Market Pulse: Wall Street Holds Breath as Inflation Cools and Trade Tensions Simmer

Finance

2025-03-12 22:56:06

Wall Street Finds Calm After Inflation Surprise Sparks Tech Rally U.S. stock futures maintained their composure on Wednesday, following a significant market boost triggered by an unexpectedly mild inflation report. The latest consumer price index data brought a wave of optimism, particularly energizing technology stocks and providing investors with a much-needed sense of relief. The cooler-than-anticipated inflation figures suggested potential easing of economic pressures, which immediately translated into increased investor confidence. Tech shares led the charge, rebounding strongly as traders interpreted the data as a positive signal for future monetary policy and economic stability. Investors are now closely watching how this inflation trend might influence the Federal Reserve's upcoming decisions on interest rates. The market's initial reaction indicates a cautious but hopeful sentiment, with traders seeing potential for a softer economic landing. As dawn breaks on Wall Street, the futures market reflects a measured optimism, balancing excitement about the inflation data with prudent expectations for the trading day ahead. MORE...

Biotech's Financial Frontier: Navigating Royalty Strategies in the Next Biomedical Revolution

Finance

2025-03-12 22:32:09

Elevate Your Legal Career: Join a Dynamic Team of Industry Pioneers Become part of an exceptional legal collective where innovation meets expertise. Our distinguished team of attorneys and industry leaders offers an unparalleled opportunity to explore and shape the complex landscape of business law. Dive deep into critical industry domains, including: • Mergers and Acquisitions (M&A) • Capital Markets • Royalty Finance • Strategic Collaborations and Licensing • Regulatory Policy Development • Artificial Intelligence Legal Frameworks We don't just observe industry trends—we anticipate and define them. Our forward-thinking approach allows us to identify emerging patterns, navigate uncertainties, and provide strategic insights that will be instrumental in the year ahead. By joining our team, you'll be at the forefront of legal innovation, working alongside thought leaders who are committed to pushing boundaries and delivering exceptional value to our clients. Discover your potential. Transform the future of legal practice with us. MORE...

Financial Leadership Shake-Up: Annapolis Welcomes Fresh Face to City Finance Helm

Finance

2025-03-12 21:10:46

A significant leadership transition is set to take place in the City of Annapolis as Brittany Moran, currently serving as treasurer for the Town of Chesapeake Beach in Calvert County, prepares to step into the role of Director of Finance. Moran will succeed Jodee Dickinson, bringing fresh perspective and financial expertise to this critical municipal position later this month. With her proven track record in local government finance, Moran is poised to bring valuable skills and strategic insights to the Annapolis finance department. Her appointment marks an important moment of renewal and potential innovation in the city's financial management. The transition represents a seamless transfer of leadership, with Moran's background in municipal finance positioning her well to continue the important work of managing the city's financial resources effectively and transparently. MORE...

Money Matters: County Leaders Brace for Fiscal Crossroads in Budget Showdown

Finance

2025-03-12 21:10:28

In a pivotal meeting on Tuesday, county financial experts unveiled a comprehensive overview of the local government's fiscal landscape, offering insights that will shape the upcoming budget for the fiscal year starting July 1st. The Board of Supervisors gathered to hear a detailed presentation that promises to provide critical guidance for the county's financial strategy in the months ahead. The presentation highlighted key economic indicators, potential challenges, and opportunities that will influence the county's financial planning. Attendees gained valuable insights into the projected revenue streams, potential expenditures, and the overall economic health of the region. This transparent approach demonstrates the county's commitment to fiscal responsibility and open communication with its constituents. As the new budget preparation enters its final stages, residents can expect a thorough and strategic approach to managing public funds, ensuring essential services continue to meet the community's needs while maintaining financial stability. MORE...

