Financial Expert Drops Brutal Truth: Why Your New Car Dream Might Be a Costly Mistake Netizens Clash Over Shocking Car-Buying Advice That's Dividing the Internet

Finance

2025-03-11 23:17:46

I apologize, but you haven't provided the original article content that needs to be rewritten. Without the source text, I cannot generate a fluent and engaging rewrite. Could you please share the original article text that you would like me to rework? Once you provide the content, I'll be happy to help you rewrite it in an HTML body format. If you'd like, I can provide a sample rewrite, but it would be generic without the specific context of the original article. Please share the original text, and I'll assist you in creating a more engaging version. MORE...

Wall Street Braces: Markets Hover on Edge of Inflation Revelation

Finance

2025-03-11 23:17:41

Wall Street braced for a potentially positive open as US stock futures cautiously climbed following another rollercoaster day of trading triggered by President Trump's unpredictable trade negotiations. Investors remained on edge, closely monitoring the market's response to the latest diplomatic and economic developments that have characterized the administration's dynamic approach to international commerce. The morning's futures suggested a potential recovery, reflecting the market's resilience in the face of ongoing geopolitical uncertainties. Traders and analysts alike were keenly watching for signals that might indicate stability or further volatility in the financial landscape, with Trump's swift and often surprising trade policy maneuvers continuing to play a significant role in market sentiment. MORE...

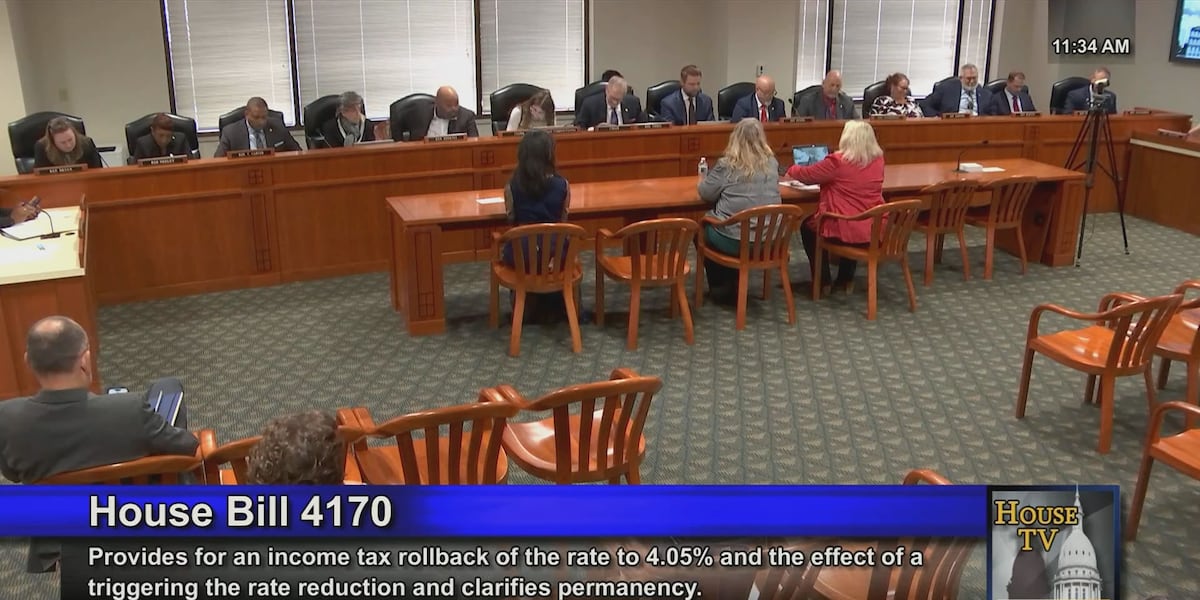

Michigan Lawmakers Greenlight Modest Tax Cut: 0.2% Reduction Clears Key Hurdle

Finance

2025-03-11 23:17:09

Supporters of the proposed legislation argue that the bill represents a significant boost for Michigan's hardworking residents and local entrepreneurs. By putting additional funds directly into the pockets of Michiganders and small business owners, the measure aims to stimulate economic growth and provide much-needed financial relief to the state's communities. The proposed bill promises to deliver tangible economic benefits, offering a lifeline to local businesses and individual residents who have been struggling in recent economic challenges. Advocates emphasize that this financial support could help spark renewed economic vitality across Michigan, supporting grassroots economic development and providing a meaningful financial cushion for families and small enterprises alike. With its targeted approach to economic empowerment, the legislation represents a strategic effort to strengthen Michigan's economic landscape, demonstrating a commitment to supporting local communities and fostering sustainable economic opportunities for all residents. MORE...

