market continues to evolve, flexibility and affordability remain key drivers of consumer decision-making. MORE...

Car Finance Bombshell: Rachel Reeves Hits Wall in Compensation Showdown

Finance

2025-02-18 11:16:09

In a landmark decision, the Supreme Court has decisively blocked the Treasury's attempt to intervene in the ongoing car finance scandal, marking a significant moment for consumer rights and financial transparency. The court's ruling sends a clear message that financial institutions cannot escape scrutiny or avoid accountability for potentially unfair lending practices. This decision could have far-reaching implications for the automotive finance industry, potentially opening the door for consumers who may have been impacted by questionable lending strategies. Legal experts suggest that the Supreme Court's rejection of the Treasury's intervention demonstrates the judiciary's commitment to protecting consumer interests and maintaining rigorous standards in financial services. The ruling underscores the importance of independent judicial oversight in complex financial disputes. While the full details of the car finance scandal continue to unfold, this Supreme Court decision represents a crucial step towards ensuring fairness and transparency in automotive lending. Consumers and industry watchdogs are closely monitoring the potential consequences of this landmark judgment. The ruling is expected to prompt further investigations and potentially lead to significant reforms in how car financing is conducted and regulated in the future. MORE...

Yuan's Global Leap: How Hong Kong Is Reshaping China's Currency Destiny

Finance

2025-02-18 11:00:13

Hong Kong is set to solidify its position as the global epicenter for offshore yuan transactions, with experts predicting an even more significant role in the international financial landscape. As China continues to expand the yuan's global reach, the city is poised to become an increasingly critical hub for international financial exchanges. Financial officials and market analysts anticipate substantial growth in yuan liquidity and diversified usage, highlighting Hong Kong's unique strategic advantage. The city's sophisticated financial infrastructure, combined with its deep connections to mainland China, positions it perfectly to facilitate cross-border financial activities and international yuan-denominated transactions. With ongoing financial reforms and China's commitment to internationalizing its currency, Hong Kong stands ready to enhance its role as the premier offshore yuan center. The city's robust regulatory framework, world-class financial services, and proximity to mainland markets make it an unparalleled platform for global yuan-based financial operations. As international investors and businesses increasingly seek alternative currency channels, Hong Kong's importance in the global financial ecosystem is expected to grow exponentially. The city's continued evolution as a yuan trading powerhouse underscores its critical role in bridging Chinese and international financial markets. MORE...

Wall Street Gears Up: Markets Surge Ahead of Holiday Trading Amid Economic Optimism

Finance

2025-02-18 10:35:24

As the holiday season approaches, investors can anticipate a relatively calm week in the financial markets. With trading volumes expected to be lighter due to the shortened week, market participants are likely to see steady, measured gains across various sectors. The upcoming holiday period typically brings a sense of cautious optimism to Wall Street, with investors taking a more measured approach to trading. Reduced market activity often leads to more stable price movements, offering a welcome respite from the usual market volatility. Analysts suggest that this period could provide an opportunity for investors to reflect on their current portfolio strategies and make measured adjustments before the new year begins. The combination of holiday spirit and financial prudence creates a unique atmosphere of strategic contemplation in the investment world. While the week may be quiet, savvy investors will remain alert to any potential market signals or unexpected developments that could impact their investment strategies. The holiday-shortened week promises to be a time of measured reflection and strategic planning in the financial markets. MORE...