Tech Titan Shake-Up: Intel Taps Lip-Bu Tan as New Chief, Investors Cheer with 11% Stock Surge

Finance

2025-03-12 21:05:34

In a strategic move signaling potential transformation, Intel has tapped Lip-Bu Tan to lead the company as its new CEO, marking a critical moment in the tech giant's ambitious corporate restructuring. The appointment comes at a pivotal time when Intel is aggressively working to revitalize its market position and manufacturing capabilities. Tan's arrival coincides with growing industry speculation about potential shifts in semiconductor manufacturing, including reports that Taiwan Semiconductor Manufacturing Company (TSMC) might be exploring new operational strategies. His leadership is expected to bring fresh perspectives to Intel's ongoing efforts to regain its competitive edge in the rapidly evolving semiconductor landscape. The executive's appointment underscores Intel's commitment to addressing recent challenges and repositioning itself in a highly dynamic technology market. With semiconductor innovation becoming increasingly critical, Tan's expertise and vision will be crucial in navigating the company's complex technological and strategic roadmap. Investors and industry observers are closely watching how this leadership change will impact Intel's future performance and its ability to compete with emerging semiconductor manufacturers in a global technology ecosystem. MORE...

Wall Street Cheers: How Pat Gelsinger's Financial Savvy Sparked Intel's Stunning Stock Rally

Finance

2025-03-12 20:56:41

Intel's Leadership Transformation: Lip-Bu Tan Brings Financial Expertise to the Helm In a strategic move that has electrified the tech industry, Intel has appointed Lip-Bu Tan as its new CEO, sparking immediate investor confidence. The market's enthusiastic response was evident as the company's shares surged by an impressive 12% following his appointment, signaling strong optimism about Tan's leadership potential. With an extensive background in finance and technology, Tan brings a unique blend of strategic insight and financial acumen to Intel's executive team. His appointment comes at a critical time for the semiconductor giant, as the company seeks to reinvigorate its market position and drive innovation in a rapidly evolving tech landscape. Investors and industry analysts are particularly excited about Tan's proven track record of financial leadership and his potential to guide Intel through complex technological and market challenges. His deep understanding of global financial markets and technology trends positions him as a transformative leader who could potentially reshape Intel's future strategy. The significant stock market reaction underscores the market's confidence in Tan's ability to lead Intel into its next chapter of growth and technological advancement. MORE...

Turbulent Takeoff: Spirit Airlines Breaks Free from Financial Turbulence, Emerges Stronger

Finance

2025-03-12 20:50:55

Spirit Airlines' parent company, Spirit Aviation Holdings, announced a significant milestone on Wednesday, revealing that the budget-friendly carrier has successfully navigated through its financial restructuring process. This development marks a crucial turning point for the airline, signaling renewed financial stability and potential growth in the competitive low-cost carrier market. The completion of the financial restructuring represents a strategic achievement for Spirit Airlines, demonstrating the company's resilience and commitment to maintaining a strong financial foundation. By successfully addressing its financial challenges, the airline is now positioned to focus on future expansion and improving its service offerings to budget-conscious travelers. MORE...

Lument Finance Trust: Earnings Report Drops Next Week - What Investors Need to Know

Finance

2025-03-12 20:45:00

Lument Finance Trust Set to Unveil Comprehensive Annual Performance in Upcoming Financial Disclosure Investors and financial stakeholders, mark your calendars! Lument Finance Trust is preparing to release its highly anticipated 2025 Form 10-K annual report on March 19, followed by an informative investor conference call on March 20. This comprehensive financial review offers a prime opportunity for shareholders and market analysts to gain deep insights into the company's annual performance, strategic achievements, and future outlook. Participants can choose to join the presentation via traditional phone conference or convenient live webcast. Don't miss this crucial opportunity to understand Lument Finance Trust's financial landscape and strategic positioning for the upcoming year. Whether you're a current investor, potential stakeholder, or financial professional, this annual disclosure promises to provide valuable perspectives on the company's financial health and strategic direction. MORE...

