Nuclear Energy Innovator NANO Taps Seasoned Finance Veteran Darlene DeRemer as Corporate Finance Chief

Finance

2025-02-28 20:10:00

NANO Nuclear Energy Appoints Darlene T. DeRemer as Executive Director of Corporate Finance

NANO Nuclear Energy Inc. (NASDAQ: NNE) has announced a significant leadership transition, promoting Darlene T. DeRemer from her role as Chairwoman of the Executive Advisory Board to the critical position of Executive Director of Corporate Finance.

In this strategic move, DeRemer will leverage her extensive expertise to drive the company's financial strategy and support its mission of developing innovative clean energy solutions. Her transition reflects NANO Nuclear's commitment to leveraging top talent and strengthening its leadership team.

As a key executive, DeRemer is expected to play a pivotal role in advancing the company's financial objectives and supporting its continued growth in the advanced nuclear energy sector.

The announcement was made on February 28, 2025, signaling an important milestone for NANO Nuclear Energy and its ongoing efforts to revolutionize clean energy technologies.

MORE...Aries Forecast 2025: Navigating Love, Career, and Financial Tides This March

Finance

2025-02-28 20:00:00

Aries Horoscope: Navigating March 2025's Financial Landscape As March 2025 unfolds, Aries will encounter a dynamic financial terrain that demands resilience and strategic thinking. The early weeks may present unexpected hurdles, with ongoing projects experiencing temporary setbacks and financial pressures testing your resolve. Don't be discouraged by initial challenges. Mid-month brings a transformative energy that will empower you to reassess your financial strategies. This is an ideal time to pivot, realign your goals, and implement creative solutions that can turn potential obstacles into opportunities for growth. Key insights for Aries this month: • Stay adaptable and open to alternative approaches • Review and streamline your financial plans • Leverage your natural leadership skills to overcome temporary roadblocks • Seek advice from trusted mentors or financial advisors By maintaining a positive outlook and proactive mindset, you'll successfully navigate March's complex financial landscape and emerge stronger and more financially savvy. MORE...