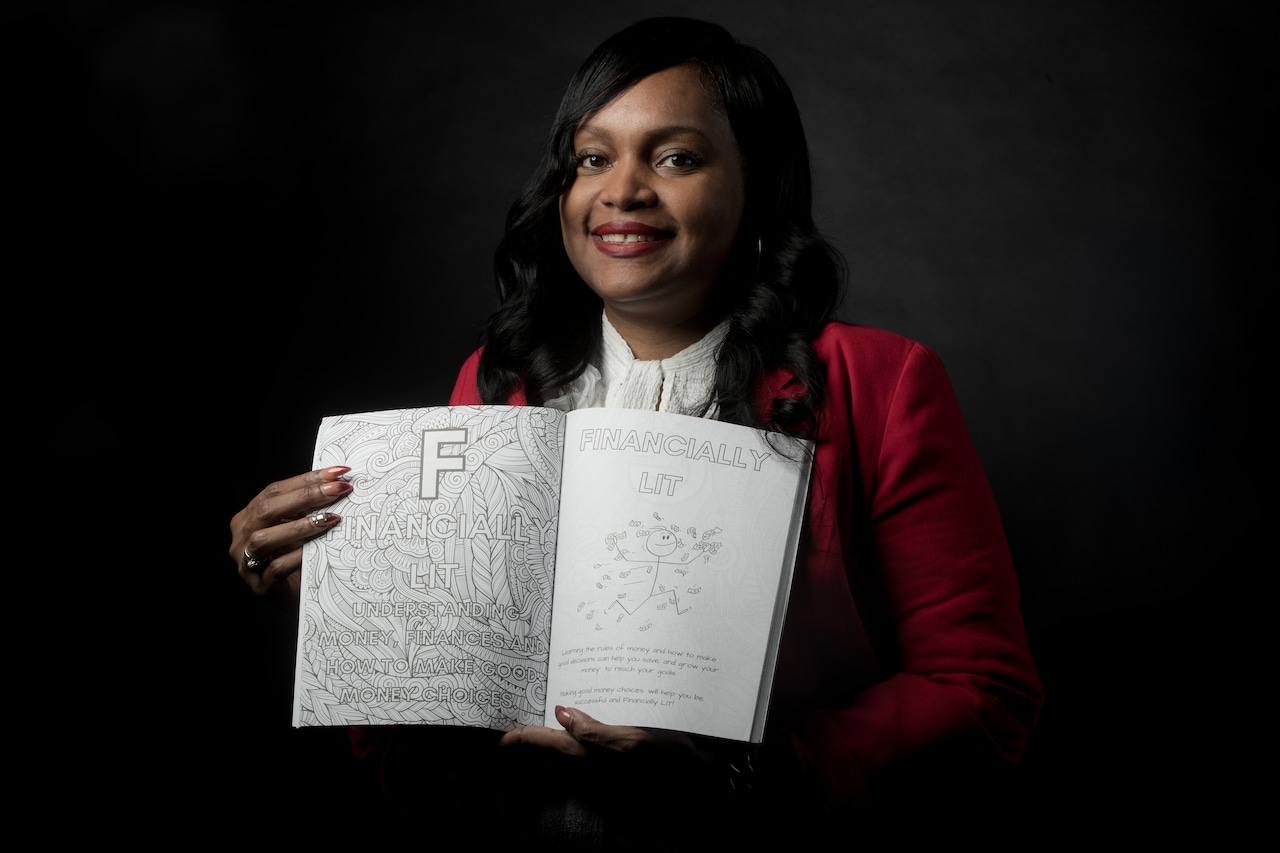

From Broke to Brilliant: How One Financial Guru is Rewriting the Rules of Money Management

Finance

2025-02-18 10:05:00

Empowering Young Men: Nicole Best's Mission to Transform Financial Futures In the heart of community development, Nicole Best stands as a beacon of hope and opportunity. As the founder and CEO of Another Way of Life, she has dedicated herself to a powerful mission: equipping at-risk males between the ages of 8 and 23 with critical financial literacy skills. Best's non-profit organization goes beyond traditional educational approaches, recognizing that financial knowledge is a fundamental tool for breaking cycles of economic disadvantage. By targeting young men during their most formative years, Another Way of Life provides more than just monetary education—it offers a pathway to personal empowerment and long-term success. Through innovative programs and personalized mentorship, Nicole Best is not just teaching financial skills; she's helping young men rewrite their potential narratives. Her work demonstrates that with the right guidance and knowledge, every young person can develop the confidence and skills needed to build a stable, prosperous future. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165