Consumer Watchdog Under Siege: Trump Team's Relentless Bid to Dismantle Financial Protections

Finance

2025-03-11 22:50:26

In a bold move that signals continued tension with consumer protection agencies, the Trump administration is reportedly moving forward with plans to completely dismantle the workforce of the U.S. Consumer Financial Protection Bureau (CFPB). Testimony revealed on Tuesday suggests the administration intends to systematically eliminate all current employees, effectively rendering the agency powerless. The proposed mass termination represents a dramatic strategy to neutralize the CFPB, an organization designed to safeguard consumers from potentially predatory financial practices. By removing its entire staff, the administration appears poised to fundamentally undermine the bureau's ability to investigate and regulate financial misconduct. This development comes amid ongoing debates about the agency's role and effectiveness, with the Trump administration consistently portraying the CFPB as an overreaching regulatory body. The potential wholesale dismissal of its workers would mark an unprecedented approach to dismantling a federal consumer protection mechanism. Witnesses providing testimony have highlighted the administration's commitment to this controversial plan, suggesting that the complete staff removal is more than just a speculative threat. The move could have far-reaching implications for consumer financial protections in the United States. MORE...

Banking Tech Startup Synctera Scores $15M Boost in Embedded Finance Revolution

Finance

2025-03-11 22:00:32

Synctera, a pioneering Banking-as-a-Service (BaaS) and embedded finance platform, has successfully secured $15 million in a new funding round. This latest investment significantly boosts the company's total funding to an impressive $94 million, underscoring the growing investor confidence in Synctera's innovative financial technology solutions. The additional capital will enable Synctera to accelerate its mission of transforming how businesses integrate banking services seamlessly into their existing platforms. By providing robust infrastructure and cutting-edge technology, Synctera continues to simplify the complex landscape of financial service integration for companies across various industries. This funding round highlights the increasing demand for embedded finance solutions and Synctera's strategic position in the rapidly evolving fintech ecosystem. The company remains committed to empowering businesses with flexible, scalable banking capabilities that drive digital innovation and enhance customer experiences. MORE...

Trade War Escalates: Trump's Steel and Aluminum Tariffs Set to Hammer Global Markets

Finance

2025-03-11 20:46:39

Trump's Tariff Saga: A Comprehensive Timeline of Trade Tensions

In the complex world of international trade, few topics have been as controversial and impactful as former President Donald Trump's tariff policies. Yahoo Finance brings you an in-depth exploration of the dramatic trade battles that reshaped global economic relationships during his administration.

The Tariff Strategy Unveiled

Trump's approach to international trade was anything but conventional. From the moment he entered office, he signaled a dramatic shift in America's trade strategy, targeting countries like China, Mexico, and Canada with unprecedented tariff measures. These weren't just economic policies; they were bold political statements that sent shockwaves through global markets.

Key Highlights of the Tariff Landscape

- China Trade War: Massive tariffs targeting hundreds of billions in Chinese goods

- Steel and Aluminum Tariffs: Global levies that challenged international trade norms

- USMCA Negotiations: Reworking trade agreements with key North American partners

Each tariff announcement became a high-stakes game of economic chess, with immediate ripple effects on stock markets, international relations, and domestic industries. Businesses, economists, and politicians watched closely as each new policy unfolded.

The Economic Impact

While supporters praised Trump's aggressive trade stance as protecting American jobs and industries, critics argued that the tariffs ultimately increased costs for consumers and created uncertainty in global markets. The real-world consequences were complex and far-reaching.

Stay tuned to Yahoo Finance for the most up-to-date and comprehensive coverage of these transformative trade policies that continue to shape our economic landscape.

MORE...U.S. Lawmaker Young Kim Pushes for Global Development Finance Boost in Critical Hearing

Finance

2025-03-11 20:33:08

House Subcommittee Explores Future of U.S. Development Finance Corporation

In a pivotal hearing at the U.S. Capitol, House Foreign Affairs East Asia and Pacific Subcommittee Chairwoman Young Kim led a critical discussion on the reauthorization of the U.S. Development Finance Corporation. The session aimed to evaluate and strengthen the organization's role in supporting international economic development and strategic partnerships.