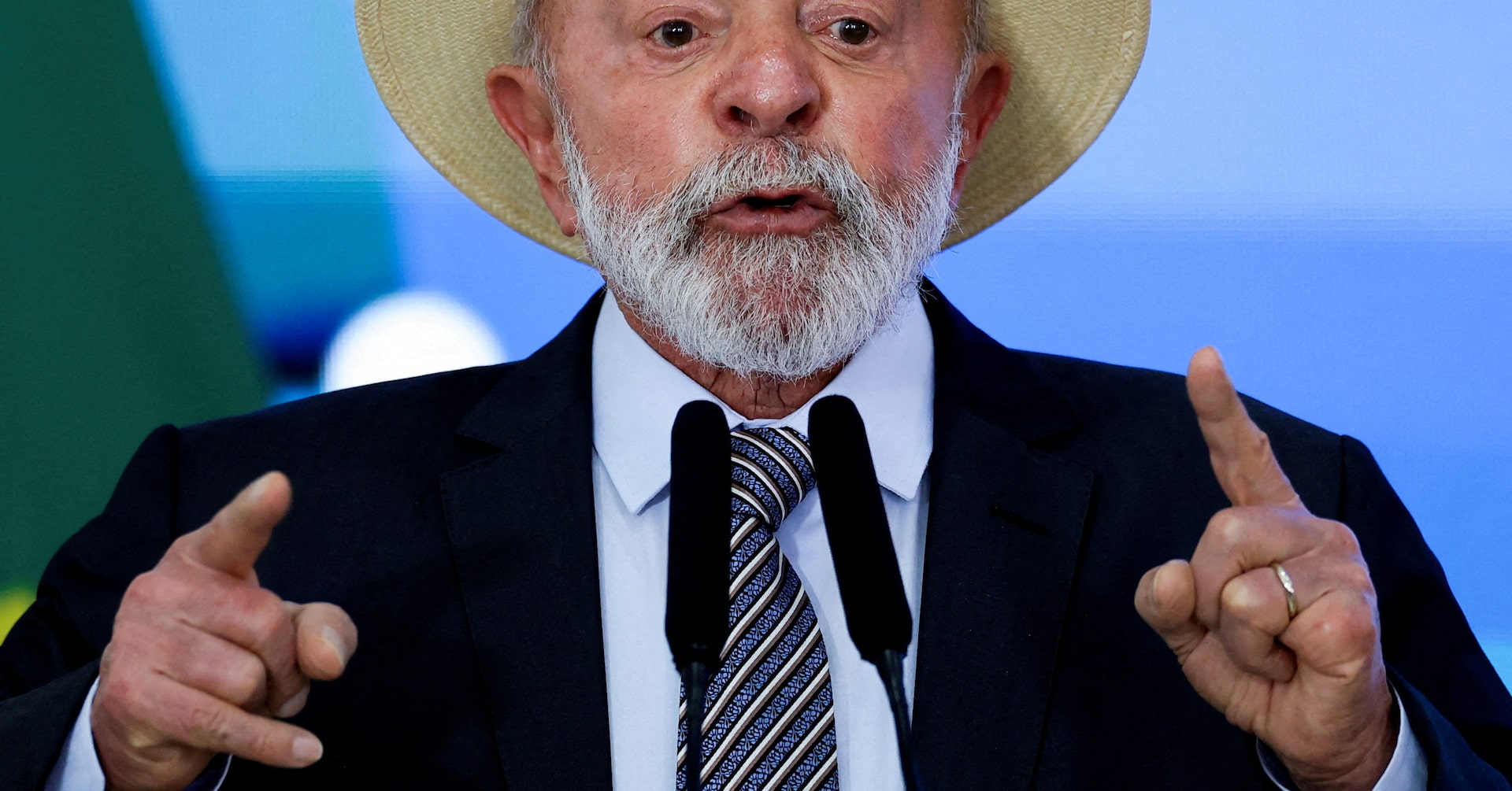

Wall Street Jitters: Brazil's Finance Chief Stands Alone as Leftist Winds Threaten Market Stability

Finance

2025-02-28 19:51:39

In a dramatic political reshuffling, Brazilian President Luiz Inacio Lula da Silva's latest cabinet changes have left Finance Minister Fernando Haddad increasingly isolated, with few allies to support his fiscally cautious approach. The strategic realignment has sparked growing concerns about a potential populist shift aimed at boosting the veteran leftist leader's waning political appeal. Haddad, known for his measured economic strategies, now finds himself without strong backing in Lula's inner circle, raising questions about the government's future economic direction. The cabinet reshuffle suggests a potential pivot towards more expansive and potentially risky economic policies that could prioritize short-term popularity over long-term fiscal stability. Political observers are watching closely, sensing that Lula may be preparing to leverage more aggressive economic interventions to reinvigorate his political standing and reconnect with his traditional base of support. The emerging dynamics signal a critical moment for Brazil's economic policy and Lula's political legacy. MORE...

Tech Tumble: Nasdaq Braces for Brutal Weekly Selloff as Market Momentum Stalls

Finance

2025-02-28 18:09:03

Wall Street Holds Its Breath: Fed Inflation Data Meets Trade Tensions Investors are bracing for a critical economic moment as the Federal Reserve's key inflation indicator prepares to take center stage, while simultaneously navigating the complex landscape of President Trump's latest trade policy maneuvers. The upcoming release of the Personal Consumption Expenditures (PCE) price index promises to offer crucial insights into the nation's economic temperature, potentially influencing market sentiment and monetary policy decisions. Market participants are keenly analyzing every detail of the inflation data, seeking signals about potential interest rate adjustments and the overall health of the U.S. economy. Simultaneously, the ongoing trade tensions introduced by the administration add an extra layer of uncertainty, creating a volatile backdrop for investors and economic strategists. The convergence of these two significant economic factors—inflation metrics and trade policy—creates a high-stakes environment where every percentage point and policy statement could trigger substantial market movements. Investors remain vigilant, ready to react swiftly to any unexpected revelations in the upcoming economic reports. MORE...

Money Smarts: The Surprising Secret to Boosting Your Credit Score Overnight

Finance

2025-02-28 18:05:18

Mastering Your Financial Future: Expert Tips for Building Credit and Financial Literacy

In today's complex financial landscape, understanding how to manage your money and build a strong credit score can feel like navigating a maze. Fortunately, financial experts have shared invaluable insights to help you take control of your financial journey.

Understanding Financial Literacy: Your Path to Financial Success

Financial literacy is more than just balancing a checkbook—it's about making informed decisions that can transform your economic well-being. Our team of financial advisors has compiled essential strategies to help you improve your financial knowledge and boost your credit score.

Key Strategies to Enhance Your Financial Health:

- Learn to create and stick to a realistic budget

- Understand credit reporting and scoring mechanisms

- Develop smart saving and investment habits

- Make timely bill payments a priority

By implementing these expert-recommended techniques, you can gradually build a solid financial foundation and improve your creditworthiness. Remember, financial empowerment is a journey, not a destination.

MORE...Inside the CFPB: Unraveling the Agency's Hidden Turmoil

Finance

2025-02-28 17:43:51

CFPB Employees Allege Massive Layoff Plan at Agency

In a dramatic legal development, employees of the Consumer Financial Protection Bureau (CFPB) have taken legal action, claiming that the Department of Government Efficiency (DOGE), under the leadership of tech mogul Elon Musk, is strategizing a comprehensive workforce reduction.

The court filing reveals an aggressive plan to dramatically downsize the agency's workforce within a tight 60-90 day window. This potential restructuring has sent ripples of uncertainty through the organization's ranks.