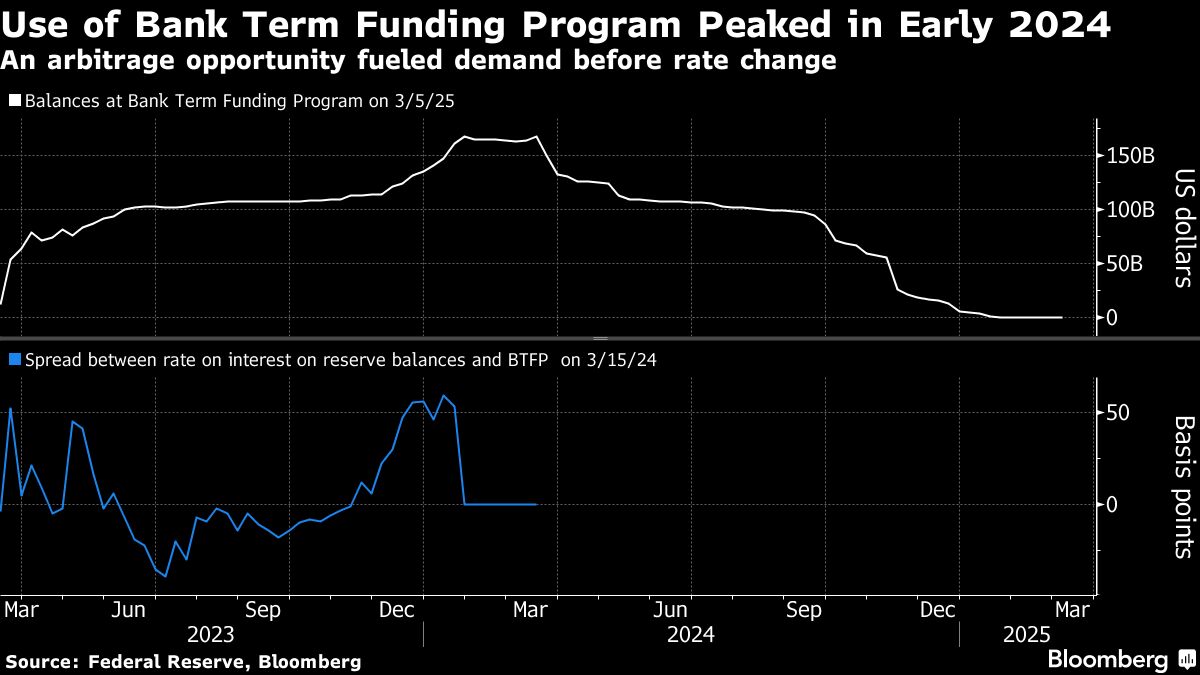

Wall Street's Lifeline: How 1,600+ Financial Giants Raced to the Fed's Emergency Rescue

Finance

2025-03-12 20:35:51

Over 1,600 Banks Leverage Fed's Emergency Lending Program During Financial Turbulence

In a remarkable display of financial resilience, more than 1,600 banks and their affiliated subsidiaries have utilized the Federal Reserve's emergency lending initiative, which was strategically designed to provide critical support during the regional banking crisis that unfolded two years ago.

The extensive participation in this emergency lending program underscores the significant challenges faced by financial institutions and highlights the Federal Reserve's proactive approach to stabilizing the banking sector during uncertain economic times.

This unprecedented level of engagement demonstrates the widespread impact of the regional banking turmoil and the crucial role of the Fed's financial safety net in maintaining economic stability.

The lending program served as a lifeline for numerous banks, offering them much-needed liquidity and confidence during a period of heightened financial uncertainty.

MORE...Tech Titans Spark Market Surge: Nvidia and Tesla Ride the Wave of Cooling Inflation

Finance

2025-03-12 20:07:40

Market Pulse: Investors Navigate Inflation Surprises and Trade Tensions Investors are carefully analyzing the latest economic indicators, finding unexpected optimism in recent inflation data while simultaneously preparing for the potential ripple effects of the escalating trade tensions. The current financial landscape presents a complex puzzle of economic signals that have market participants on high alert. The surprisingly positive inflation figures have injected a dose of cautious optimism into investment circles, offering a momentary respite from the ongoing economic uncertainties. Meanwhile, the intensifying trade war adds an additional layer of complexity, keeping investors strategically positioned and ready to adapt to rapidly changing market dynamics. As economic indicators continue to fluctuate and geopolitical strategies evolve, investors remain vigilant, balancing their portfolios between measured optimism and strategic risk management. The interplay between inflation trends and international trade negotiations promises to keep financial markets both challenging and intriguing in the weeks ahead. MORE...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165