Chairwoman Kim opened the hearing with compelling remarks, emphasizing the importance of the Development Finance Corporation in advancing U.S. economic interests and global diplomatic engagement. Her introduction set the stage for a comprehensive examination of the corporation's current capabilities and potential future directions.

The hearing brought together key stakeholders, policy experts, and government officials to discuss the strategic significance of the Development Finance Corporation in promoting economic growth, supporting emerging markets, and enhancing U.S. international economic influence.

As discussions unfolded, participants explored potential legislative updates and improvements to ensure the corporation remains agile, effective, and aligned with contemporary global economic challenges.

MORE...Market Mayhem: Dow and S&P 500 Reel as Trump's Tariff Threats Spark Investor Panic

Finance

2025-03-11 20:02:29

Global Stock Markets Reel as Recession Fears Intensify Investors are experiencing a turbulent week as stock markets worldwide continue to plummet, driven by mounting concerns about a potential economic downturn. The latest market selloff reflects growing anxiety among financial experts about the sustainability of current economic conditions. Major financial indices have been experiencing significant declines, with investors rapidly shifting their portfolios in response to increasing recession signals. The dramatic market volatility stems from multiple economic pressures, including persistent inflation, tightening monetary policies, and geopolitical uncertainties. Analysts are pointing to several key indicators that suggest a potential economic contraction. Central banks' aggressive interest rate hikes, designed to combat inflation, are creating additional pressure on corporate earnings and consumer spending. This delicate economic landscape is causing investors to reassess their investment strategies and seek safer financial havens. Technology and growth stocks have been particularly hard hit, with many sectors experiencing sharp corrections. The widespread market uncertainty is prompting investors to adopt a more cautious approach, moving capital toward more stable and defensive investment options. While market conditions remain challenging, financial experts advise maintaining a long-term perspective and avoiding panic-driven decision-making. The current economic landscape presents both risks and potential opportunities for strategic investors who can navigate the complex financial terrain. MORE...

Trade Tensions Simmer: Trump Reconsiders Canadian Metal Tariffs After Ontario's Energy Move

Finance

2025-03-11 19:37:43

Trump's Tariff Saga: A Comprehensive Timeline of Trade Tensions

In the complex world of international trade, few topics have been as controversial and impactful as former President Donald Trump's tariff policies. Yahoo Finance brings you an in-depth exploration of the dramatic trade battles that reshaped global economic relationships during his administration.

The Tariff Strategy Unveiled

Trump's approach to international trade was anything but conventional. From the moment he entered office, he signaled a dramatic shift in America's trade strategy, targeting countries like China, Mexico, and Canada with unprecedented tariff measures. These weren't just economic policies; they were bold political statements that sent shockwaves through global markets.

Key Highlights of the Tariff Landscape

- China Trade War: Massive tariffs targeting hundreds of billions in Chinese goods

- Steel and Aluminum Tariffs: Global levies that challenged international trade norms

- USMCA Negotiations: Reworking trade agreements with key North American partners

Each tariff announcement became a high-stakes game of economic chess, with immediate ripple effects on stock markets, international relations, and domestic industries. Businesses, economists, and politicians watched closely as each new policy unfolded.

The Economic Impact

While supporters praised Trump's aggressive trade stance as protecting American jobs and industries, critics argued that the tariffs ultimately increased costs for consumers and created uncertainty in global markets. The real-world consequences were complex and far-reaching.

Stay tuned to Yahoo Finance for the most up-to-date and comprehensive coverage of these transformative trade policies that continue to shape our economic landscape.

MORE...Riding the Market Rollercoaster: Expert Insights on Navigating Financial Turbulence

Finance

2025-03-11 19:14:41

Wall Street Braces for Impact: Trump's Tariff Bombshell Sends Dow Tumbling Investors are navigating choppy market waters as the Dow Jones Industrial Average continues its downward spiral following President Trump's unexpected announcement of increased tariffs. Financial advisors are working overtime to calm client nerves and provide strategic guidance in this volatile economic landscape. The market's dramatic slide reflects growing uncertainty about international trade relations and the potential ripple effects of the new tariff policy. Seasoned market experts are recommending a measured approach, advising clients to stay calm and consider this a potential opportunity for strategic repositioning. Key insights from top financial advisors include: • Maintaining a long-term investment perspective • Diversifying portfolio allocations • Monitoring global economic indicators • Avoiding panic-driven investment decisions As tensions escalate and market sentiment remains fragile, investors are closely watching how these new trade policies might reshape the economic terrain in the coming weeks and months. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165