Wealth host Brad Smith provided an in-depth analysis of the CFPB's current employment landscape, also highlighting the agency's recent decision to withdraw lawsuits against several prominent technology industry leaders.

For those seeking deeper insights and expert market analysis, viewers are encouraged to explore more content on Wealth for comprehensive coverage of this unfolding story.

MORE...Campaign Cash Clash: Portland Auditor Challenges Voter-Backed Finance Rules

Finance

2025-02-28 16:58:57

The auditor's proposal sent shockwaves through political reform advocates, who have long battled to reduce the outsized role of money in political campaigns. Their concerns were immediately triggered by what they perceived as a potentially dangerous recommendation that could further open the floodgates to unrestricted campaign financing. Watchdog groups quickly raised alarm, arguing that the pitch threatened to undermine years of careful work aimed at creating more transparent and equitable political funding mechanisms. The proposed changes seemed to signal a potential rollback of hard-won campaign finance protections, raising serious questions about the integrity of the electoral process. Advocates warned that such recommendations could dramatically shift the balance of political influence, potentially allowing wealthy donors and special interest groups even greater sway over electoral outcomes. Their passionate response underscored the ongoing struggle to maintain fairness and accountability in political fundraising and representation. MORE...

Green Finance Revolution: Akropolis Group Sets New Sustainability Standard

Finance

2025-02-28 16:55:00

Akropolis Group Unveils Innovative Green Finance Framework to Accelerate Sustainable Investment Akropolis Group has taken a significant step towards sustainable finance by introducing a comprehensive Green Finance Framework. This groundbreaking initiative creates a direct connection between the company's environmental goals and its financial strategies, enabling more purposeful and eco-conscious investment approaches. The new Framework empowers Akropolis Group to finance and refinance projects that meet rigorous sustainability standards. Notably, the framework focuses on key areas such as green buildings, offering a versatile range of Green Finance Instruments to support environmentally responsible development. By establishing clear and transparent requirements for project selection, the Framework ensures that every financial decision aligns with stringent sustainability criteria. This approach not only demonstrates the company's commitment to environmental stewardship but also provides investors with a clear pathway to supporting green initiatives. Through this innovative Framework, Akropolis Group is setting a new benchmark in sustainable finance, showcasing how financial strategies can effectively contribute to broader environmental goals. MORE...

AI Gold Rush: Can Nvidia Keep Its Crown in the Tech Stock Rollercoaster?

Finance

2025-02-28 16:01:01

Nvidia's recent financial report sent ripples through Wall Street, falling short of the sky-high expectations set by investors who have crowned the chipmaker as the undisputed champion of the AI investment landscape. Despite its remarkable rise as a tech powerhouse driving the artificial intelligence revolution, the company's latest earnings revealed that even golden children of the stock market can experience moments of uncertainty. The semiconductor giant, which has become synonymous with cutting-edge AI technology, found itself facing increased scrutiny as investors carefully dissected its financial performance. While Nvidia continues to be the poster child for AI innovation, this earnings report serves as a subtle reminder that the path of technological leadership is rarely a straight line of uninterrupted success. Investors who have been riding the wave of Nvidia's meteoric stock price growth were momentarily jolted by the results, underscoring the volatile nature of tech investments in the rapidly evolving AI sector. Yet, the company's fundamental strengths and pivotal role in powering artificial intelligence technologies remain largely unchanged, suggesting that this earnings hiccup may be nothing more than a temporary speed bump in Nvidia's ambitious journey. MORE...

Economic Alarm: Is the Market's Momentum Grinding to an Unexpected Halt?

Finance

2025-02-28 16:00:00

Market Turbulence: Navigating Uncertain Economic Waters

U.S. stock markets are currently experiencing significant challenges as investors grapple with a complex economic landscape. Multiple factors are creating market volatility, including persistent inflation, potential tariff complications, and an unpredictable interest rate environment.

Expert Insights from Interactive Brokers

Steve Sosnick, chief strategist at Interactive Brokers, offers a nuanced perspective on the current market dynamics. In a recent interview with Catalysts host Madison Mills, Sosnick highlighted the stark contrast between individual and institutional investor sentiments.

"Individual investors continue to show remarkable conviction, having successfully navigated market dips and momentum trends in recent years," Sosnick noted.

Economic Slowdown Concerns

A growing concern among market participants is the potential for an economic slowdown that might outpace the Federal Reserve's response. Sosnick warns that investors are increasingly anxious about the pace of economic deceleration.

Strategic Recommendations

To mitigate risks in this uncertain environment, Sosnick recommends investors consider:

- Increasing cash holdings

- Shifting towards low-beta stocks

- Focusing on high-dividend investment opportunities

For more in-depth market analysis and expert perspectives, continue following Catalysts' comprehensive market coverage.

MORE...- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165